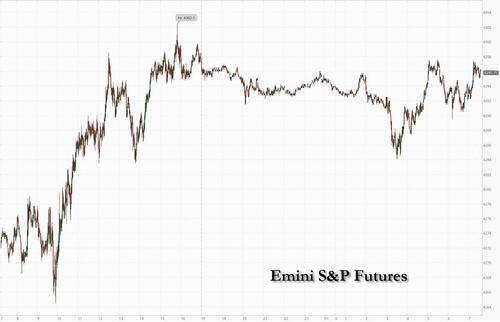

After the S&P closed in a bull market from its October 2022 lows yesterday, futs were again paralyzed, their 4th consecutive session with virtually no changes in the overnight session. As of 8:00am ET, S&P futures were up 1 point or less than 0.05% to 4,300 while Nasdaq futures were also modestly in the green; bond yields are 2-4bp higher this morning, most markedly at the short end. The Bloomberg dollar index is strengthening while oil prices are edging higher after yesterday’s drop. Gold prices are little changed, while iron ore continues its weekly ascent.

In premarket trading, Tesla shares jumped 4.5%, up more than 130% from its January lows, and was on track to rise for an 11th straight session as General Motors Co. announced it’s joining the company’s charging network. GM advanced 3.5%. Target Corp. shares retreated 1.3% after Citigroup Inc. analysts cut their rating, citing slower foot traffic and tough competition. Carvana rose as much as 7.6% in premarket trading, following a record 56% surge on Thursday after the extremely shorted used-car retailer said its operations were improving in the second quarter. Here are some other notable premarket movers:

Yesterday, jobless claims surprised to the upside, which pushed yields lower and sent stocks higher after expectations of a June rate hikes were doused; in equities, we also saw some reversion to the recent RTY v. NDX outperformance. SPX closed at 4293, implying 20% gains since the October low; entering a bull market. Overall, today’s macro calendar remains quiet as investors are waiting for CPI, Fed, ECB, and BOJ next week, and may explain why investors are reluctant to take big positions ahead of next week’s looming interest-rate decisions. Unexpected hikes from two central banks this week have raised speculation that policymakers may have to keep interest rates higher for longer. Meanwhile, US data pointing to a cooling labor market has supported the consensus view that the Fed is likely to pause.

“The backdrop of late has been one of heightened macro uncertainty, but with inflation still running uncomfortably high,” ING rates strategists led by Benjamin Schroeder wrote in a note. “Our house view is that the Fed is already at its peak policy rate, though with the caveat that a higher CPI reading could still eke out a hike next week. In any case, the Fed is likely to leave the door open to more.”

“If you look at where the market sits now in absolute terms, it’s not too hard to make a case that it’s justified at current levels,” said Matt Britzman, equity analyst at Hargreaves Lansdown. “The worry is how fast it’s risen and the concentration within a select few names. A pullback at the top wouldn’t be too much of a surprise as markets take a breather.”

European stocks erased early gains on Friday and headed for a weekly decline as investors monitored a deteriorating economic outlook, while chemicals makers slumped following a glum forecast from Croda International Plc. The Stoxx 600 Index was down 0.4%; chemicals dropped 2%, with Croda International Plc set for its worst day since 2000 after saying it expects customer destocking in consumer and industrial end-markets to persist into the second half of the year. Utilities and real estate shares gained. Here are the most notable European movers:

Earlier in the session, Asian stocks rose, with the regional benchmark heading for a second week of gains amid a rally in technology shares in Japan, South Korea and Taiwan. The MSCI Asia Pacific Index rose as much as 0.8%, driven by gains info technology shares. Samsung, TSMC and Sony were among the biggest boosts. Chinese equities underperformed as data showed the nation’s inflation remained close to zero in May as the economy’s recovery weakened, Hang Seng stocks were modestly firmer after early tech gains evaporate. Still, overseas investors are increasingly optimistic about A shares, as evidenced by growing inflows, according to a report in the Financial News, which is backed by the People’s Bank of China.

Japan’s Nikkei 225 rose nearly 2%, set to cap its ninth-straight week of gains - the longest stretch of gains since 2017 - ahead of the Bank of Japan’s policy decision next week and annual general meetings later this month. The Topix jumped 1.3% as Japanese shares resume gains after two-day slide. Heavy foreign buying amid easy-money policy, company reforms and signs of stable inflation have helped drive the world’s best rally so far this year among major markets. “In addition to relative advantages for earnings and macro climate, the Japanese market has many catalysts,” MBC Nikko strategist Hikaru Yasuda wrote in a note. “This should mean overseas investors are unlikely to pull out soon, so we look for buying interest to spill over from large-cap exporters to domestic-demand stocks.” Kospi, Taiex and ASX 200 indexes were also in the green.

In FX, the Turkish lira extended its decline to an all-time low against the dollar, taking its weekly drop to 11%, after Erdogan appointed a former First Republic Bank CEO as his new central bank head. The yuan weakened after Chinese producer prices fall the most since 2016, adding to PBOC easing speculation. The Bloomberg Dollar Spot Index rose 0.1% but was poised to end the week 0.5% lower, marking its second week of losses on expectations the Federal Reserve is nearing the end of this hiking cycle. The USDJPY is up 0.4%, boosted by short covering in the dollar during Asian trade; EURUSD down 0.2%.

In rates, treasury yields ticked higher on Friday, with the 10-year rate at 3.75% and with yields cheaper by 2bp to 5bp across the curve near session highs after yesterday post-initial claims jump. Yields were cheaper by ~5bp across front-end of the curve with 2s10s, 5s30s spreads flatter by 1bp and 2bp on the day; 10-year yields around 3.75%, cheaper by 3.5bp vs Thursday close with bunds and gilts outperforming by 1.5bp and 3.5bp in the sector. The yield on the two-year Treasury yield rose 4bps to 4.55%; traders are betting on a roughly 30% possibility that the Fed will raise interest rates at its meeting on Wednesday, while the possibility of a hike at its July meeting stands around 90%. Front-end-led losses flatten spreads ahead of next week’s Fed meeting, where around 8bp of rate-hike premium remains priced into Fed-dated swaps. Supply concession may emerge ahead of Monday’s heavy auction schedule, including 3- and 10-year note sales. No significant events are scheduled for Friday’s US session. Elsewhere, Australian yields about 4-5bps weaker across the curve. JGB futures remain rangebound.

In commodities, WTI crude rose to $71.50; gold quiet at $1,964. Saudi Crown Prince MBS reportedly threatened major economic pain on the US economy last fall amid the oil feud, according to Washington Post. Russian Ambassador to Turkey says they continue consultations, but there are no grounds which exist for a grain deal renewal, via Ria. Oh, and confirming yesterday's big fake news, Iran's IRNA confirmed there is not a temporary deal to replace the JCPOA on the agenda.

It's a quiet day ahead with nothing major scheduled in the US, data releases include Italian industrial production for April, and the Canadian employment report for May. Otherwise from central banks, we’ll hear from ECB Vice President de Guindos, along with the ECB’s de Cos and Centeno.

Market Snapshot

Top Overnight News from Bloomberg

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher following the gains on Wall St where the S&P 500 entered a bull market and tech outperformed as yields declined due to labour market concerns after Initial Jobless Claims spiked to the highest level since October 2021. ASX 200 was led by strength in the tech and the mining industries but with upside capped by pressure in the energy sector after oil prices dropped on reports that Iran and US were near an interim deal on nuclear enrichment and oil exports which was later refuted by the White House. Nikkei 225 spearheaded the advances amongst the major indices with the index back above the 32,000 milestone. Hang Seng and Shanghai Comp. were indecisive after weaker-than-expected Chinese inflation data continued to point to an uneven economic rebound, although there were some hopes of a thawing in US-China relations with Secretary of State Blinken’s delayed trip to Beijing said to be in planning for next week.

Top Asian News

European bourses are contained as the complex once again struggles for direction amid a lack of fresh/scheduled catalysts, Euro Stoxx 50 -0.2%. Sectors are mixed with Basic Resources outperforming amid broader metals action while Chemicals lag after a Croda profit warning. Stateside, futures are slightly in the red with action very much contained given the mentioned lack of fresh drivers thus far and scheduled, ES -0.1%.

Top European News

FX

Fixed Income

Commodities

Crypto

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

I got a lot of responses but no workable solution to my plea for help on Wednesday given that my free time was starting to be totally eliminated by kids sports, clubs and activities. Let me give you tomorrow's itinerary as an example of the relentlessness. 9am: The 3 kids have a group golf lesson that I take them too while my wife sets up a parents vs teachers vs pupils mini netball tournament at the kids' school. 11am: I rush to take Maisie for her swimming lesson and swim with the twins while she does that. 1145am: After getting all dried and changed we go to the school to watch the netball tournament where my wife has her annual match. 1pm: I leave for a football tournament with the twins that starts at 2pm and goes on until 5pm. I then stuff food down them and we rush to see Maisie perform in her artistic swimming summer performance at 530pm. She has two shows. The second one starts at 730pm and after she finishes her second run I take the twins home to bed and my wife and Maisie get home at 930. Maisie then has to have her artistic swimming hair gel showered/hosed off and at 10pm my wife and I collapse on the sofa with a glass of wine and some TV. 10:15pm I nod off on the sofa and my wife pokes me and says she's not telling me what I missed.

If you're still awake yourself after that download, yesterday was one of those days where although markets were hit by a succession of bad news, the S&P 500 (+0.62%) shrugged these off and entered bull market territory at the close, with a +20.04% gain from its October 2022 low. To show the extreme forces helping us along, the NYFANG+ index is up +65.6% from that point and up +79.7% from it November lows just before the launch of ChatGPT.

In terms of the bad news, in the US, the weekly jobless claims were at their highest since October 2021. In the Euro Area, data revisions showed the economy did in fact experience a winter technical recession after all. And even when it came to the weather, we got confirmation that an El Nino event was now underway, with predictions still pointing to a strong one developing as we move deeper into the year. The weaker data did drive a bond rally though, with yields on 10yr Treasuries coming down -7.7bps to 3.72%.

The main catalyst for the bond moves were those US jobless claims, which saw a big jump to 261k over the week ending June 3. That was well above the 235k reading expected by the consensus, and it takes claims up to their highest level since late-2021, back when Covid was still a significant factor affecting the economy. Another worrying feature was the size of the jump, where the +28k increase on the previous week was the largest since July 2021, so these are not your typical moves we see each week.

The big question now is whether this release is just a blip, or whether it might foreshadow a broader softening in the labour market that culminates in wider job losses. Our economists suggested that two states made up 86% of the increase in non seasonally adjusted claims with Minnesota up +97.5% w/w and Ohio up +61.2% w/w. So for now this might suggest caution when reading too much into the data, a bit like with the Massachusetts fraudulent filings a few weeks ago.

That didn't prevent a big rally in Treasuries though, in part since investors grew more confident that the Fed would finally hit the pause button on its rate hikes after 10 successive increases. Indeed, futures pricing for a June hike came down to 28%, having been at 35% on Wednesday after the Bank of Canada’s surprise hike. In turn, that meant yields fell back across most of the curve, with the 2yr yield down -4.2bps to 4.515%, and the 10yr yield down -7.7bps to 3.72%. Yields really are in a bit of a yo-yo mood at the moment albeit within a relatively constrained range. This morning in Asia, Treasuries have slightly lost ground again with 10yr yields +1.3bps higher as we go to print.

With investors pricing in a rate pause, that helped equities to recover some ground, and tech stocks led the gains, helping the NASDAQ (+1.02%) and the FANG+ Index (+2.04%) outperform again. The tech performance led the S&P 500 to again outperform its equal weight equivalent (+0.04%). In stark contrast, the small-cap Russell 2000 (-0.41%) lost ground, whilst S&P energy stocks (-0.44%) struggled after Brent crude oil prices (-1.29%) closed at a one-week low of $75.96/bbl. In the meantime, European equities were stuck in the middle, with the STOXX 600 posting a very modest -0.02% decline.

Speaking of Europe, the big news was revised data showing that the Euro Area had in fact experienced a winter recession after all. That was confirmed by the latest Q1 GDP reading, which unexpectedly showed a -0.1% contraction, having initially been a +0.1% expansion in the flash estimate. Coming off the back of another -0.1% contraction in Q4, that meant the Euro Area has contracted for two consecutive quarters and met the common technical definition of a recession, even if it was the mildest possible. For markets, there was little direct relevance given the news was backward looking, and the ECB is still widely expected to proceed with a 25bp rate hike at their meeting next Thursday. In fact, the main driver for European sovereign bonds were the US jobless claims, with yields reversing on the print with 10yr bunds (-5.4bps), OATs (-5.9bps) and BTPs (-9.9bps) yield all closing notably lower.

Most Asian equity markets are struggling to gain traction this morning. As I type, Chinese stocks are mixed with the Hang Seng (+0.05%) swinging between gains and losses while the CSI (-0.11%) is slightly lower and the Shanghai Composite (+0.02%) flat after the release of inflation data (more on this below). Elsewhere, the Nikkei (+1.61%) is strong, reversing some of its losses in the previous two sessions with the KOSPI (+0.92%) also climbing higher. Outside of Asia, US stock futures tied to the S&P 500 (-0.08%) are marginally down after the S&P 500 notched its highest close for 2023.

Coming back to China, producer deflation continued in May for the eighth consecutive month with the producer price index (PPI) declining -4.6% y/y in May (v/s -4.3% expected), the steepest drop since June 2016 as weakening demand is weighing on the fragile economic recovery. It followed a further decline from -3.6% in April. Meanwhile, the consumer price index (CPI) rose in line with market expectations, up +0.2% y/y in May after a +0.1% rise the previous month.

One thing that could influence inflation later in the year is the El Niño. The US’ Climate Prediction Center confirmed that El Niño conditions had emerged in May, with the latest weekly indices above the threshold for an El Niño event. The question now is how severe this episode may be, and their forecasts are seeing a 56% chance of a strong El Niño later in the year (up from 54% last month). As a recap, an El Niño event is where unusually warm sea surface temperatures in the eastern Pacific cause the jet stream to move south. That creates changes in weather patterns and ecosystems, but is unfortunately correlated with a higher frequency of natural disasters like flooding. So historically they’ve had negative effects on the harvest and food supply, and risk putting renewed upward pressure on food prices and inflation. Definitely one to keep an eye on as we move through the year.

With all this negative news piling up, one area that really benefited was gold (+1.31%), where the weak claims data led to its best daily performance in over a month. And similarly, silver (+3.50%) experienced its best day in over two months. And with commodities taking on heightened importance, our colleague Michael Hsueh has just published a timely handbook (link here) that takes a deep analytical dive into the various precious metals. He expects them to remain front and centre of global markets in the coming years.

To the day ahead now, and data releases include Italian industrial production for April, and the Canadian employment report for May. Otherwise from central banks, we’ll hear from ECB Vice President de Guindos, along with the ECB’s de Cos and Centeno.