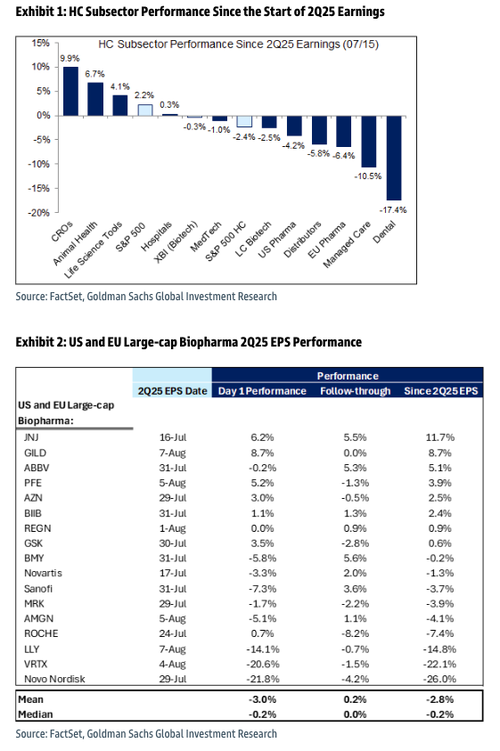

Earnings season has ended for large-cap biopharma stocks, with steep selloffs across many names as the healthcare sector's weighting in the S&P 500 falls to a multi-decade low. Pessimism is elevated across the sector amid the Trump administration's Most Favored Nation (MFN) pricing proposal for Medicaid and the prospect of pharmaceutical tariffs.

A Goldman Sachs team led by Asad Haider told clients Friday that healthcare stocks face weak sector performance and mounting pessimism, as earnings season wrapped up last week.

Here are some of the highlights of the note titled "Global Healthcare: Pharmaceuticals: Friday Fodder: Slimmer Positioning Into The August Lull":

What's causing some of the gloom and doom across healthcare stocks?

Well, it's policy overhangs:

Earnings Themes & Stock-Level Notes Winners

Winners

Johnson & Johnson: strongest post-earnings follow-through in U.S. pharma; remains top YTD performer.

Gilead Sciences: +6% WTD, +30% YTD; robust HIV franchise momentum and Yeztugo launch.

Losers

- Obesity trade: Novo's profit warning and LLY's weak oral obesity pill data drove $100B market cap loss for LLY, partial rebound for Novo; Wall Street analysts trimmed obesity forecasts and PTs.

Top charts

Chart we're watching...

Here's Goldman analyst Salveen Ritcher's big picture view on healthcare:

Big Picture: Although the biotechnology sector has recovered with the broader market since April lows (XBI/NBI/S&P 500 are up ~1/3/2% over the last month), we see the potential for further volatility in 2H+ as policy dynamics (e.g., tariffs/tax policy, drug pricing/Medicaid cuts, FDA/HHS, etc.) evolve. We continue to monitor the administration's proposal to incorporate MFN pricing into Medicaid, and await a likely announcement regarding pharmaceutical tariffs upon the conclusion of the ongoing Section 232 investigations (potentially by mid-August, per our U.S. economists, although delays are possible), noting pharmaceuticals were excluded from the recently announced US-EU trade deal (establishing a 15% baseline tariff rate for most EU imports) pending Section 232 investigation conclusion.

Pro Subs can read the full note in the usual place.