By Peter Tchir of Academy Securities

We get the election and the Fed this week, both of which should provide us with some clarity.

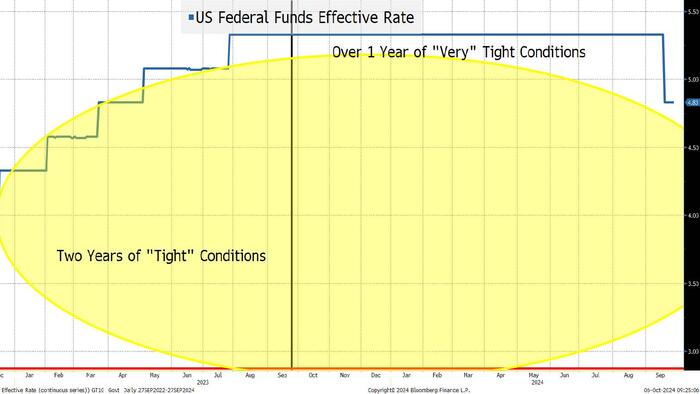

Let’s start with the Fed because I think the Fed is easy:

The market has moved closer to our views, and we expect that it will continue to do so. Actually, the 10-year yield up at 4.38% is above the top end of our range, but we remain reluctant to fight it (at least not yet) as market positioning (amongst other things) makes us nervous – see Bond Vigilantes in last weekend’s report.

This might be a good way to segue from bond markets and the Fed to election prognostications.

We did think that the rally in bonds after the report would fade. But going from 4.22% all the way to 4.38% was a much bigger fade than I would have expected. I did think that stocks would fade, and they did close well off their highs, but they were above their opening levels, so I got this wrong. What is surprising is how resilient stocks were in the face of bond yields rising for the wrong reason (not due to economic strength), but it was the first day of the month and the first big “buy the dip” opportunity in the past month as well.

But I digress. The main point of this section, ahead of the election section, is to point out that sometimes, even if you knew the data in advance, it would have been difficult to make money. A weak jobs report sending Treasury yields to a fairly large one-day loss doesn’t seem obvious – even in hindsight.

We discussed some of our scenarios and views on the election in last weekend’s report (Who Wins and What Does it Mean?). Since then, the betting markets have reversed course to some degree, making even those markets closer than they were last weekend.

I’m also hearing more people question whether the “Trump Bump” is real. This is the view that he tends to get more votes than the polls indicate. With a sample size of 2, where the 2nd time certainly wasn’t as strong as the first time, I’m pretty dubious about this view heading into Tuesday.

I do remain convinced, despite being told I’m dead wrong, that a lot of “undecided people” will be flip- flopping their thoughts right until the moment they vote (kind of like how many market participants will second guess their well-thought-out Fed strategies between noon and 2pm ET on November 7th).

Frankly, I think that there are too many permutations to properly analyze this. There is virtually no scenario that would “surprise” me. I don’t think all scenarios are equally likely, but I could be convinced that a lot of them are possible.

Also, with the cop-out in the previous section, I’m not sure it is easy to interpret how markets will react to what could be quite complex outcomes.

Having said that, it would be irresponsible not to have some sort of a playbook coming into this week. That is particularly true as I will be on Bloomberg TV at 9pm ET on election night trying to digest the information real-time.

Best Case for Markets:

Worst Case(s) for Markets:

Beyond that, I just think there are too many possibilities. We might not know who will control the House or the Senate right away. Again, I think that any uncertainty will be digested by the market if gridlock looks likely.

I think that a few days of contested results and recounts is pretty much built into markets. However, I’m not sure if contested results extending well into the following week, with rhetoric getting increasingly nasty, is priced in (I’d like to say that this possibility is extremely low, but I’m not sure that it’s that low).

It would be great if election night gives us clarity, even if that clarity is bad for markets, but that is not a certain outcome. I do think that many people are being a bit cavalier about how easily we will absorb a “contested” election – since I think it very much depends on how hotly that election is contested (if we get to that point at all).

Not sure this is much of a game plan for the election, but it is the best that I can come up with at the moment.

We will get through this election. The system will work as intended and we will adjust and adapt our strategies appropriately.

Yes, there is a lot of heated “debate” occurring in social media and it is easy to get disheartened. But I think that is really just at the extreme and gets far too much attention relative to the people working together to get the country, the economy, and even the globe on a good path forward!

Due to some misspent youth, I am well aware of the Sex Pistols. They had songs like “Anarchy in the U.K.” (what would have been my walk up song if they had those when I played sports) and “God Save the Queen.” So, a lot of what we are hearing and seeing (as many of our Geopolitical Intelligence Group members remind our clients) is not new. It just receives a lot more attention than it should. And now, I cannot resist one message about “unintended consequences” because that is a favorite subject of mine. The Queen’s Jubilee had the Queen floating down the river Thames. Word leaked that the Pistols were going to perform “God Save the Queen” somewhere along the route and annoy the entourage and many of the spectators. So, as I recall, they implemented some rule about no performances within a certain distance from the Queen. Problem solved? No, the band, or their organizers, put them on a barge and they followed the Queen to play the song – making the entire experience for the Queen likely much worse. Unintended consequences are always worth thinking about!

But in any case, decades later, England is still functioning and the “dire” warnings never materialized, so I think much of the concern is misplaced and will be largely forgotten (or at least tuned out) as we move forward!

Good luck with this week and I cannot believe that we still make it dark extra early on purpose!