After two mediocre (at best) coupon auctions, including a tailing 10Y benchmark reopening yesterday, moments ago the Treasury held the week's last auction when it sold $18BN in 30Y paper.

The auction was solid, if nothing to write home about: the high yield of 3.661% was well below last month's 3.877% (to be expected in light of the collapse in rates this month), and the lowest since January's 3.585%; it also closed on the screws with the When Issued which was also 3.661%, and followed two consecutive tailing auctions.

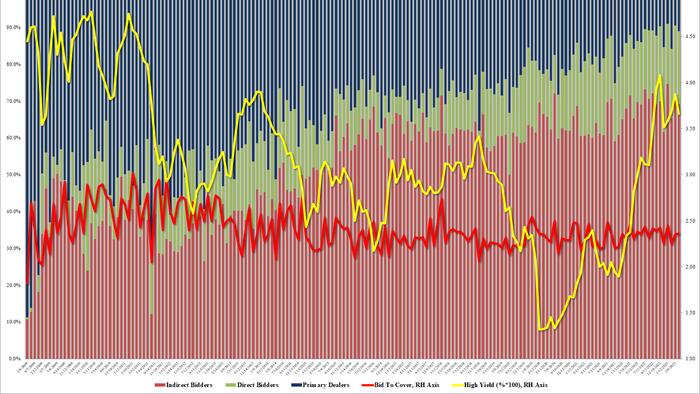

The Bid to Cover of 2.359 was virtually unchanged from 2.351, which was also the six-auction average.

The internals were solid: indirects were awarded 69.12%, just below last month's 70.72% and above the recent average of 68.5%; and with Directs taking down 19.8% (identical to March), Dealers were left holding 11.1% of the auction, not far below the 11.9% recent average.

Bottom line: a solid auction with solid buyside demand, which could only have been better if it had stopped through: there certainly was enough of a concession with 30Y yields trading not far off session highs at 3.4224% for the 10Y.