By Peter Tchir of Academy Securities

Coming up for air after what was an intense week on the geopolitical and market side of things, I’m really being forced to reconsider my current recommendations (bearish bonds, stocks, and credit).

I keep thinking:

If I go, there will be trouble

And if I stay, it will be double

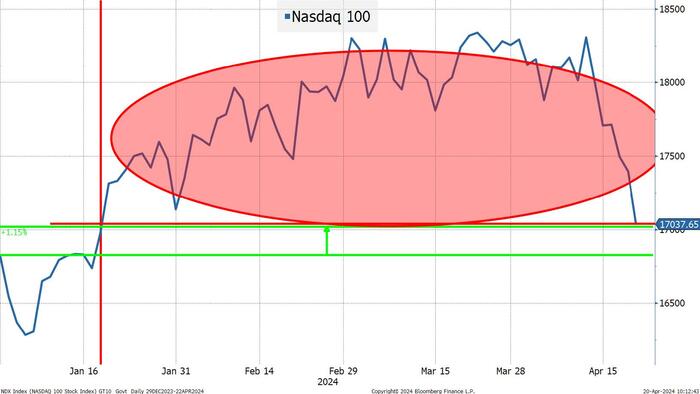

Bearish rates has worked well from the start. We turned negative on credit right near the lows, so that too has worked. On equities, by the time we turned bearish, it definitely moved against us. We had some drawdowns, and they seesawed back and forth between potentially making sense and looking very stupid (sometimes, on the same day). Well, the Nasdaq 100 (the main focus of our ire) is now down 7% since April 11th (6 trading days). We saw a rather nasty 2% drop on Friday (even after it had largely recovered from overnight Geopolitical concerns) and is now only up 1%. Our call had been that the market was highly susceptible to a rapid 5% to 10% decline, which we stretched to 10% as it continued to “defy” gravity. Remember, for all the hype about “all-time highs” and “tech is all you need”, the Nasdaq 100 closed above 18,300 all the way back on March 1st and barely got any higher than that in what is now almost 2 months.

We’ve updated this chart since we sent it around in an “informal” report, and the story is even more bleak, though not as bleak as it would have been had the markets closed at 3:45pm when this index was below 17,000.

Based on closing pricing, no one who bought the Nasdaq 100 since January 18th has made money. If you started the year long, you are now sitting on a relatively measly 1% gain – which just does not seem at all consistent with the hype.

In Thursday’s T-Report – We Can Drive it Home, With One Headlight, we reiterated our bearish views, while devoting much of the space to the section “AI valuations seem questionable.” There are some big stocks (some in the AI space) down around 10%. If you are keeping track at home, the leveraged single stock ETF that has caught my attention actually had net inflows on Friday, despite being down 20% - indicating that we haven’t seen a wipe out. I also distinctly remember headline after headline when we had record-setting market cap gains for individual companies, yet crickets on what had to be a historic drop in market cap. Another sign that we have not seen a washout.

But before we go through our analysis and recommendations coming into this week, I have to admit, “Should I Stay or Should I Go” isn’t close to being my favorite song by the Clash. But, I’ve already used “Magnificent Seven”, “Clampdown” seemed too harsh, “Lost in the Supermarket” would have made more sense when inflation was spiking, and “Death or Glory” sadly seems destined to pop up in a piece on geopolitics (the way the world is going). I did want to do I Fought the NDX and I Won, but the Clash cover stuck to the traditional title, and it was the Dead Kennedys who changed it to “I won” rather than “the law won.” But in the end it hasn’t been a resounding win, and I didn’t want to jinx myself too badly if I come out still bearish (spoiler alert, I am).

Today we will focus on what is “new” as the bear case was well covered in the previously referenced One Headlight piece.

The most bullish thing I can say is that equities are now 5% to 7% cheaper than a week or so ago. So, if you were planning on “backing up the truck” and loading up on stocks, you have that opportunity. You literally have missed nothing by not being massively overweight the Nasdaq 100 since the start of the year. Two issues fighting this come to mind:

But anyways, I digress, I just think that enough has changed and enough dips have been bought, that there is no trove of “rescue” money about to flood the market with new buying liquidity.

Since AI remains too important, I will add one thing to the laundry list from Thursday:

Earnings will be important, and we will get several from very important companies this week.

Think like an algo.

In the end, I’ve started to reduce shorts, but remain bearish, and think that the correct strategy is to sell bounces and keep reloading shorts, until something occurs that forces me to change my views.

In the end, on equities, it turned out to be “more of the same” (maybe slightly less pounding on the table), but bonds are far more interesting in terms of “staying” or “going” from a bearish perspective.

We’ve been bearish on yields for most of this year and it has largely worked. Not a one-way street by any stretch of the imagination, but not bad. In fact, we’ve raised our range on the 10-year yield, from 4.2%-4.4% to 4.3%-4.5% and then from 4.4%-4.6%. I don’t think we’ve officially changed the band, but it is implicit that if 10-years are at 4.62% and I’m still bearish (though far less so than at 3.9% where we started the year), the band must be higher. Do we raise the range again? That is always a dangerous game, as many equity analysts, who felt compelled to raise price targets in the past few months, can tell you. Were we too low originally? Have things changed that significantly? Take the win? I’m not sure if repeatedly raising your bands is something that should be considered in current analysis, but it makes sense (at least for me).

Aside from many specific reasons to be bearish, we had the catch-all of “nothing that was in place to push 10s to 5% last fall has been resolved.” That is still true.

What is the bull case for bonds?

I am worried about “faux” liquidity, even in the Treasury market. Electronic trading and a multitude of platforms tend to make liquidity appear more abundant than it really is. There aren’t 50 people sitting on the bid. There are 10, they just happen to all put them on 5 platforms, assuming they can yank the bid in time. There are really only 5 buyers, the other 5 just “see” them buying, so are along for the ride hoping to scalp some money and thinking they can pull their bids if necessary. That is why we get “air pockets” in pricing and will continue to do so. Positioning is better than it was (not everyone is long), but this “gap” risk is real – in both directions.

I like the 2-year at 5% and am “tolerant” of 10s at 4.6%.

Credit spreads for me are now largely just a proxy for equites. Yes CDX, credit spreads, and even high yield held their own on Friday amidst the debacle of an equity market, but that will be difficult to sustain.

I see no fundamental problems in credit, but it is difficult to remain bearish on equities and like credit. Also, the aforementioned “faux” liquidity is even more obvious in credit markets and creates far more gap risk. While that gap risk is usually somewhat symmetric, I think the gap risk to much wider is higher than the risk to a gap tighter. Still like 65-70 as range on CDX.

Academy Securities has sent a lot out on the current situation in the Middle East. We’ve done what we can with our team of retired Generals and Admirals. Not just via written word (please see the “new” Daily Brief that we’ve been sending on Bloomberg), but also through more video calls than I can keep track of.

Even with their expertise, there is a range of “error” or “doubt” centered around “what has happened” let alone “what might happen.”

There have been some fast and furious discussions about deterrence and General (ret.) Ashley highlighted this Rand publication – Understanding Deterrence from 2018. Academy’s game theory centric piece – Geopolitical Chicken – is worth reading if you haven’t already.

Anyways, my base case is:

Therefore, my base case is that Iran is trying to figure out how to attack again, which may take some time, and a lot could change between now and then, but the current “quiet” is more about a failed attack than any meaningful de-escalation.

That may or may not be your base case, and even by working so closely with our Geopolitical Intelligence Group, you can find support for a range of “base cases,” but this is my working assumption. This means that I think possible shocks are still on the table. From Hedging Geopolitical Risk I think any shock will be bad for equities, temporarily good for bonds (but fade that quickly), and good for oil.

There is very little I can find in equities. I’m not even “loving” long China (for a trade) versus short Nasdaq 100 (though I’d be remiss to point out for the past 3 months, FXI is up 10.8% while QQQ is down 1.4%). Remember, I think that as time goes by, more people will question whether slower sales into China are a function of problems with the Chinese economy or part of a broader strategy to suppress sales of Western brands in favor of domestic brands – The Threat of Made by China 2025.

Hopefully, by the time you read this report it is still relevant in a world where countries don’t adhere to a policy of attacking only during U.S. trading hours!

Good luck navigating this and please feel free to use Academy’s resources, as we as a firm are at your disposal!