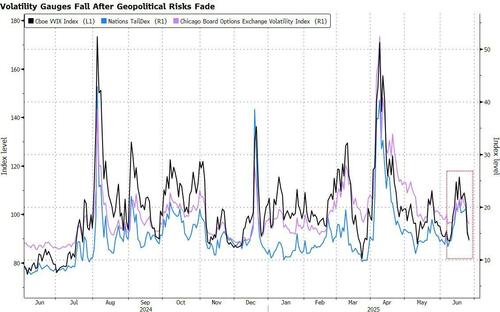

US equity futures extend their torrid short squeeze rally and are set to hit a new all time high for the S&P, with Tech outperforming while volatility is falling rapidly. As of 8:00am, S&P futures rose 0.3% to 6,170 while Nasdaq futures gained 0.5% with all Mag7 names higher again, and semis aiding the rally after solid earnings from Micron; cyclicals outperform defensives. The VIX is trading below 17 amid a relentless selloff in volatility, and heading for a four-month low, despite Trump’s looming trade deal deadline and other simmering risks. The dollar slumped to the lowest since April 2022 as traders ramped up bets for faster US interest-rate cuts, spurred by a WSJ report that Trump may fast-track his nomination for the next Federal Reserve chief. Treasury yields declined across the curve, with the 10-year rate down two basis points to 4.27%. Commodities are seeing a rebound led by Ags/Precious metals. Today’s macro data focus includes Durable/Cap Goods, Initial Claims, and regional Fed activity indicators. On Durable/Cap, Goldman expects a +15% MoM surge in Durables thanks to the sharp increase in aircraft orders after Trump's visit to the Middle East; Initial Claims are expected to print at 243k.

In premarket trading, Mag 7 stocks are higher alongside index futures (Nvidia +1.3%, Alphabet +1%, Meta +0.8%, Amazon +0.7%, Microsoft +0.4%, Tesla -0.1%, Apple -0.1%).

In corporate news, Tokyo Gas is said to be in discussions with multiple US liquefied natural gas suppliers to secure a long-term purchase agreement. Mars’s $36 billion takeover of snack maker Kellanova was given the green light by the FTC on the same day EU regulators opened up a lengthy probe of the deal. Shell said it has no intention of making a takeover offer for BP.

The Bloomberg dollar index fell 0.4% to the lowest level since April 2022; Treasury yields declined across the curve, with the 10-year rate down two basis points to 4.27%, as markets are pricing 64 basis points of easing from the Fed by the end of the year, compared to 51 basis points at the end of last week, with a 20% chance of a quarter-point cut next month.

The moves followed a WSJ report that Trump may announce Powell’s successor as soon as September, which could essentially create a “shadow” central bank chair who’s more open to rate cuts, before Powell’s term is over (market now pricing in a 25% chance of a July cut/100% chance of a cut by Sept meeting). According to the WSJ, "the president has toyed with the idea of selecting and announcing Powell’s replacement by September or October, according to people familiar with the matter…Trump is considering former Fed governor Kevin Warsh and National Economic Council director Kevin Hassett. Treasury Secretary Scott Bessent is being pitched to Trump by allies of both men as a potential candidate. Other contenders include former World Bank President David Malpass and Fed governor Christopher Waller."

The “discussion around naming a Fed chair early and that Fed chair presumably being more dovish, or willing to do a little more of what Trump wants to do in terms of cutting rates, it’s all going to weigh on rates and the dollar,” said Timothy Graf, head of EMEA macro strategy at State Street Global Markets.

Sentiment was boosted by the continued gains in chip stocks and the AI theme: Micron climbed about 1.5%, while Nvidia Corp. is set to extend its advance into record territory, rising 1.1%. “The Micron earnings are likely to boost tech again and when tech thrives, everything thrives,” said Pierre Alexis Dumont, chief investment officer at Sycomore Asset Management. “In that sense, we could reach a new record today.”

Sure enough, Barclays strategists expect US stocks to see further gains and note that “fears of a foreign buyers’ strike against US assets are overdone.” Elsewhere, the Treasury Department is nearing a deal that would make the so-called “revenge tax” irrelevant, a development that could bring relief to Wall Street investors worried about punitive tax measures on foreigners.

Meanwhile, the VIX is now below 17 and heading for a four-month low, despite Trump’s looming trade deal deadline and other simmering risks. It’s a big day for macro data, with durable goods, GDP and the Fed’s preferred inflation gauge, core PCE, all on deck.

Turning to trade, Deputy Treasury Secretary Michael Faulkender said the expectation is that, following negotiations with US trading partners, tariffs won’t go back as high as the reciprocal levies Trump announced on April 2. Japan’s chief trade negotiator said the country can’t accept the US’s 25% tariffs on cars, as Japanese automakers produce far more cars in the US than they export to it. China’s $1.3 trillion sovereign wealth, CIC, is in retreat from the US, as tensions with the US throw up investment roadblocks and Beijing seeks to lower risk by reining in the massive fund.

In Europe, the Stoxx 600 rises 0.2%, lifted by retail shares after H&M delivered better-than-expected profit. Miners are also outperforming while auto shares lag. Here are some of the biggest movers on Thursday:

Earlier in the session, Asian equities advanced, lifted by technology shares after Nvidia climbed to a record high. Stocks in South Korea and Hong Kong retreated following recent rallies. The MSCI Asia Pacific Index advanced as much as 0.9%, poised for its best three-day gain since April. The benchmark is trading at its highest level since September 2021. Tech stocks were among the biggest boosts to the gauge after Nvidia reclaimed its position as the world’s most valuable company, suggesting that the AI trade has further to run. Meanwhile, Hong Kong shares were on track for their first loss in five sessions and Korean stocks paused one of the world’s hottest rallies of the year.

In FX, the Bloomberg Dollar Spot Index is down 0.4%, the lowest since April 2022, and on course for a fourth straight day of declines after the Wall Street Journal reported US President Donald Trump is considering an early appointment for the next Federal Reserve chairman. That’s bolstering expectations that Fed interest rates will be cut sooner than previously expected. The Japanese yen is leading gains against the greenback, rising 0.9%. The Swiss franc and pound outperform most of their G-10 peers.

In rates, treasuries gain on the back of news that a shadow Fed chair may soon be revealed. Front-end yields are 2bp-3bp richer, keeping 2s10s and 5s30s spreads near Wednesday’s highs. 10-year around 4.27% is 1bp lower on the day with bunds and gilts lagging by 0.5bp and 1.5bp in the sector. Fed-dated OIS contracts price in around 62bp of easing for the year, of which about 5bp are priced for the next policy meeting in July. The week’s coupon auction cycle concludes with $44 billion 7-year note sale, following unremarkable results for 2- and 5-year notes; WI 7-year yield near 4.03% is ~16.5bp richer than last month’s, which stopped through by 2.2bp

In commodities, spot gold climbs $8 to around $3,340/oz. WTI is little changed near $65 a barrel.

Looking at today's calendar, US economic data slate includes May trade balance, May preliminary wholesale inventories, 1Q GDP revision, May Chicago Fed national activity and durable goods orders and weekly jobless claims (8:30am), May pending home sales (10am) and June Kansas City Fed manufacturing activity (11am). Fed speakers include Goolsbee (8:30am), Barkin (8:45am), Daly (8:45am), Hammack (9am), Barr (1:15pm) and Kashkari (7pm)

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed in choppy fashion following a similar session on Wall Street, with overnight newsflow relatively light as Israel and Iran seemingly continued to observe the ceasefire. ASX 200 was weighed on by the tech sector despite outperformance in the space stateside. ASX-listed software giant Xero fell over 7% after announcing its intention to purchase payments provider Melio for around USD 3bln. Nikkei 225 outperformed and topped the 39k mark for the first time in over a month, led by strong gains in the industrial sector. This came despite a firmer JPY, with market focus turning to the upcoming US-Japan trade talks after local media flagged Japanese Economy Minister Akazawa’s planned visit to Washington as early as June 26th. Hang Seng and Shanghai Comp were mixed, while Chinese Premier Li said authorities will take forceful steps to boost consumption. Thereafter, bourses drifter higher as a Chinese state planner official said that with policy implementation and introduction, "we are confident and capable of minimizing the adverse impacts from external shock."

Top Asian News

European bourses (STOXX 600 +0.2%) are generally modestly firmer across the board, following a mixed and choppy APAC session overnight. Though it is worth noting that price action (aside from the DAX 40) has been quite choppy and within a tight range so far. European sectors hold a positive bias, in-fitting with the broadly positive mood in European indices. Basic Resources takes the top spot, lifted by strength in metals prices following positive commentary from Chinese Premier Li and the State Planner; the latter said that with policy implementation and introduction, they are confident in minimising adverse effects from external shocks. Retail is found in the second spot, buoyed by post-earning strength in H&M (+5.2%).

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

Markets were broadly steady yesterday, with few headlines to push things in either direction. Indeed, for a sense of that, the S&P 500 fell just -0.0003%, which was its smallest move in either direction since 2017, whilst the 10yr Treasury yield only moved -0.4bps. Admittedly, there were several political developments, but none really had a market-moving impact, and the ceasefire between Israel and Iran continued to hold. We also heard from Fed Chair Powell again at the Senate Banking Committee, but after his testimony the previous day, there was little that changed our understanding of the Fed’s near-term outlook either. So there were few big moves among the major assets, and with calm returning to markets again, the VIX index of volatility (-0.72pts) closed at a 4-month low of 16.76pts.

With markets holding steady, we’re now at a point where the focus is turning to several important catalysts over the next two to three weeks. The first is the US tax bill, which is currently working its way through the Senate, and the administration is trying to get it passed by Independence Day on July 4. To achieve that, things could move quickly from here, and Senate Majority leader Thune has previously said to Axios that they could start voting on the bill tomorrow.

Moreover, Politico also reported earlier this week that House Speaker Johnson told House Republicans to stay in town, given that the House needs to pass the same version as the Senate before President Trump can sign the bill. So it’s a fluid situation on timing, but given the upcoming July 4 deadline, it will need to move swiftly in the days ahead in order to pass by then. Remember that alongside the tax cuts, the bill also contains an increase to the debt ceiling, so if passed, it would remove that risk from the summer as well.

As well as the tax bill, the focus is set to swiftly turn back to tariffs, as the 90-day extension to the reciprocal tariffs ends in less than two weeks’ time on July 9. As it stands, it’s still unclear what will happen at that point, although several countries remain in negotiations with the US. The administration has signalled that trade deals are likely to follow the passage of the tax bill, and NEC director Kevin Hassett said earlier in the week that “We know that we’re very close to a few countries and are waiting to announce after we get the Big Beautiful Bill closed”.

After that, the June CPI report on July 15 is likely to assume outsize importance, as that’ll be crucial for whether the tariff pass-through is being felt in consumer prices. Only yesterday, Fed Chair Powell mentioned the uncertainty around this, saying that in terms of who’ll pay for the tariffs, “it’s very hard to predict that in advance”. But it’s crucial for the path of rate cuts, as those officials calling for caution have in part based that around the tariff impact showing up in the summer inflation numbers. We’ve already seen an impact in categories like major appliances, and even with the 90-day reciprocal tariff delay, there’s still the baseline 10% in place, as well as others in place like the steel/aluminium tariffs, the Canada/Mexico tariffs, and the China tariffs.

With all that to look forward to, markets remained in a holding pattern yesterday, with the S&P 500 (-0.0003%) holding steady as investors awaited to see what would happen on the above issues. The overall mood leant on the cautious side, with the equal-weighted version of the S&P down -0.75% and small cap Russell 2000 (-1.16%) seeing a sizeable underperformance. However, tech stocks advanced, with the NASDAQ 100 (+0.21%) hitting a fresh all-time high, whilst the Mag-7 were up +0.47% as Nvidia (+4.33%) posted a record high of its own. Meanwhile, banks (+0.87%) outperformed within the S&P 500 as the Fed Board unveiled plans to ease the enhanced Supplementary Leverage Ratio. By contrast, the declines were more consistent in Europe, with losses for the STOXX 600 (-0.74%), the DAX (-0.61%) and the CAC 40 (-0.76%).

On the geopolitical front, the ceasefire between Iran and Israel continued to hold over the last 24 hours, and President Trump said on Iran that “We’re going to talk to them next week”. Nevertheless, oil prices did recover a bit after falling over -12% over Monday and Tuesday, with Brent crude up +0.80% yesterday to $67.68/bbl, and overnight they’re up another +0.33%. Separately, the NATO leaders’ summit was taking place in the Netherlands, where the leaders agreed that by 2035, they’d spend 5% of GDP “on core defence requirements as well as defence-and security-related spending”. That’s going to be made up of 3.5% on the “core defence”, and 1.5% of GDP on areas like infrastructure.

Reviewing the summit outcome, my colleague Peter Sidorov writes that while several European countries may struggle to reach the 3.5% core spending target, it’s the ramp-up of spending and defence industrial capacity over the next few years that will determine the success of Europe’s new defence strategy.

In the meantime, sovereign bonds saw a fresh steepening yesterday. 2yr Treasury yields fell -4.3bps as investors continued to dial up expectations of Fed rate cuts, with the amount priced by year-end rising to 64bps, its highest since early May. Those moves came even as Fed Chair Powell again struck a patient tone at the Senate Banking Committee.

Significantly overnight, the WSJ also reported that President Trump is considering announcing the new Fed Chair earlier than usual, potentially by September or October, although the person would not replace Powell until next May when his current four-year term ends. That’s helped to push Treasury yields lower overnight, with the 10yr yield down another -2.2bps to 4.27%. And in turn, that’s weighed on the dollar index, which is trading at a 3-year low this morning, whilst the euro is currently trading at its highest level against the dollar since late-2021, at $1.1685.

Over in Europe, 10yr bunds (+2.2bps) underperformed OATs (+0.8bps) and BTPs (+1.5bps) for a fourth day running, following on from the increased German borrowing announcement the previous day.

Overnight in Asia, there’s been a pretty mixed performance across the major equity indices. The Nikkei (+1.35%) has posted a strong advance, which would leave the index at a 4-month high. But others have struggled, and South Korea’s KOSPI is down -1.27% after hitting its highest level since September 2021 the previous day. Elsewhere, the Hang Seng (-0.48%) and CSI 300 (-0.01%) have posted smaller losses, with the Shanghai Comp (+0.11%) only up a small amount. And looking forward, US equity futures are up slightly, with those on the S&P 500 up +0.07%.

Lastly, there was little data yesterday, although US new home sales fell by more than expected to an annualised rate of 623k in May (vs. 693k expected). That’s their lowest level since October, and the monthly drop of -13.7% was the biggest monthly decline since June 2022.

To the day ahead now, and data releases in the US include the weekly initial jobless claims, pending home sales for May, preliminary durable goods orders for May, and the third estimate of Q1 GDP. Central bank speakers include ECB President Lagarde, Vice President de Guindos, and the ECB’s Schnabel, BoE Governor Bailey, and the Fed’s Barkin, Daly, Hammack and Barr. Finally, an EU leaders’ summit will begin in Brussels.