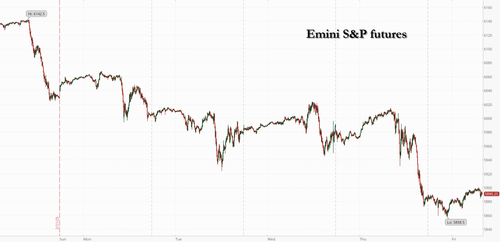

US equity futures are higher, rebounding from an overnight rout driven by a plunge in Chinese and Japanese stocks, while the ongoing crash in bitcoin which sent the token briefly below $80K and down 25% from its all time high, is not helping the dismal sentiment. As of 8:00am ET, S&P futures were up 0.2% and well off the lows,signaling a rebound after the underlying index erased the last of its 2025 gains on Thursday and outperforming both Nasdaq and Russell. Mag 7 are higher led by META (+0.5%) and NVDA (+0.5%). Crypto-linked stocks are lower as Trump’s latest trade-tariff threats prompted a rush by some investors to safer assets, deepening the recent rout in Bitcoin. Bond yields are 1-2bp lower and the USD is higher as the yen finally cracks lower. Commodities are mostly lower: WTI -1.1%, copper -0.7%. Overall, we have seen equities trying to rebound modestly from yesterday’s selloff, but macro narrative has been pressured from trade/policies uncertainties (Trump is set to talk with Zelensky today) and stagflation concerns ; today we get the January PCE and income/spending report: core PCE is expected to print 2.6% YoY, vs. 2.8% prior.

In premarket trading, Meta is leading gains among the Mag 7, meanwhile, Tesla is on track to drop for a record-matching seventh consecutive session (Meta Platforms +0.6%, Alphabet +0.2%, Amazon ,Apple, Microsoft and Nvidia are little changed, while Tesla -0.2%). US-listed Chinese stocks decline in premarket trading, putting the Nasdaq Golden Dragon China Index on course for its first week of decline in seven. Traders are paring bets following Donald Trump’s additional 10% tariffs on Chinese goods. Cryptocurrency-exposed stocks slid as a rout in Bitcoin deepened on Friday, with investors rushing to safer assets in the wake of Donald Trump’s latest tariff threats. Here are some other notable movers:

The S&P 500 has slipped almost 3% this month, in part on worries that Trump’s proposed tariffs would fuel a global trade war. It’s now just about 1% from its closing level of 5,783 points on Nov. 5, the day of the Presidential election. About half of S&P 500 members are now down since election day, according to data compiled by Bloomberg. On the outlook for stocks, BofA's Michael Hartnett said a reversal of the post-election rally would spark investor expectations for intervention by the US president to support the market. The Nov. 5 closing level is the “first strike price of a Trump put, below which investors currently long risk would very much expect and need some verbal support for markets from policymakers,” BofA’s Michael Hartnett wrote in a note.

Attention turns later to the core personal consumption expenditures price index — which excludes often-volatile food and energy costs. The index probably rose 2.6% in the year through January, after an increase of 2.8% in December, according to Bloomberg economists. It likely ticked up to 0.27% monthly compared with 0.16% in December. A hotter-than-expected reading would prompt concern among investors, said Kevin Thozet, a portfolio advisor at Carmignac. “It would be another hint that there hasn’t been much progress on US inflation since June 2024,” he said. The inflation reading is in sharper focus after Trump said 25% tariffs on Canada and Mexico will be enforced from March 4, while Chinese imports would face a further 10% levy. Economists say tariffs may hurt US growth, worsen inflation and possibly spark recessions in Mexico and Canada.

Bitcoin plunged, extending declines from its January peak to over 25%, in a striking pullback for one of the most popular Trump trades. The dollar edged up and Treasuries advanced, with US 10-year yields touching levels not seen since December.

“This is not an environment for de-risking,” said Laura Cooper, global investment strategist at Nuveen, on Bloomberg Television. “Perhaps it is just the case of finding hedges to protect the downside, because that 4th of March deadline is looming.”

In Europe, the Stoxx 600 fell 0.3%, although has recovered off its worst levels, with mining and technology shares faring worst as broader risk sentiment starts to stabilize having been rocked by US President Trump’s latest pronouncements on tariffs. The benchmark was off its Friday lows after French and Italian inflation data boosted the case for European Central Bank interest-rate cuts. Here are the biggest movers Friday:

Asian equities slumped, on track to snap their longest weekly winning streak in nearly a year, as US President Donald Trump’s latest tariff threats and underwhelming Nvidia results damped investor sentiment. The MSCI Asia Pacific Index fell 2.5%, set to cap its worst day since Feb. 3, with Alibaba, Tencent and Meituan among the biggest drags. Shares in Hong Kong led the declines, after Trump said he would impose an additional 10% levy on imports from the Asian nation. The move aggravates growth concerns for the world’s No. 2 economy and threatens to derail a rally induced by optimism over artificial intelligence. South Korea was also among the worst performers, with the Kospi down more than 3%, as tech stocks including Samsung and SK Hynix tracked Nvidia lower after its “good-but-not-great” quarterly raised doubts on the sector’s outlook. Japanese stocks were also hit by trade and chip sector worries. Southeast Asian stocks tumbled as currency weakness and tariffs weighed on sentiment, with Thailand’s SET Index on track to enter a bear market.

The additional tariffs “deliver a negative signal to the market that the trade conflict between the two nations still exists,” said Jason Chan, a senior investment strategist at Bank of East Asia in Hong Kong. “The market in general expects trade talks will be held before a new round of tariff hikes occurs, but Trump’s latest announcement may be a surprise.”

In FX, the Bloomberg Dollar Spot Index rose 0.1% advancing for a third session, and hitting its highest since Feb. 13, after President Donald Trump said the 25% tariffs on Canada and Mexico would come into force from March 4, while Chinese imports would face a further 10% levy. The kiwi is the weakest of the G-10’s, falling 0.6% against the greenback. The pound erased losses after Bank of England Deputy Governor Dave Ramsden said policymakers will have to take “great care” when cutting interest rates given signs of persistent inflation Earlier, the pound slipped to its lowest in more than a week against the dollar. USD/JPY rose 0.4% to 150.4, its highest level in a week.

In rates, treasuries are little changed as US session gets under way after erasing gains that sent yields to fresh YTD lows. US 10-year yield at 4.25% is back within 1bp of Thursday’s closing level after declining as much as 4bp to 4.22%, last seen in Dec. 11; earlier gains in Treasury futures were backed by a rally in JGBs after domestic inflation slowed more than expected. Core European rates outperformed after French inflation fell to its lowest level in four years and prices in Italy unexpectedly held steady — bolstered expectations for ECB rate cuts. bunds and gilts in the sector outperform by 2bp and 2.5bp; bunds gapped higher at the open, tracking the overnight rally in Treasuries and later showed little reaction to German state inflation data. French and Italian EU harmonized CPI rose less than forecast. German 10-year yields fall 3 bps to 2.38%. Gilts also gain, with UK 10-year borrowing costs dropping 3 bps to 4.48%. Bank of England interest-rate cut bets are steady after Deputy Governor Ramsden said policymakers will have to take great care when lowering rates. Focal point of US day is January personal income and spending data that include PCE price indexes, with core gauge expected to show first deceleration since September.

In commodities, oil prices decline, with WTI falling 1% to $69.60 a barrel. Spot gold falls $15 to around $2,862/oz. Bitcoin briefly tumbles below $80000, plunging 25% from its all time high a little over a month ago.

US economic data calendar includes January personal income/spending and advance goods trade balance (8:30am), February MNI Chicago PMI and February Kansas City Fed services activity (11am). Fed speaker slate includes Goolsbee at 10:15pm.

Market Snapshot

Top overnight news

Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks declined with heavy pressure seen at month-end following the sell-off on Wall St with global risk sentiment hit by tariff threats and following a slump in NVIDIA shares post-earnings. ASX 200 was pressured with nearly all sectors in the red and the declines led by underperformance in miners and tech. Nikkei 225 slumped from the open and briefly dipped below the 37,000 level with the index down by more than a thousand points amid tech-related selling, while there were mixed data releases from Japan including softer-than-expected Tokyo CPI, a miss on Retail Sales and a slightly narrower-than-feared contraction in Industrial Production. Hang Seng and Shanghai Comp conformed to the broad downbeat mood amid trade-related frictions after US President Trump announced that an additional 10% of tariffs on China is set to take effect on March 4th which is on top of the 10% tariffs the US had previously imposed earlier this month. Nonetheless, the losses in the mainland were somewhat cushioned ahead of next week’s annual ”Two Sessions” in Beijing, where markets will be hoping for fiscal stimulus.

Top Asian News

European bourses (STOXX 600 -0.4%) began the session entirely in the red, continuing the down-beat and risk-off mood seen in US and APAC hours. As the morning progressed, there has been an upward bias, attempting to pare back some of the early morning pressure; indices still generally reside in the red. European sectors hold a strong negative bias, given the risk-off sentiment. Construction & Materials tops the pile, lifted by post-earning strength in Holcim (+3.5%). Basic Resources is the underperformer today, given the risk-tone which has weighed on underlying metals prices. It is also no surprise that Tech is amongst the laggards, following the significant losses in NVIDIA (-8.5%) in the prior session; ASML (-2.5%)

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Happy Friday. It's been a busy week of travel and dinners, and on getting home last night our kitchen cupboards had finished being repainted. I couldn't tell any difference. When I told my wife that, she said (and I'm paraphrasing to get through compliance), "How on earth can you not tell? They were getting disgusting and now they look new". I didn't think they needed doing but I can't tell if that's me lacking standards or whether my wife has too high ones. Now we're 7-8 years on since we gutted our house and starting again I fear this is the first of many redecoration altercations!

Markets were in a stressed mood of their own yesterday, with renewed tariff threats from President Trump in addition to a sharp tech sell-off that saw the Magnificent 7 (-3.03%) post its worst day of 2025 so far as Nvidia slumped -8.48% after its earnings the previous evening. This marked a sixth consecutive decline for the Mag-7, the first time that’s happened since April last year, and it now leaves the index -13.56% beneath its December peak. In turn, the S&P 500 fell -1.59%, moving back into the red YTD and on course for its worst week since September, while the VIX closed above 20 for the first time this year (+2.03pts to 21.13).

Risk assets had already come under some pressure after President Trump confirmed that 25% tariffs on Canada and Mexico were still scheduled for this Tuesday, March 4. In a post on Truth Social, President Trump said that “Drugs are still pouring into our Country from Mexico and Canada”, and that “until it stops, or is seriously limited, the proposed TARIFFS scheduled to go into effect on MARCH FOURTH will, indeed, go into effect, as scheduled.” On top of that, he said that China would face an additional 10% tariff, and then on April 2, the reciprocal tariffs would also go into force.

Of course, it’s worth bearing in mind that at the start of February, the proposed tariffs were extended by a month with just hours to spare. And President Trump’s post did leave some room for another extension or deal, as he used the phrase “until it stops, or is seriously limited”, suggesting there was a way of avoiding them. However, if they do come into place for a prolonged period, then the same framework from before would apply, with Canada and Mexico likely to go into an imminent recession. Moreover, it would raise US inflation, and make it more likely that the Fed doesn’t cut this year at all. Our US economists have previously suggested that the 25% tariffs on their two neighbours would reduce US growth by between 0.4 to 0.7% in 2025 and raise core PCE by between 0.3% to 0.7% if sustained. See their analysis here.

In terms of whether a deal could be reached, officials in Canada and Mexico were both still talking as though that was possible. Indeed, Mexican President Sheinbaum said yesterday that “I hope we can reach an agreement and that on March 4 we can announce something else”. Meanwhile, Canada’s public safety minister David McGuinty said in Washington yesterday that “We are quite convinced that the efforts we’ve made thus far should satisfy the US administration”. And given the last extension was made in the final 24 hours, it’s not implausible that markets won’t start to price the full impact of tariffs until after they actually come into force. However, in the case of China, it’s worth bearing in mind that they didn’t reach a deal, and the 10% tariff did come into force earlier this month, so this would be an extra 10% on top of that.

Although investors are still anticipating a potential last-minute deal again, the most tariff-sensitive assets saw an immediate reaction to Trump’s post. For instance, the Canadian dollar weakened by -0.69% against the US Dollar, while the euro fell to back below 1.04 against the dollar posting its worst day in eight weeks (-0.83%). Elsewhere in Europe, the STOXX Automobiles and Parts index was already having a bad day given President Trump’s announcements of 25% auto tariffs on the EU, but it extended its losses to close -3.73% lower. More broadly, there was underperformance for the DAX in Germany (-1.07%) and the FTSE MIB in Italy (-1.53%), two countries relatively more exposed to trade with the US, while the STOXX 600 fell -0.46%.

On top of the tariffs, we got some more inflationary news from the latest Q4 GDP data, as the Fed’s preferred inflation measure of PCE was revised up on the second estimate. It showed that headline PCE was now running at +2.4% in Q4, an upward revision of a tenth, whilst core PCE was revised up two-tenths to +2.7%. So it’s in a zone where it’s still lingering above target, and that’s before the imposition of any Trump tariffs. With WTI crude oil prices also moving +2.52% higher yesterday to $70.35/bbl, investors moved to price in higher inflation, with the 1yr inflation swap bouncing +5.7bps higher on the day to 2.925%. Looking forward, that inflation focus will continue today, as we’ve got the PCE numbers for January coming out, and our US economists are expecting a core PCE reading of +0.27%.

For rates, the combination of a risk-off tone and a more inflationary backdrop drove a curve steepening. Despite the rise in near-term inflation pricing, the front-end saw a modest rally as investors moved to price in 61bps on Fed cuts by December (+1.4bps on the day). This saw 2yr Treasury yields (-2.0bps) fall to a new 4-month low of 4.05%, while the 2yr real yield fell to 0.87%, its lowest since August 2022. By contrast, 10 year yields ended a run of 6 consecutive declines (+0.4bps to 4.26%). However, overnight in Asia they've rallied a sizeable -4bps for this time of day, trading at 4.22% as I type.

Over in Europe, sovereign bonds had seen a modest rally, with yields on 10yr bunds (-2.0bps) and OATs (-0.9bps) moving slightly lower. That came as the Spanish CPI release for February was in line with expectations, with the EU-harmonised measure at +2.9%, so the lack of an upside surprise helped reassure investors ahead of the numbers from other countries, including France, Italy and Germany today.

President Trump’s comments again drew attention later in the day with Keir Starmer’s visit to Washington. On trade, President Trump said he envisaged "a real trade deal" with the UK, which could mean that tariffs were “not necessary”. On Ukraine, the UK Prime Minister said that the UK would be ready to puts “boots on the ground" to support a peace deal. While saying he supported NATO's Article 5, President Trump refrained from promising any US backstop for European involvement in Ukraine, stating "I don’t like to talk about peacekeeping until we have a deal". Ukraine will remain in the headlines today with President Zelenskiy due to visit Trump in Washington, as the two are expected to sign a deal on Ukrainian minerals. The ongoing focus on European defence saw Germany’s Rheinmetall (+3.20%) continue to outperform yesterday, taking its YTD gains to +62.87%.

Asian equity markets are tumbling this morning with the KOSPI (-3.28) and the Nikkei (-3.10%) the largest underperformers with the latter plunging to its lowest level since mid-September 2024 while the Hang Seng (-2.78%) is also trading sharply lower as local tech shares are slumping following the Nvidia sell-off on Wall Street overnight. Elsewhere, the S&P/ASX 200 (-1.18%) and the Shanghai Composite (-1.29%) are also trading lower. US equity futures have stabilised and are up around a tenth of a percent.

Early morning data showed that headline inflation for Tokyo came in at +2.9% y/y in February (v/s +3.2% expected) down from +3.4% in January. At the same time, Tokyo’s core consumer prices rose by +2.2% y/y in February, a deceleration from January’s 2.5% increase, an 11-month high, and a tenth lower than expectations. The same miss as core/core inflation. Separately, other data showed that Japan’s industrial production in January decreased by -1.1% m/m, aligning with market expectations and compared to a -0.2% contraction in December. Concurrently, retail sales experienced a +3.9% y/y gain in January, in line with projections as against a +3.5% gain in the prior month.

To the day ahead now, and data releases include the French, German and Italian CPI prints for February, along with US PCE inflation for January. Otherwise, we’ll get Canada’s Q4 GDP, and German unemployment for February. Elsewhere, central bank speakers include the BoE’s Ramsden.