With markets focused on the tech rout, it is easy to forget that ahead of the Wednesday FOMC there is not one but two coupon auctions, the first of which was just concluded.

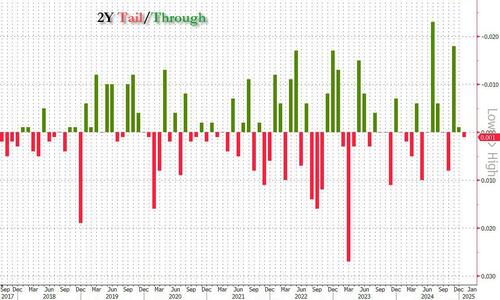

At 11:30am ET, the US sold $69 billion in 2Year notes, at a high yield of 4.211%. Courtesy of the sharp jump in Treasuries in the past week and especially today, this was 12 bps below last month's stop of 4.335%, however, it tailed the When Issued 4.210% by 0.1bps, the first tail on 2Y paper since Oct 24.

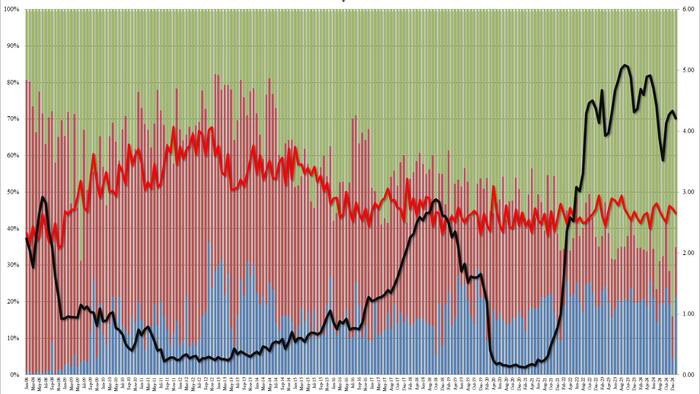

The bid to cover dipped from 2.73 to 2.66, the lowest since October and just below the six-auction average of 2.68.

The internals were also rather subpar: Indirects, i.e. foreign bidders, tumbled and took down only 65.02%, down sharply from 82.09% and the lowest since October (and below the 70.8% six-auction average). And with Directs awarded 21.27%, the most since October, Dealers were left holding 13.71%, up from 11.26% and the highest since - you guessed it - October.

Overall, this was an unremarkable, somewhat soft auction but hardly anything to worry the market, and the result was that the 10Y barely budged in the secondary market.