US equity futures and global stocks rebounded on Wednesday as investors awaited the Fed's final policy decision of the year, where the US central bank is widely expected to cut 25bps. As of 8:00am, futures for the S&P 500 advanced 0.3%, on pace for their 58th record high of the year, while Nasdaq 100 futs rose 0.2% after both indexes fell on Tuesday. We are seeing some momentum reversions early with TSLA (-2.5% pre mkt after closing at a new ATH yday) and NVDA (+2.7%) the standouts on light news. The Stoxx 600 was set for its first day of gains in five sessions, while Asian equities also gained, snapping a three-day losing streak (FTSE +20bps, CAC +40bps, DAX +40bps, Nikkei -72bps, Hang Seng +83bps, Shanghai +62bps). US treasuries dropped, the yield on the 10Y TSY rising 2bps to 4.41% as the dollar index also gained, as did oil, with WTI rising 0.6% to $70.51. Elsewhere, Bitcoin slid 1.55% to $104,740 as global equities chop around ahead of FOMC this afternoon (consensus expects 25bps cut and messaging of slowing pace of cuts going forward, full preview here). If that wasn't enough, tomorrow we also get BoE/BoJ. On today's macro calendar we get housing start and building permits, but the highlights is the 2pm FOMC decision and 2:30pm Powell press conference.

In corporate news, Boeing stock was about 1% higher after it resumed production across its range of aircraft programs at factories in the Pacific Northwest after a lengthy strike. Here are some other notable premarket movers:

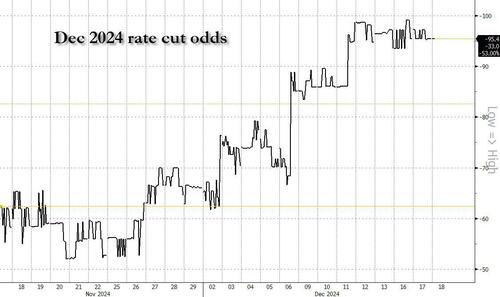

While a quarter-point Fed interest-rate cut is almost fully priced in for Wednesday, investors will focus on the outlook for 2025 as inflation decelerates more slowly than anticipated and the economy remains resilient.

The possible impact of key policies under the incoming administration of Donald Trump adds to the uncertainty. Last quarter, the Fed’s so-called dot plot projected a full percentage point of rate cuts for 2025, following a similar magnitude of easing this year. Currently, money markets are pricing in that a cut on Wednesday would be followed by less than two 25 basis-point reductions next year. Read our full preview here for more.

"Today’s decision will be less consensual than what the market expects," said Florent Wabont, an economist at Ecofi Investissements. “It think it’s the end of back-to-back cuts. The big question is how will Jerome Powell communicate this to the market.”

Still, while Wall Street banks have started anticipating fewer reductions, some interest-rate option traders are betting the market’s view is too hawkish and that the Fed would ease policy more closely to what it projected in September: the equivalent of four quarter-point cuts.

“I don’t expect the market to move hugely today,” said Guy Miller, chief strategist at Zurich Insurance Co. Yields already reflect potentially fewer rate cuts and “that there is a bit more risk premium already baked into that in terms of the inflation dynamic,” he said.

European stocks also rose as they looked to snap a four-day losing streak while shorter-dated bonds in the region outperform on signs of easing inflation pressures. The Stoxx 600 adds 0.2%, led by gains in energy, bank and technology shares. Commerzbank AG rose after UniCredit SpA said it has boosted its stake in the German lender. In Japan, shares of Nissan jumped the most since at least 1974 on news that the ailing carmaker is exploring a possible merger with Honda Motor. Renault SA, Nissan’s biggest shareholder, rose as much as 7.4% in Paris. Here are some of the biggest movers on Wednesday:

Asian stocks eked out small gains, led by a rebound in Chinese and South Korean shares, as traders awaited the Federal Reserve’s final policy decision of the year. The MSCI Asia Pacific Index was up about 0.1%, with tech heavyweights such as TSMC and Samsung Electronics among the biggest contributors. The Hang Sang China Enterprises Index and Korea’s Kospi each jumped about 1%. The gains in Chinese shares came after local regulator issued guidelines stipulating state-owned firms to improve and strengthen market value management over their holding companies. Hong Kong-listed Chinese tech stocks shrugged off news that the US is set to initiate a trade investigation into Chinese semiconductors in the coming days. Japanese shares fell as sentiment remained cautious ahead of the central bank’s monetary policy decision this week. The country’s automakers soared on news that Nissan Motor is exploring a possible merger with Honda.

In rates, US Treasuries were little changed ahead of the Fed announcement, the 10Y rising 1bps to 4.41%. Still, the yield on the 10-year note has surged about 80 basis points since September as traders rethink their outlook for inflation and policy easing. Gilts gained at the open after UK core and service CPI rose less than expected in November but its only front-end bonds that have sustained the move. UK two-year yields fall 1 bp to 4.45% while 10-year borrowing costs add 1 bp. The German yield curve is also steeper as euro-area CPI was revised lower.

In US, equity futures rise. Treasuries are steady before the Fed decision with US 10-year yields flat at 4.40%.

In FX, the Bloomberg’s gauge of the dollar was little changed. The pound fluctuated after UK inflation rose to an eight-month high in November, drifting further above the Bank of England’s 2% target and supporting expectations that it will hold interest rates at its final meeting of the year. The Antipodean currencies are the weakest of the G-10’s, falling 0.4% each against the dollar. The euro adds a few pips.

In commodities, oil prices advance, with WTI rising 0.8% to $70.60 a barrel. Spot gold is steady near $2,648/oz. Bitcoin falls 2% after topping $108,000 for the first time on Tuesday.

Looking at today's calendar, besides the FOMC at 2pm, US economic data calendar includes November housing starts/building permits and 3Q current account balance (8:30am)

Market Snapshot

Top overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded mixed after the earlier upward bias somewhat abated, with sentiment cautious following the negative lead from Wall Street with eyes turning to the FOMC announcement and Chair Powell's presser. ASX 200 is currently flat as the upside in Real Estate, Tech, and Healthcare offset losses in Financials. Nikkei 225 was subdued but with ranges narrow in the run-up to Thursday's BoJ as expectations lean towards a hold. Meanwhile, Nissan shares surged 22% amid several source reports suggesting a potential merger with Honda, whose shares fell 3%. Hang Seng and Shanghai Comp saw positive trade with Chinese markets outperforming despite quiet newsflow but sentiment buoyed ahead of the PBoC's LPR setting on Friday.

Top Asian News

European bourses began the European session on either side of the unchanged mark to display a mixed open; since, sentiment has improved a touch with most indices managing to climb incrementally into the green. European sectors are mixed, in-fitting with the indecisive price action seen in the complex thus far. Energy takes the top spot, lifted by strength in underlying oil prices. In the banking sector, UniCredit (+0.5%) upped its stake in Commerzbank (+2.9%) to 28% (prev. 21%). Basic Resources is found at the foot of the sector list, with metals prices continuing to extend the losses seen in the prior session. US equity futures are very modestly in the green in-fitting with the price action seen in Europe, but also as traders eye the looming FOMC Policy Announcement. Novo Nordisk's (NOVOB DC) Ozempic faces EU review for potential eye disease connection.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US event Calendar

DB's Jim Reid concludes the overnight wrap

There continues to be a lot going on as we hit the final FOMC decision of the year today. More on that below but last night saw the 12th day in a row where the number of decliners exceeded advancers within the S&P 500. This is the second longest run in 100 years and has only been exceeded by a run of 14 days in 1978. Quite remarkable really.

Also remarkable over the last week has been the rise in Broadcom which is fast approaching the Magnificent Seven in size. It passed $1tn market cap for the first time on Friday and surged +45.5% in the week to Monday night's close after very positively received earnings. Yesterday it saw a retracement of -3.91%, but at a market cap of $1.1tn it is about $400bn behind Tesla in 7th place in the Mag-7 largest to smallest list. So today I'm launching a competition to create a moniker for what might become a new group of eight. The best suggestions my team and I came up with yesterday were "The Great Eight", or "The Innov-eightors" or even "The Domin-eightors". Or if you want to be bearish "The Specul-eightors". All ideas welcome and I'll announce the best in the last EMR of the year on Friday.

The Mag-7 (+0.40%) outperformed again yesterday as the S&P 500 (-0.39%) slipped. The main index is still only less than 1% from its all time high but the equal weight S&P 500 (-0.75%) hit a 6-week low yesterday, it's 11th down day in 12, and marking its lowest closing level since the US election outcome was known. However, even this index is only -4.06% from its peak on November 29 so hardly a rout. We should add that Nvidia is now down -12.4% from its peak on November 7 and is trading back at levels first hit in June of this year. So essentially 6 months of range trading. And in a sign of the softening for traditional blue chip names, the Dow Jones (-0.61%) posted its ninth consecutive decline, which is again the longest such run since 1978. European equities also lost ground yesterday, as the Stoxx 600 fell -0.42%, with Spain’s IBEX (-1.62%), Italy’s FTSE MIB (-1.22%) and UK’s FTSE 100 (-0.81%) underperforming.

Moving onto the Fed, it is widely expected that they'll be another 25bp cut today, so the bigger question is what they’ll signal in their dot plot for next year, as there’s been speculation they could pivot in a more hawkish direction. Last time in September, the dots pointed to a further 100bps of cuts in 2025. But since then, the inflation prints have been a bit stronger than expected, so the consensus (and DB’s own forecasts) expect the FOMC to only pencil in 75bps of cuts for next year.

The risk that we actually go the other way is something we pointed out in our curveballs chartbook. 2024 is the third year in a row that markets have over-estimated the Fed’s dovishness. Indeed at the start of this year, futures were pricing in over 150bps of cuts for this year, but after today it looks as though we’ll only end up with 100bps. And when it comes to next year, our US economists think the same will likely happen again, as their baseline sees a much more hawkish path than the futures curve. They think that after today’s cut, a skip in early 2025 could turn into an extended pause, and they don’t see the Fed cutting rates at all next year. See their full preview for today’s meeting here.

Ahead of the meeting, US Treasuries were pretty stable yesterday, with the 10yr yield narrowly posting a 7th consecutive rise (+0.1bps to 4.40%). It had reached a 4-week intra-day high of 4.438% early on but then retreated as a few US data releases weren’t quite as robust as expected. For instance, industrial production was down -0.1% in November (vs. +0.3% expected), and capacity utilisation was down to 76.8% (vs. 77.3% expected). Admittedly, headline retail sales were up +0.7% (vs. +0.6% expected), but the measure excluding autos was only up +0.2% (vs. +0.4% expected). So with all that in hand, the Atlanta Fed’s GDPNow estimate for Q4 ticked down from an annualised rate of 3.29% to 3.14%.

Here in the UK, there were also some pretty significant moves after the latest wage data came out. They showed average weekly earnings up by +5.2% (vs. +4.6% expected), which led investors to dial back their expectations for rate cuts from the Bank of England. It also led to a pretty sizeable gilt selloff, with 10yr yields +8.2bps higher at 4.52%. Significantly, the spread of UK 10yr gilt yields over 10yr bunds closed at 230bps yesterday, surpassing the closing peak when Liz Truss was PM of 228bps, and reaching its highest level since 1990. In essence, the view from a market perspective is that UK inflation is at risk of proving stickier than in the US and the Euro Area, so the BoE likely won’t be able to cut as aggressively as the Fed or ECB, with investors now only expecting 53bps of cuts by the time of the November 2025 meeting. All eyes will now be on this morning’s CPI report from the UK, ahead of tomorrow’s BoE policy decision.

Elsewhere in Europe, there was some pretty mixed data out yesterday. In Germany for example, the Ifo’s business climate indicator was down to 84.7 in December (vs. 85.5 expected), which is the lowest since May 2020 at the height of the pandemic. But we also had the ZEW survey, where the expectations measure picked up to a 4-month high of 15.7 (vs. 6.9 expected). So there wasn’t an obvious steer for markets to trade off, although 10yr yields did end the day slightly lower, including for bunds (-1.7bps), OATs (-1.0bps) and BTPs (-1.5bps).

China risk is leading the way in Asia this morning with the Hang Seng (+1.27%) and Shanghai Composite (+0.98%) higher alongside the KOSPI (+1.30%). On the other side the Nikkei (-0.48%) is lower. S&P 500 (+0.11%) and Nasdaq (+0.07%) futures are trading slightly higher and 10yr USTs are -1.4bps lower at 4.385% as I type.

Early morning data showed that Japan’s exports continue to recover, rising +3.8% y/y in November (v/s +2.5% expected) as against an increase of +3.1% the previous month as weakness in the yen has helped exporters. Imports unexpectedly contracted -3.8% y/y in November (v/s +0.8% expected) as against an increase of +0.4% the previous month. As a result, Japan saw a trade deficit of -117.6 billion yen in November, smaller than the -687.9 billion yen forecast and compared to -461.2 billion last month.

Staying with Japan, Nissan and Honda two major Japanese automakers facing recent challenges, are in discussions regarding a potential merger. The companies released a statement confirming the talks but did not provide specifics about the potential deal or a timeline for completion. Nissan's shares have surged +23.7% following the announcement, the largest increase since at least 1974, while Honda's stock is -3.9% lower.

To the day ahead now, and the main highlight will be the Fed’s latest policy decision, along with Chair Powell’s subsequent press conference. We’ll also hear from the ECB’s Muller, Lane and Nagel. Otherwise, data releases include the UK CPI for November, along with US housing starts and building permits for November.