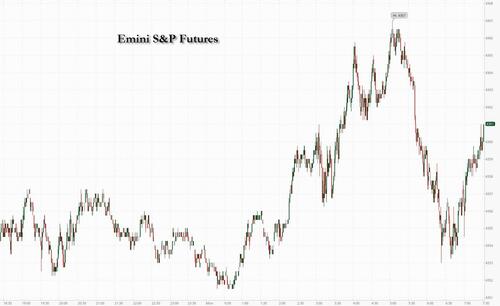

US equity futures, Asian markets and European bourses are all higher as part of a global risk-on tone, ahead of a week packed with central bank decisions. S&P 500 futures and contracts on the Nasdaq are both well in the green this morning, up 0.3% and 0.6% respectively as at 7:30 a.m. ET. The S&P is poised to surpass its August 2022 closing high, rising to the highest level since April of last year. Paradoxically, treasury yields are also ticking higher across the curve, with the sharpest rises in two- and three-year notes. A measure of the dollar is weakening, helping drive gains in spot gold prices. Oil prices are continuing their decline following another price cut forecast from Goldman Sachs, while iron ore drops slightly as recession fears once again outweighing fundamentals in commodities but certainly not in equities. Tesla was poised to set a record winning streak, rising for a 12th consecutive day. Keep an eye on labor strikes across US ports and potential stall supply chain normalization.

Tech led in pre-market trading; the underinvested sector may see additional position squaring ahead of what could be a large drop in CPI and Fed that pauses or skips. Tesla shares rose as much as 1.6% in premarket trading as its electric-car chargers become the industry standard. If gains hold, as noted above, it would be a 12-day winning streak for the electric-car maker, the longest on record. Here are some other notable premarket movers:

A busy calendar for investors kicks off with the US consumer price data on Tuesday and the Fed’s latest policy decision the next day. With the pace of inflation still proving sticky, positioning in rates markets suggests one more hike in July.

While the consensus is for the Fed to pause this week, unexpected hikes from the Bank of Canada and the Reserve Bank of Australia have added an extra element of uncertainty to markets. The European Central Bank is projected to lift its benchmark rate Thursday and the Bank of Japan is expected to stand pat on Friday.

“It feels like markets have been underpricing the probability of a June hike,” said Pooja Kumra, senior European rates strategist at Toronto Dominion Bank. “Data is moving in the right direction, but still not where central banks would like inflation to be.”

Meanwhile in stocks, Wall Street’s top strategists are giving divergent views on what the S&P 500 will likely do next. Goldman Sachs strategists expect the gains to continue as other sectors catch up with the searing rally for technology shares. Morgan Stanley’s Michael Wilson, meanwhile, remains bearish and points instead to the example of the bear market of the 1940s, when the S&P 500 rallied 24% before returning to a new low.

In Europe, consumer-products shares led the advance in Europe, where Adidas AG rallied after analysts at Bernstein upgraded the German sportswear maker; autos and retailers were also among the strongest performing sectors, while energy stocks were the biggest laggards in European trading as oil extended losses amid persistent concerns around the demand outlook, with Goldman Sachs cutting its price forecast again. Shell Plc and BP Plc both slipped more than 1%. Miners were also weaker after iron ore slumped almost 5%, falling for the first time in nine sessions because of worries about weakness in China’s property industry. Here are some of the most notable European movers:

Earlier in the session, Asian stocks traded mixed with the region mostly cautious at the start of a risk-packed week as markets await the upcoming key events including major central bank meetings and data releases, while Australian markets were shut in observance of the King’s Birthday holiday.

In emerging markets, Turkish stocks surged to record highs, while the lira traded near all-time lows, despite the appointment of two former Wall Street bankers to the country’s new economy team which some erroneously said "offered hopes of a return to orthodox and conventional policies." Sorry: it won't happen.

Nigerian international debt surged after the surprise weekend ouster of the central bank governor, with investors wagering that his removal will allow President Bola Tinubu to better pursue his pledge to shake up monetary policy settings blamed for holding back Africa’s biggest economy.

In FX, the Bloomberg Dollar Index fell as much as 0.2%, led by losses against the higher-risk Swedish krona and Australian dollar; the index has fallen for the past two weeks as traders have decreased bets for a Fed rate rise this week. The Turkish lira led declines, weakening 1% past 23.6 against the dollar to a record low; Turkey’s current-account deficit widened to $5.4 billion, worse than analysts’ estimates.

In rates, treasuries were mixed with the curve flatter as S&P 500 futures hold near Friday’s YTD high. Yields cheaper by ~2bp across front-end of the curve with long- end little changed, flattening 2s10s by ~0.5bp, 5s30s by ~1.5bp; 10-year near 3.75%, with bunds outperforming by 1.5bp in the sector and gilts lagging by 2bp. Two-year Treasury yields edged up 2 bps to 4.62%, just below a 2 1/2-month high of 4.64% touched late last month. A compressed auction cycle begins with $40b 3-year new issue at 11:30am followed by $32b 10-year reopening at 1pm. WI 3-year yield around 4.225% is ~53bp cheaper than last month’s, which stopped 2.8bp through the WI level. Gilts underperform Treasuries and bunds across the curve, led by the 10-year.

In commodities, WTI drifts 2.1% lower to trade near $68.67. Spot gold rises roughly $3 to trade near $1,965/oz.

Bitcoin is under modest pressure despite the constructive risk tone and as the USD pulls back, with specifics limited and the agenda ahead for today a particularly sparse one before a blockbuster week of key risk events.

There is nothing on today's economic calendar but investors are closely waiting a US CPI report on Tuesday, which comes the day before the Fed decision and where traders see roughly a 30% possibility of a 25bps rise, while they see a nearly 90% chance of a hike in July. US session includes both 3- and 10-year note auctions, with May CPI report and FOMC decision ahead over next two days.

Market Wrap

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed with the region mostly cautious at the start of a risk-packed week as markets await the upcoming key events including major central bank meetings and data releases, while Australian markets were shut in observance of the King’s Birthday holiday. Nikkei 225 initially outperformed and tested the 32,500 level amid expectations for the BoJ to maintain ultra-easy policy settings later this week and after PPI data was softer-than-expected and showed wholesale inflation eased for a 5th consecutive month which further supports the case for the BoJ to refrain from policy tweaks. Hang Seng and Shanghai Comp. were subdued amid weakness in healthcare and the property sector, with the latter pressured by a warning from Goldman Sachs. However, losses were stemmed amid some expectations for potential PBoC rate cuts to support the economy as more banks reduced their deposit rates and following comments last week from PBoC Governor Yi that there is plenty of room for policy adjustment and that they will continue targeted and forceful monetary policy.

Top Asian News

European bourses are firmer across the board, Euro Stoxx 50 +1.0%, despite a lack of fresh drivers and newsflow light. Sectors are green across the board and feature outperformance in consumer-related names after updates for French Retail, European Gamers and favourable broker updates on Adidas, among others. On the flip side, Energy and Basic Resource names lag on benchmark pricing with the latter occurring despite the upside in Glencore after its latest Teck Resources proposal. Stateside, futures are firmer though with action slightly more contained while the NQ +0.5% outperforms incrementally amid/ahead of numerous AI-related updates, click here for details. GS on S&P 500 by end-2023: 4500 (prev. 4000), 25% chance of US recession within the next 12-months. EU antitrust regulators set to approve Broadcom's (AVGO) USD 61bln bid for VMware (VMW), via Reuters citing sources.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

We'll need everyone to stay on the pitch this week as after a quiet newsflow one just gone, this week steps up a gear with the FOMC on Wednesday the obvious highlight. Elsewhere US CPI tomorrow is probably the event of the week in terms of potential vol as it could impact final pricing for the FOMC and impact terminal pricing as well. The ECB (Thursday) and the BoJ (Friday) are also making policy decisions.

In Asia, investors will be hotly anticipating China's key monthly activity indicators (Friday) including industrial production and retail sales after recent disappointing data releases. In other US data, the key releases outside of CPI are PPI (Wednesday), retail sales and industrial production (Thursday) and the UoM Michigan survey (Friday) with the important inflation expectations series thrown in for good measure. Key European data releases include UK GDP and labour market indicators and the German ZEW survey (both tomorrow).

Going through some of this in more detail, there is around a 30% probability priced into the FOMC this week. DB expect them to hold but raise rates in July (see our economists preview here). Our economists expect the meeting statement, Summary of Economic Projections (SEP), dot plots, and Chair Powell's press conference to skew hawkish, signalling the likely need for further policy tightening as soon as the July 26 meeting.

In our latest World Outlook (link here) our US economists nudged the first rate cut back to March 2024, one meeting later than our previous estimate, and expect the Fed to slash rates by a cumulative 275bps next year. This would lower the Fed Funds rate modestly below their view of longer run neutral, which is currently around 3% in nominal terms.

The last swing factor for the FOMC will clearly be CPI tomorrow. In our economists preview here they are expecting a wafer thin +0.01% month-over-month advance for headline CPI (vs. +0.37% previously) and a +0.37% increase for core (vs. +0.41%). This would lead the former to drop by about a full percentage point to 4.0% YoY, with the latter down -0.2% to 5.3%, with the 3, 6 and 12 month core readings all still struggling to gain much downward momentum below 5% at the moment. For PPI the day after, DB expect the headline series (-0.2% vs. +0.2) to underperform the core component (+0.2% vs. +0.2%) due to energy prices.

Staying with prices, another insight into inflation pressures will come from the University of Michigan's consumer survey for June, with inflation expectations especially in focus after the gauge for the next 5-10 years climbed to an 11-month high of 3.1% last month, albeit revised down (as it often is) 0.1pp from the first print. For the sentiment index itself, our team sees a 62.0 reading, a jump from 59.2 in May but still below the 63.5 reading in April.

On the other side of the Atlantic, our Economists’s preview of the ECB meeting is here. They expect another +25bps hike, followed by an additional one in July that would take the terminal rate to 3.75% but they do see the risk of moving towards 4.00-4.25% in the autumn and expect somewhat hawkish messaging.

The BoJ will round out the busy week for central banks on Friday. Our Chief Japan economist previews the meeting here and doesn't expect changes to the current policy. Given there won't be an Outlook Report, he sees the central bank as likely continuing to focus on downside inflation risks but emphasises that inflation and currency are among key catalysts for a policy change. Our economist has also published a Japan outlook update this week here, significantly increasing our inflation forecast. For more highlights, the full day by day calendar of events can be found at the end as usual.

Asian equity markets have begun the week on a slightly negative note with the KOSPI (-0.48%), the Hang Seng (-0.48%), the Shanghai Composite (-0.29%) and the CSI (-0.24%) lower but with the Nikkei (+0.68%) bucking the trend and continuing to trade around 33-year highs. Elsewhere, markets in Australia are closed for a holiday. In overnight trading, US stock futures are indicating a positive bias with contracts tied to the S&P 500 (+0.13%) and NASDAQ 100 (+0.22%) edging higher.

Ealy morning data showed that producer prices in Japan rose +5.1% y/y in May (v/s +5.6% expected), increasing at the slowest pace since July 2021 after recording an upwardly revised gain of +5.9% previously. On a month-on-month basis, wholesale prices slumped -0.7% in May (v/s +0.3% in April) and sharply lower than Bloomberg’s estimate of a -0.2% drop.

Looking back at last week, the main story was just how durable risk assets were in the face of several negative data surprises. For instance in the US, the ISM services index was only barely in expansionary territory at 50.3, and then the weekly initial jobless claims hit their highest level since October 2021. Bear in mind that both came in worse than every economist’s estimate on Bloomberg, so these were much weaker than anyone had been expecting. There looked like there were a few distortions on claims (holiday week and State level oddities) so this week’s will be closely watched. In the meantime, the Euro Area growth data was revised to confirm that the economy did in fact experience a winter recession after all, having contracted by -0.1% in Q4 2022 and Q1 2023.

But even as the data led to growing fears of a near-term recession, the S&P 500 still managed to move into bull-market territory last week, having advanced by +0.39% over the week (+0.11% Friday). In part that was thanks to the continued resilience of large-cap tech stocks, as the NYFNG+ index posted a +1.15% gain last week (+0.90% Friday). While the Nasdaq actually underperformed a fraction (+0.14%) last week (+0.16% Friday) but still moved higher for a 7th consecutive week. Indeed, that’s the first time the NASDAQ has advanced for 7 weeks running since 2019. Europe was the main underperformer on a regional basis, with the STOXX 600 down -0.46% (-0.15% Friday). Meanwhile in Japan, the Nikkei advanced for a 9th consecutive week with a +2.35% gain (+1.97% Friday).

Whilst equities were generally resilient, bonds had a much trickier time after both the Reserve Bank of Australia and the Bank of Canada delivered a surprise rate hike. In both cases, it went against market pricing and the consensus of economists, and delivered a shock for markets that led to questions as to whether the Fed might follow through with their own hike this week. Ultimately, pricing for a Fed hike this week remained at 31% by Friday, but the prospect of higher rates for longer led to a noticeable increase in government bond yields in several regions. Among others, yields on 10yr Treasuries were up +4.9bps on the week (+2.1bps Friday) to 3.74%, and those on 10yr bunds were up +6.5bps (-2.5bps Friday) to 2.38%. There was also a further bout of curve flattening, and the 2s10s Treasury curve ended the week at an inverted -85.8bps, which is the most inverted it’s been since SVB’s collapse.

Finally, it was an interesting week for commodities, with European natural gas futures (+35.29%) seeing the largest weekly gain since last summer. Now admittedly, that only takes them up to €32.05/MWh, which is still more than ten-fold beneath their peak last year, but it reverses a trend of continuously falling prices over recent weeks. Elsewhere, oil prices fell sharply with most of the move coming on Friday as Brent Crude fell -1.76% (-1.54% Friday). Otherwise, metals had a decent week, with both copper (+1.65%) and gold (+0.68%) moving higher.