It appears that after we spent years pounding the table on the sector, someone else also figured out that energy stocks are trading at single digit PEs.

The WSJ reports that European energy giant Shell is in early stage talks to acquire the other European energy giant, BP, in what would be the largest oil deal in a generation, and one of the largest merger deals of all time.

The Journal writes that while talks between company reps are active, BP is considering the approach carefully as the resulting company would be one of the biggest energy companies in the world; acquiring BP would put Shell on firmer footing to challenge larger competitors such as ZeroHedge favorite Exxon Mobil and Chevron, and would be a landmark combination of two so-called supermajor oil companies.

A Shell spokesman told the WSJ that “we are sharply focused on capturing the value in Shell through continuing to focus on performance, discipline and simplification.”

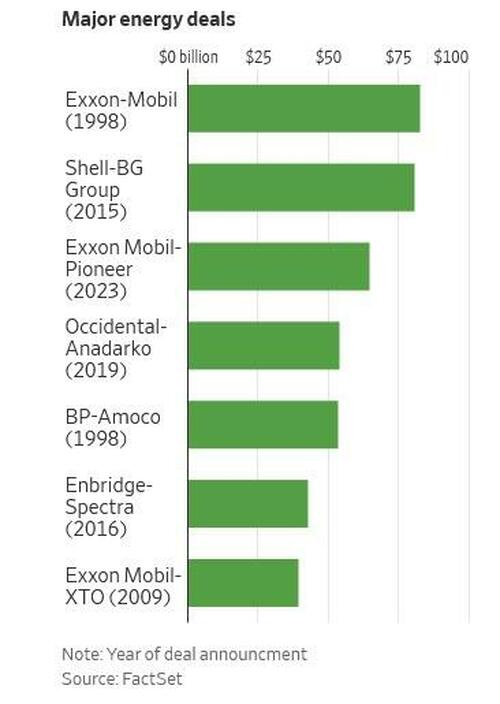

While potential terms of any deal couldn’t be learned and a tie-up is far from certain, BP is currently valued at around $80 billion, and when taking into account the usual acquisition premium, a deal could end up as the largest corporate oil deal since the $83 billion megamerger that created Exxon Mobil at the turn of the century. It would also easily be the biggest M&A deal of the year, and one of the largest deals of the century, in a market that has been rattled by President Trump’s trade war and other geopolitical tensions.

Shell is coming into the acquisition talks from a position of strength, with its stock sharply outperforming BP in recent years. Shell, which like BP is based in the U.K. but has operations around the world, has a market value of more than $200 billion. Meanhwhile, BP has been the laggard among major oil companies and a poster child for getting woke and (almost) going broke, after an ill-fated push away from fossil fuels into renewable energy, to signal just how virtuous the company is sent the stock into a tailspin. It has also suffered years of management upheaval and operational disasters.

Activist investor Elliott Investment Management, which owns more than 5% of BP’s shares, has pushed for changes at the energy company since at least February, underscoring the oil and gas producer’s exposure to a potential takeover bid from a rival. BP has since adopted several measures to try to address investor frustrations. It announced plans earlier this year to boost oil and gas production and sharply cut investments in clean energy.

While BP has struggled, Shell has focused on its most profitable operations, pledging to pump more oil and gas and rolling back green energy targets. When asked publicly, Shell CEO Wael Sawan has said recently that the company’s bar for big dealmaking would be high. Shell in May announced a multibillion-dollar share buyback plan, the latest in a long series of big share repurchases. Shell has been working with bankers on a potential sale of its chemicals assets in Europe and the U.S., The Wall Street Journal previously reported.

For Shell, acquiring BP would take years of integration, complicated by culture clashes and possibly the sale of overlapping assets. But a deal could give Shell’s global trading business greater reach and bolster its dominance in areas like liquefied natural gas. Analysts and investors also see a good matchup in the companies’ Gulf of Mexico operations.

Acquiring BP would also offer an opportunity for Shell to spread costs over a larger operating base and would box out rivals. Shell would also be more politically palatable to U.K. regulators who may oppose a foreign buyer from acquiring BP, a more than century-old company that traces its roots to oil exploration in Persia during the height of the British Empire.

While huge, a Shell-BP deal would be only the latest in a wave of M&A activity across the energy landscape as the producers look to achieve greater economies of scale. Chevron is still working to close its $53 billion megadeal for Hess, which has been held up due Exxon’s effort to challenge the deal’s legality.

Meanwhile, Exxon is already boosting its operational efficiency after closing a $60 billion deal to buy US shale giant Pioneer Natural Resources. Diamondback Energy sealed a $26 billion deal for Endeavor Energy Resources to bolster its position in the Permian Basin.

In response to the news, BP stock spiked 10%, erasing all losses since Liberation Day...

... while the rest of the energy sector is also trading higher.