Rising inventory and softening demand — key indicators of a broader housing slowdown — suggest that South Florida's pandemic-fueled real estate boom continues to lose steam.

"South Florida is the epicenter of housing market weakness in the United States," said Redfin analyst Chen Zhao, as quoted by Bloomberg.

Zhao asked, "The question for the rest of the country is, will this spread? Florida is uniquely bad right now."

Redfin data shows that April home-purchase contracts in Miami, West Palm Beach, and Fort Lauderdale fell sharply from a year earlier — the steepest declines among the 50 largest U.S. metro areas. Pending sales dropped 23% in Miami, 19% in Fort Lauderdale, and 14% in West Palm Beach. Homes in all three markets also recorded the longest listing times nationwide.

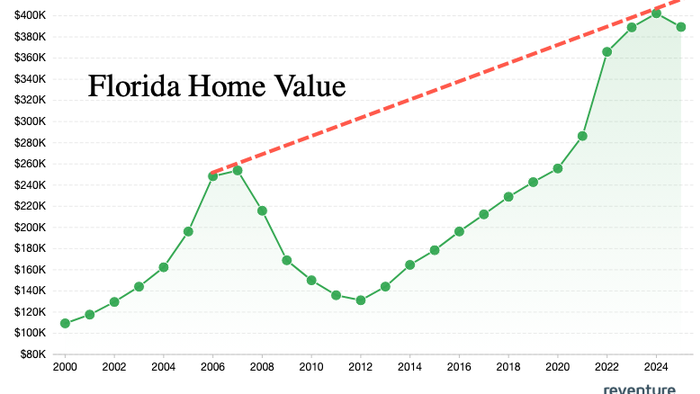

Zhao warned, "I think you're seeing a really long, slow deflation of that bubble" in the South Florida market, which just a few years ago boomed with low interest rates and inbound migration trends from blue states.

In March, Florida's median home sale price decreased 1.7% from the same time last year. For the three metro areas in April, 5% of sales closed below the listing prices as rising inventory pressured prices lower.

As we've previously reported in our coverage of Florida's housing downturn:

Additional color on the downturn from Nick Gerli, CEO and Founder of real estate analytics firm Reventure Consulting:

What could possibly go wrong?

The question for the Sun Belt states is whether this downturn will spread.