US futures ticked higher again on Friday morning ahead of the release of CPI revision data (previewed here), assuring that the S&P 500 cash index will rise above the historic 5,000 level when it breaks for trading. S&P 500 futures traded 0.2% higher as 7:50am in New York, while contracts for the Nasdaq 100 Index gained 0.3% as Big Tech stocks made more advances in premarket trading. While Asian stocks fell, weighed by Hong Kong, as China was closed for holidays, European stocks gained paced by the Estoxx 50, where energy sector leads as WTI crude oil futures hold most of Thursday’s 3.2% advance. Meanwhile 10Y interest rates rose again, hitting 4.18%, leaving their yield up about 17 basis points in the past five days, as the US dollar and oil traded flat. Today, we get receive CPI revisions (updated seasonal factors and weights) where few expect any major changes but according to JPM, expect “headline inflation rates for recent months to be lowered somewhat on net." The next key data point will be the regular US inflation print due Tuesday.

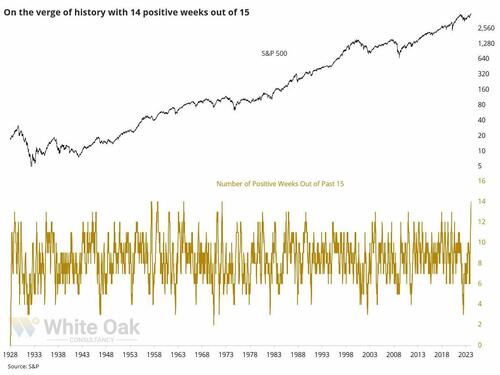

With the S&P set to close well above 4958, it will make it 14 up weeks out of the past 15...

... and it will match the best 15-week stretches in history according to Sentiment Trader.

In premarket trading, Expedia Group shares fell after the online travel agency reported fourth-quarter gross bookings that slightly missed estimates, and named Ariane Gorin chief executive officer of the online travel company, while Pinterest made steep losses after the social-media company’s revenue fell short of estimates.

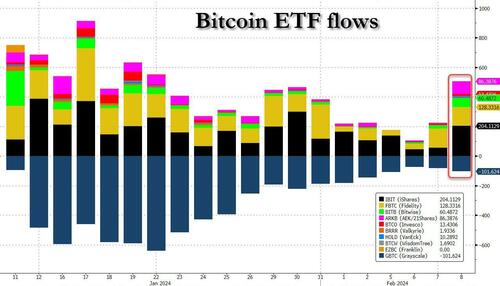

Cryptocurrency-linked companies rallied on Friday as Bitcoin surged past the $47,000 mark after the latest flow data revealed the 2nd biggest net inflow on record into bitcoin ETFs as GBTC outflows trickle to a halt.

The BLS will release its annual revisions to its consumer price index at 8:30 a.m. New York time. Last year, the update was significant enough to cast doubt on overall inflation progress and traders were speculating again that the recalculations might sway views over when the Federal Reserve will cut interest rates (full review here). “This could have important implications for the Fed,” wrote analysts at Rabobank in a research note. “It could increase or decrease the confidence that the FOMC has in a sustainable return to 2% inflation.”

Back to markets, on Thursday the S&P 500 briefly hit 5,000 for the first time after a massive buy program lifted the market as if just for that one reason, before closing little changed. US equities have posted only one weekly drop since late October and the gauge has more than doubled from its March 2020 pandemic-low — driven by expectations for a soft economic landing and optimism about the impact of artificial-intelligence.

“The equity market is responding to the positive data story and quite incredibly continues to march on,” said Charles Diebel, at Mediolanum International. “If growth holds up and there is a soft or no landing, that’s good for equities. And if something bad happens, the Fed will cut rates.”

Despite some soft earnings this season, US stocks have been buoyed by the technology sector and strong economic data, which has kept the benchmark rallying this year. The fun may be ending however: according to Bank of America’s Michael Hartnett, the rally is getting close to triggering sell signals. The bank’s custom bull-and-bear indicator is nearing a reading that could be interpreted as a contrarian signal to sell, he said.

Europe's Stoxx 600 was little changed after contrasting updates from heavyweights Hermes and L’Oreal. L’Oreal shares tumbled 7% as Chinese shoppers reined in travel spending, while Tesco advanced after Barclays said it will acquire much of the supermarket chain’s banking business. Hermes rallied after reporting surging sales at the end of last year. Here are some of the biggest European movers on Friday:

Earlier in the session, Asian stocks fell weighed by Hong Kong, while many markets including China, Taiwan, South Korea, Indonesia, the Philippines and Vietnam were shut for public holidays. The MSCI Asia Pacific Index slipped as much as 0.4%, dropping for a second day, as investors turned cautious about Chinese markets ahead of the multi-day Lunar New Year holiday. Alibaba and Toyota were among the biggest drags. The Hang Seng dropped 0.8% and Hang Seng China Enterprises Index slid 1.1%, both falling a third straight day. Mainland markets were already shut for the holiday, which meant an absence of southbound flows as a potential support. Meanwhile, Japan's Nikkei 225 breached 37,000 for the first time since February 1990 amid a weaker currency and earnings updates. In Australia, the ASX 200 was rangebound amid light catalysts, while RBA Governor Bullock reiterated a focus on bringing inflation down but noted that the Board hasn't ruled in or out a further rate hike and even touched upon cuts.

Stocks dropped in Hong Kong as there is “no further positive policy from the mainland, and no stock connect inflows,” said Steven Leung, executive director at UOB Kay Hian Hong Kong. There seemed to be limited buying interest in Hong Kong “other than that from the southbound stock connect recently.”

In rates, treasuries were steady, with US 10-year yields rising 1bps to 4.17%. Bunds and gilts have pared most of an earlier fall. The Bloomberg Dollar Spot Index is flat. The kiwi tops the G-10 FX pile, rising 0.7% versus the greenback after economists at ANZ said the RBNZ will resume hiking interest rates later this month.

In rates, treasuries were marginally cheaper on the day, still inside weekly ranges, with yields higher by 1bp-2bp across the curve. US 10-year around 4.17% is ~1bp wider vs bunds and gilts in the sector; US 5s30s is little changed with corresponding German and UK curves flatter by ~3bp on the day. By contrast, core European rates see curve-flattening as German and UK long end outperform.

In commodities, oil prices edge up, with WTI rising 0.2% to trade near $76.30. Spot gold falls 0.1%. Bitcoin jumps 2.9%.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed and were mostly subdued in holiday-thinned conditions ahead of the Lunar New Year. ASX 200 was rangebound amid light catalysts, while RBA Governor Bullock reiterated a focus on bringing inflation down but noted that the Board hasn't ruled in or out a further rate hike and even touched upon cuts. Nikkei 225 breached 37,000 for the first time since February 1990 amid a weaker currency and earnings updates. Hang Seng was pressured amid losses in property and tech in a shortened trading session and with mainland participants already away for Chinese New Year celebrations.

Top Asian News

European bourses are mixed and trading around the unchanged mark, following a mostly higher APAC lead, with slight underperformance in the CAC 40, hampered by losses in L’Oreal (-6.2%) post-earnings. European sectors are mixed; Healthcare is propped up by gains in Carl Zeiss Meditec (+9.4%) after it reported strong results. Utilities are on the back foot, after Enel (-0.9%) received a downgrade at RBC. US Equity Futures (ES U/C, NQ +0.2%, RTY +0.3) are on a mixed footing, with overall price action mirroring that seen in Europe; Expedia (-13.9%) is lower after it reported a deeper than expected loss in FCF; Take-Two Interactive (-8.6%) suffers after cutting Net Bookings guidance.

Top European News

FX

Fixed Income

Commodities

Earnings

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap