A slowdown in economic activity, combined with growing tariff uncertainty, appears to be curbing consumer appetite for highly processed junk food. The latest trends show a declining demand for sweet snacks in North America as more shoppers shift their spending toward real food, such as meat, vegetables, and eggs.

Mondelez International — the maker of Sour Patch Kids, Oreos, Ritz, Toblerone, Cadbury, and other highly processed food brands — reported slower-than-expected sales for the first quarter.

Organic revenue, which excludes currency fluctuations and one-time items, increased 3.1%, falling short of the Bloomberg consensus estimate of 3.5%. Notably, sales in North America declined during the quarter.

On an earnings call, Mondelez CEO Dirk Van de Put told analysts: "I really do not expect to see a significant improvement in consumer confidence in the near term in the US."

"Two, three years ago consumers would easily pay above $4 for a pack of biscuits," Van de Put said adding, "We're now seeing that we need to be below $4 and ideally below $3."

Mondelez noted that shoppers are beginning to prioritize real food — if that's meat, vegetables, and eggs — over snacks, chips, and candy. Also, lower-income consumers are pivoting towards smaller packages, while higher-income consumers are searching for larger value bundles.

Mondelez reiterated its full-year guidance and warned profit will slide 10% this year "due to unprecedented cocoa cost inflation."

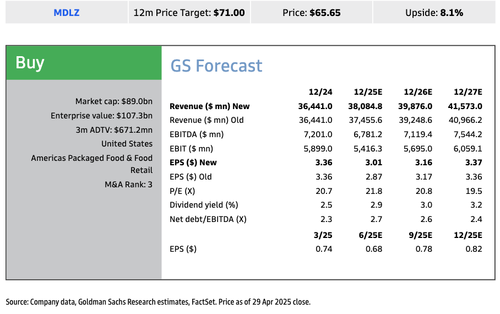

Weighing in on the North American junk food slowdown, Goldman analysts Leah Jordan and Eli Thompson offered clients their first take on Mondelez's first-quarter results and its unchanged full-year outlook:

North America came in softer-than-expected on the back of retailer destocking and softer cracker demand as the consumer remains value-focused;

chocolate elasticity tracked in-line with expectations, although more pricing is still to come; and

MDLZ reiterated its FY25 guide in constant currency while potential upside is likely to be reinvested throughout the year to support potential growth in FY26

The key takeaway for the North American market:

Details about the cocoa market:

Notes on guidance:

Despite key downside risks, such as an economic slowdown, Goldman analysts remained "Buy" rated on Mondelez, with a 12-month price target of $71.

Mondelez did not indicate that the slowdown in junk food demand was influenced by the "Make America Healthy Again" movement in any way (well at least not yet).