Inflation expectations at the one-year horizon dropped for the second month in a row, sliding to 3.02% in June from the previous month’s 3.17%, and from a 2024 high of 3.26% in April, according to the New York Fed’s survey of consumer expectations. At the same time, 3 year inflation expectations rose modestly to 2.93% (up from 2.76%) and the highest since Nov 23. Finally, the median five-year ahead inflation expectations also dropped to 2.83% after hitting a one-year high of 3.00% in May.

Some more details from the survey: disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) remained unchanged at the one-year ahead horizon, declined at the three-year-ahead horizon, and rose at the five-year ahead horizon. Median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—declined at the one- and three-year-ahead horizons, but rose at the five-year-ahead horizon.

The survey affirms other recent data showing that inflation decelerated in recent months after being more stubborn than expected in the first quarter of this year. Thursday's CPI report is expected to show that the core consumer price index, which excludes food and energy costs, rose 0.2% in June for a second month. That would mark the smallest back-to-back gains since August, a pace closer to what Fed officials would like to see.

Median home price growth expectations decreased to 3.0% from 3.3%, back to the series 12-month trailing average.

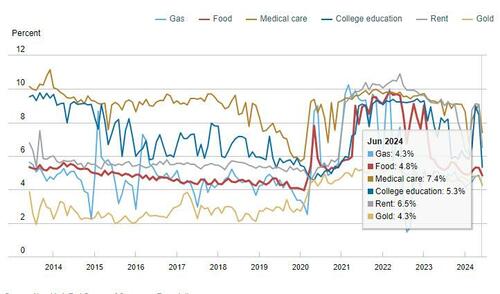

What was more notable is that median year-ahead expected price changes decreased for all goods in the survey: by 0.5% for gas to 4.3%, 0.5% for food to 4.8%, 1.7% for the cost of medical care to 7.4%, 2.6% for rent to 6.5%, and 3.1% for the cost of a college education to 5.3% (the series’ lowest level since December 2020).

Turning to the labor market we find the following:

Finally, looking at expectations about household finance, here are the main findings:

Source: NY Fed