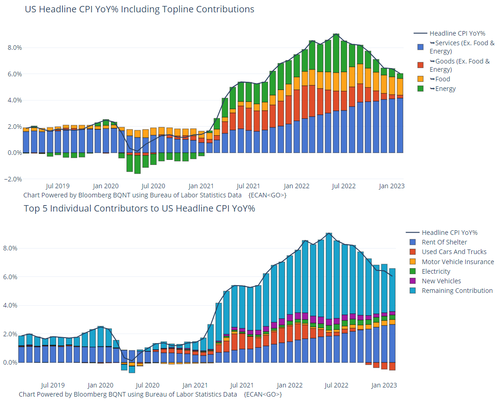

After January's disappointing 'stall' in the linear demise of inflation, consensus expectations were for a re-acceleration of the YoY decline in headline CPI (from 6.4% to 6.0%), and the actual print came in right on expectations (+0.4% MoM, +6.0% YoY). That is the lowest YoY CPI since Sept 2021...

Source: Bloomberg

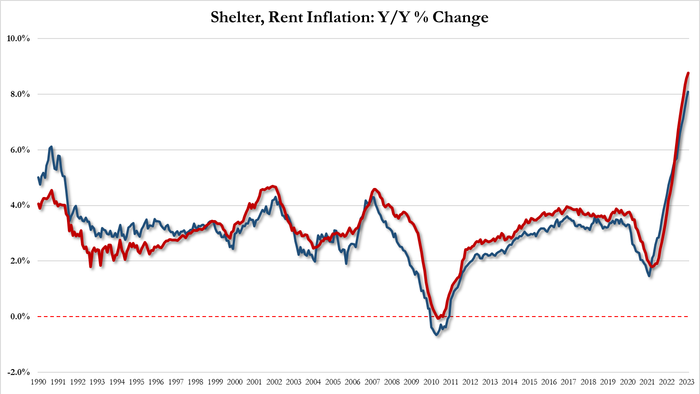

Services dominated the headline CPI YoY shift with Shelter continuing to be a main driver...

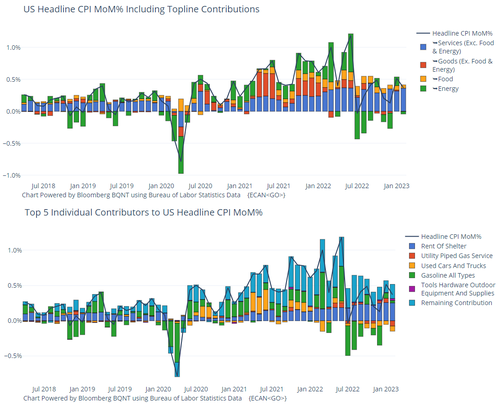

On a MoM basis, Services and Shelter also dominated, with Used Car prices lower (which lags the real shift as Manheim prices have risen for two straight months)...

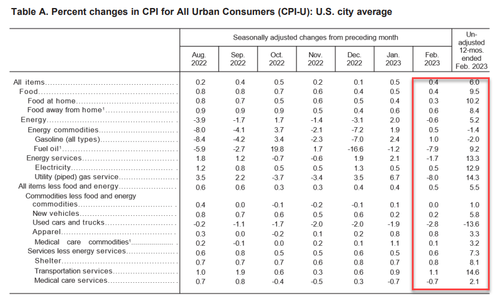

The index for shelter was the largest contributor to the monthly all items increase, accounting for over 70 percent of the increase, with the indexes for food, recreation, and household furnishings and operations also contributing. The food index increased 0.4 percent over the month with the food at home index rising 0.3 percent. The energy index decreased 0.6 percent over the month as the natural gas and fuel oil indexes both declined.

Core CPI was expected to slow only marginally in February from 5.6% YoY to 5.5% YoY and it did - dropping to its lowest YoY print since Dec 2021...

Source: Bloomberg

The index for all items less food and energy rose 0.5 percent in February, after rising 0.4 percent in January.

The costs of putting a roof over your head remains a critical factor for The Fed to deal with:

There is some good news... egg prices appear to have peaked...

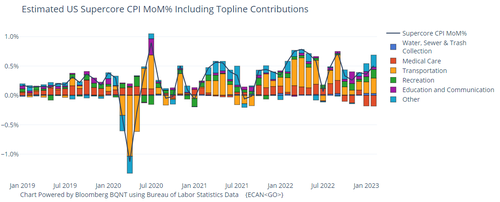

Increases in Transportation costs outweighed a drop in Medical Care costs...

Crucially, the core inflation measure Powell watches - core services excluding rents - went in the wrong direction. Up 0.5% versus 0.36% in January. The year-on-year rate came down slightly, to 6.15% from 6.22%.

Source: Bloomberg

Finally, this is the 23rd straight month where Americans cost of living has outpaced their wage growth with real average hourly earnings down 1.3% YoY...

Source: Bloomberg

Obviously the world is a different place after the SVB collapse and bailout, but The Fed still has a job to do.

Before the print, the market had priced in 17bps of hikes for March's meeting next week