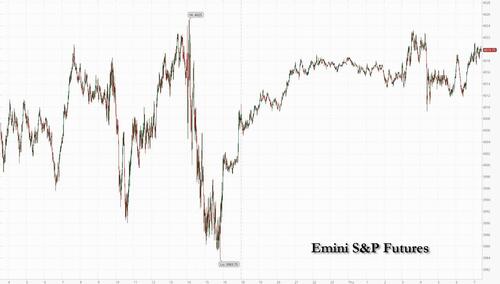

US futures rebounded from yesterday's post FOMC selloff, rising back over 4,000 as concern about aggressive monetary tightening eased and Nvidia soared 10% after giving a bullish revenue outlook. Contracts on the Nasdaq 100 were up 1% as of 7:45 a.m. ET while S&P 500 futures rose 0.4%. The underlying stock gauges closed mixed on Wednesday as minutes from the Federal Reserve’s latest meeting signaled its determination to keep hiking interest rates to combat inflation. The tech rally may be short-lived thought: treasuries edged lower again, reversing yesterday’s gains. The Bloomberg Dollar Spot Index recovered from earlier lows, pressuring most Group-of-10 currencies. Gold was little changed, while oil advanced. Bitcoin rose nearly 2% following two days of losses, before fading some of its gains.

In premarket trading, tech stocks were among the best performers, with chipmaker Nvidia, which has a 4.2% weighting in the Nasdaq 100, surging 10% after it reported Q4 results that beat expectations and gave a bullish revenue outlook for the current quarter. Growth in sales of chips for data centers has helped the company weather a slowdown in the PC market as it gears up for an expected boom in artificial intelligence. By contrast, EV maker Lucid plunged 8.1% in premarket trading after it posted worse-than-expected results in the final months of what it called a “challenging” year. Unity Software dropped 7.3% after the company’s revenue forecasts trailed consensus estimates. Here are some other notable premarket movers:

Nvidia provided “an excellent report and solid outperformance amid weakening macro trends,” CJ Muse, an analyst at Evercore ISI, wrote in a note. Still, others saw this as merely another modest bounce in an otherwise bearish slump. Further policy tightening “will create some small recessionary result probably in the third or fourth quarter of 2023, but we will still be in a scenario of soft landing,” said Stephane Monier, chief investment officer at Banque Lombard Odier. “In that scenario we expect the S&P 500 to be around 3,900,” he said on Bloomberg TV. “We are currently underweight US equities as we are expecting a little bit of a correction in the weeks to come,” Monier said. “And we have a strong preference for Asian equities, particularly China but not only.”

After months of divergence over the perceived path of monetary tightening, the Fed and markets are increasingly getting aligned in their expectations, reducing the scope for hawkish shocks. While the minutes and comments by Fed officials including James Bullard reiterated a continuing preference for rate hikes, they didn’t say anything that wasn’t factored in by the market’s aggressive repricing of Fed bets in recent weeks.

“One of our big concerns coming into this year was the market was anticipating an event that wasn’t likely to occur, that being a dovish Fed pivot,” Danielle Poli, co-portfolio manager of the diversified income fund for Oaktree Capital Management, said in an interview with Bloomberg Television. “The market has woken back up a little bit in these last two weeks.”

US Jobless claims data due Thursday may help shine a light on the strength of the labor market, which has remained stubbornly robust through the rate-hiking cycle. Eurozone inflation data due today will also help investors outline the health of the European economy.

European stocks struggled for direction as investors remained wary of the prospect of additional monetary tightening by the Fed when the latest Fed minutes revealed that a “few” officials favored a larger half-point hike. The Stoxx 600 was up less than 0.1% with autos, tech and media the best performing sectors. The FTSE loses 0.4%. Here are some of the biggest European movers:

Earlier in the session, Asian stocks snapped a two-day decline as traders focused on US economic data due Thursday, while shares in Hong Kong entered correction territory. The MSCI Asia Pacific ex Japan Index rose as much as 0.9%, before paring gains to 0.3% in afternoon trading. South Korean shares were among the biggest advancers in the region as the Bank of Korea paused rate hikes for the first time in a year. Meanwhile, Hong Kong’s Hang Seng Index fell into correction amid growing geopolitical concerns and doubts over the strength of China’s economy. Japan was closed for a holiday. The US will release data on economic growth, consumption and employment, providing more clues on the Fed’s policy path.

The MSCI Asia gauge is trading about 6% lower than a peak reached in late January as investors assess higher bond yields and China’s path to recovery. Still, a gauge of tech stocks soared as the US 10-year Treasury yield eased toward 3.9% overnight, although it reversed the decline in the afternoon. Minutes of the latest Federal Reserve meeting showed that officials continued to anticipate further increases in borrowing costs, although most were in favor of smaller rate increases. Fed’s Williams Says Fed’s 2% Inflation Goal Key to Taming Prices The FOMC “sounded hawkish at the margin,” Saxo Capital Markets strategists wrote in a note. “While this risk of a recession was noted, data since the meeting including the most recent PMI numbers this week have continued to ease recession concerns.”

Australian stocks declined again, as the S&P/ASX 200 index fell 0.4% to close at 7,285.40, extending losses for a third day, dragged by mining shares and banks. National carrier Qantas was among the day’s laggards after the airline flagged higher-than-expected spending on planes, while Eagers, the top performer, rallied after the Australian auto dealer said demand for new cars remains strong. In New Zealand, the S&P/NZX 50 index rose 0.8% to 11,888.50.

Indian stocks ended lower after a volatile session as monthly derivative contracts expired on Thursday. The S&P BSE Sensex fell 0.2% to 59,605.80 in Mumbai, while the NSE Nifty 50 Index declined by a similar measure. The gauges have now dropped for five straight sessions, the longest run of declines since Sept. 29. The benchmark Sensex has nearly erased its gains for February, while the Nifty has fallen to its lowest levels since Oct. 18. All but two of ten companies controlled by the Adani Group closed lower as concerns linger about the conglomerate’s corporate structure. Expiry of monthly options also weighed on the stocks. India’s finance ministry on Thursday said that if predictions on the return of El Nino conditions are accurate, that could lead to a deficient monsoon, resulting in lower agricultural output and higher prices. Sixteen of 20 sector sub-gauges compiled by BSE Ltd. declined. Realty firms and utilities were the worst performers, while metal and services sector companies advanced. For the week, all but fast-moving consumer-goods companies have retreated. HDFC Bank contributed the most to the Sensex’s decline on Thursday, decreasing 0.7%. Out of 30 shares in the Sensex index, 13 rose and 17 fell.

In FX, the BBG Dollar Index traded marginally weaker, having come off day’s lows; the New Zealand dollar and Australian dollar are vying for top sport among the G-10’s, while the pound was the worst.

In rates, Treasuries were under pressure as US trading day begins, with yields still inside Wednesday’s ranges. UST yields are higher by as much as 2.4bp in 10-year sector; Wednesday’s ranges included YTD highs for most tenors; the 10Y TSY rose 4bps to 9.449%, near session highs. The week's auction cycle concludes with 7-year note sale at 1 p.m. New York time, last coupon auction until March 8 and poised to draw a record high yield. WI 7-year yield 4.08%; record high stop was 4.027% in October. In Europe, gilts underperformed their German counterparts after hawkish remarks from BOE policymaker Mann. UK 10-year yields are up 4bps while the German equivalent is up 2bps.

Traders are now pricing in a Fed peak rate of 5.55% by July, compared with 4.90% they were betting on at the start of year. However, Fed officials haven’t grown more aggressive during this time: Fed Bank of St. Louis President Bullard reiterated his earlier stance, saying “I’m still at 5.375%.” Markets fully price in a 25 basis-point hike in March, but assign a 24% probability for a 50-point hike.

In crypto, bitcoin is firmer on the session having successfully reclaimed the USD 24k mark after losing the figure on Wednesday, though it remains shy of recent USD 25k+ levels.

In commodities, oil gained — after the longest run of losses this year — as traders took stock of a mixed demand outlook of tightening US monetary policy and China’s reopening. WTI rose 0.7% to trade near $74.45. Spot gold is little changed around $1,826.

Looking to the day ahead now, and data releases include the final CPI release from the Euro Area in January, which came in just hotter than the Flash print, as well as the second estimate of US GDP in Q4. Otherwise, we’ll get the US weekly initial jobless claims, and the Kansas City Fed’s manufacturing index for February. Meanwhile from central banks, we’ll hear from the Fed’s Bostic and Daly, the ECB’s de Cos, and the BoE’s Cunliffe and Mann. Finally, today’s earnings releases include Booking Holdings and Moderna.

Market Snapshot

Top Overnight News from Bloomberg

- The global economy is in a better place today than many predicted months ago, US Treasury Secretary Janet Yellen said Thursday, while reiterating her calls for support to Ukraine on the eve of the one-year anniversary of Russia’s invasion. BBG

- The EU and the US are close to an agreement on raw materials used in batteries that would allow EU companies access to some of the same benefits in President Joe Biden’s green investment plan as Washington’s free-trade partners, according to the bloc’s trade chief Valdis Dombrovskis. BBG

- Sweden’s government budget is likely to be in the red for the first time since the pandemic hit in 2020, as tax income is set to drop and large-scale electricity-price support weighs on finances, according to the National Debt Office. BBG

- Hong Kong’s CPI for Jan overshoots the St, coming in at +2.4% Y/Y (vs. the consensus forecast of +2.1% and up from +2% in Dec). BBG

- BABA +4% pre mkt reported solid Q4 upside, including revenue +2% to RMB247.7B (vs. the St RMB245.8B), EBITDA +15% to RMB59.16B (vs. the St $RMB53.5B), and EPS +14% to RMB19.26 (vs. the St 16.57). Revenue upside was driven by the core China Commerce business along with Int’l Commerce and Cainiao Logistics while Local Consumer Services and Cloud Computing fell a bit short. During Q4 the company repurchased 45.4 million ADSs for approximately US$3.3 billion. They still have $21.3B left on the buyback (as of 12/31). BBG

- Chinese leader Xi Jinping is preparing to shake up the leadership of the country’s financial system, installing key associates to run the central bank and reviving a Communist Party body to tighten political control over financial affairs, according to people familiar with the discussions. WSJ

- Washington is considering releasing intelligence showing that China is considering supplying weapons to Russia as part of a campaign aimed at deterring Beijing from intervening militarily. WSJ

- South Korea’s central bank left rates on hold, as expected, joining the Bank of Canada as the second monetary authority to complete its hiking cycle. RTRS

- The European Commission has banned its staff from using the TikTok app on their work-issued devices, widening across the Atlantic a patchwork of similar, limited bans affecting U.S. officials. WSJ

- Europe’s final CPI for Jan was revised higher on core (from +5.2% to +5.3%) while the headline figure of +8.6% was kept unchanged. BBG

- The US oil buildup continued. Inventories bumped up by just under 10 million barrels last week for a ninth weekly increase, the API is said to have reported. That would take total holdings to the highest in 21 months if confirmed by the EIA. More bearish pressures: Brent's prompt timespread narrowed sharply yesterday, signaling a softer market, and the nearest spread for WTI indicates ample supply. BBG

- New York Federal Reserve Bank President John Williams on Wednesday said the U.S. central bank is "absolutely" committed to bringing inflation back down to its 2% target over the next few years, by bringing demand down in line with constrained supply. RTRS

- After peaking at $47.7 trillion in June, the total value of US homes declined by $2.3 trillion, or 4.9%, in the second half of 2022, according to real estate brokerage Redfin. That’s the largest drop in percentage terms since the 2008 housing crisis, when home values slumped by 5.8% from June to December. BBG

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks lacked firm direction with price action mostly rangebound amid thinned conditions due to the holiday closure in Japan and following the mixed performance stateside where the major indices faded mild gains in the aftermath of the FOMC minutes. ASX 200 was the laggard with the index weakened by underperformance in the mining industry after recent declines in commodity prices and a slump in Rio Tinto’s profits, although losses were limited as participants also digested better-than-expected capex data. KOSPI was the biggest gainer amid recent currency weakness and after the BoK kept its rate unchanged for the first time in a year, as unanimously expected. Hang Seng and Shanghai Comp. were indecisive with stocks initially led higher by strength in tech and after China vowed to improve measures to cut taxes and fees, although the gains were briefly pared amid ongoing global frictions and the PBoC’s liquidity drain.

Top Asian News

European bourses are firmer on the session with a hefty earnings docket dictating action after an uninspiring APAC handover, Euro Stoxx 50 +0.4%. However, the FTSE 100 -0.5% is the exception following pressure from Anglo American and BAE Systems post earnings, though this is offset a touch by marked outperformance in Rolls Royce. Stateside, futures are broadly-speaking in-fitting with Europe though the NQ +0.7% outperforms given tailwinds from NVIDIA's after-market update.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Although markets have stabilised after Tuesday’s sell-off, the release of the FOMC minutes yesterday still led the S&P 500 (-0.16%) to lose ground for a 4th consecutive session, marking the longest run of declines of 2023 so far. Admittedly, the minutes were always going to feel a bit stale given the strong payrolls and CPI data as well as the upward revisions that have transpired since the meeting, but there were still some insights to be gleaned. In particular, they showed that “almost all” participants favoured downshifting to a 25bp hike, whilst “a few” still wanted a 50bp move. Furthermore, many on the committee “observed that a policy stance that proved to be insufficiently restrictive could halt recent progress in moderating inflationary pressures, leading inflation to remain above the Committee’s 2 percent objective for a longer period, and pose a risk of inflation expectations becoming unanchored.” That follows recent data prints indicating that policy may not yet be fully restrictive. And on financial conditions, the minutes noted that “a number of participants observed that financial conditions had eased in recent months, which some noted could necessitate a tighter stance of monetary policy."

Following the minutes, pricing for the Fed’s terminal rate closed at its highest level of this cycle to date, with futures expecting a rate of 5.37% at the July meeting, ending the day up +0.5bps higher. Overall though, the curve was little changed, with the end-2023 rate for December down by -1.1bps to 5.18% by the close. In turn, that prompted US Treasuries to pare back their earlier gains, with the 10yr yield moving off its lows for the day prior to the minutes to only close down -3.7bps at 3.92%. Those swings were even more evident looking at the 2 year yield, which was down -7.1bps in the early US afternoon before spiking +4.1bps to end the day down -2.9bps at 4.69%.

The perception that the minutes had a hawkish tilt meant that market-based measures of US inflation expectations moved lower in response, having been on a consistent run higher over recent weeks. For instance, at one point yesterday the 2yr inflation breakeven was on track to close above 3% for the first time in over 6 months, before closing -1.9bps lower at 2.97%. Bear in mind it was only on January 18 that it closed at 2.04%, so the last month has seen a serious reappraisal about the likely path of inflation over the next couple of years. That’s been echoed at longer time horizons as well, with the 10yr breakeven on track to close at its highest level since early November yesterday just ahead of the minutes, before falling -4.1bps to 2.60%.

Ahead of the Fed minutes, we heard separately from St Louis Fed President Bullard who said in a CNBC interview that “I’m still at 5.375%” in terms of where he wanted to take rates. That would be 75bps above their current levels, and is roughly in line with where current market pricing is expecting terminal to get to. After the close, we then heard from New York Fed President Williams, who reiterated his previous stance that inflation would return to trend in the next “few years”. He noted that goods prices have come down, but not as quickly as he had hoped. He also echoed the FOMC minutes by emphasising they did not want the “inflation expectations anchor to slip.”

When it comes to the Fed’s hiking cycle, another interesting datapoint came from the Mortgage Bankers Association, whose index of home-purchase applications fell to its lowest level since 1995 in the week ending February 17. That comes as mortgage rates have begun to rise again following their decline at the end of last year, with the MBA’s data for a 30-year contract showing rates have gone up by +44bps in the last two weeks, which is the biggest two-week increase since September.

US equities had fluctuated between moderate gains and losses throughout the day, before moving lower following the FOMC minutes with the S&P 500 down -0.16%. The largest underperformers were mostly made up of cyclicals such as Real Estate (-1.02%), Transportation (-0.99%), and Energy (-0.77%), but also some defensives like Food & Staples (-1.15%). The best performers were led by Autos (+1.34%) due in large part to Tesla (+1.77%), and the NASDAQ (+0.13%) posted a modest gain as well.

Over in Europe, markets had similarly put in a pretty subdued performance ahead of the Fed minutes, with the STOXX 600 down a further -0.33%. That said, this marked a recovery from its earlier lows, when it had been down -1.03% during the European morning before recovering into the afternoon. It was much the same story for bonds, with yields on 10yr bunds as high as 2.57% intraday before closing -0.8bps lower at 2.52%. Those more positive moves came as we had further evidence that the economic situation was improving in Europe with the release of the Ifo Institute’s latest business climate indicator for February. That rose to 91.1 in February (vs 91.2 expected), which marked its 4th consecutive monthly advance and is its highest level since June. The expectations component also hit a 1-year high of 88.5 (vs. 88.4 expected), although the current assessment dipped slightly to 94.1 (vs. 94.9 expected).

Overnight in Asia, it’s a quieter session given the Japanese holiday today, but equity markets have remained subdued as in the US and Europe. For instance, the Hang Seng is up just +0.01% this morning, whilst the Shanghai Comp (-0.11%) and the CSI 300 (-0.11%) have both posted modest declines. The main exception to that pattern has come from the KOSPI (+1.01%), which follows the Bank of Korea’s decision to leave interest rates unchanged for the first time in a year, holding at 3.5%. The BoK’s Governor said that one member wanted a 25bp increase, and also that “I hope the hold this time isn’t going to be seen as meaning the rate-hike stance is over”. In response, the South Korean Won has strengthened by +0.62% against the US Dollar this morning. And looking forward, US equity futures are pointing to a better performance today, with those on the S&P 500 (+0.43%) and the NASDAQ 100 (+0.79%) posting decent gains.

To the day ahead now, and data releases include the final CPI release from the Euro Area in January, as well as the second estimate of US GDP in Q4. Otherwise, we’ll get the US weekly initial jobless claims, and the Kansas City Fed’s manufacturing index for February. Meanwhile from central banks, we’ll hear from the Fed’s Bostic and Daly, the ECB’s de Cos, and the BoE’s Cunliffe and Mann. Finally, today’s earnings releases include Booking Holdings and Moderna.