With the market desperate for any visibility into the economy - due to data being cutoff during the shutdown - this morning's soft survey data on the services sector could have a larger impact on stocks and bonds than normal.

With 'hard' data surging higher, S&P Global's US Services PMI rose from 53.9 preliminary to 54.2 final in September (but that is down from the 54.5 final print for August). The ISM Services PMI also fell MoM from 52.0 to 50.0 (worse than the 51.7 expected) - that is the weakest since May...

Source: Bloomberg

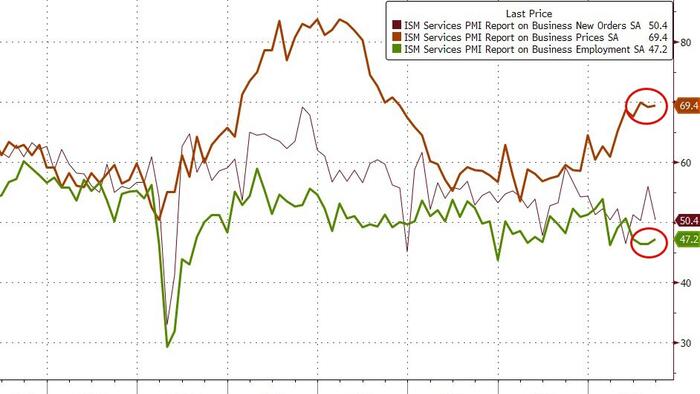

Under the hood of the ISM survey we saw prices sticky at highs, employment weak (but a small improvement) and orders slowdown...

Source: Bloomberg

The S&P Global US Composite PMI recorded 53.9 in September. That was down from 54.6 in August and represented the slowest growth for three months.

Both sectors covered by the survey recorded weaker output expansions in line with slower gains in new business. Employment meanwhile barely rose, but confidence in the outlook strengthened noticeably. Cost pressures remained elevated, although inflation softened to a five-month low. A similar trend was seen for output charges.

“Service sector growth softened slightly in September but remained strong enough to round off an impressive performance over the third quarter a whole," according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence

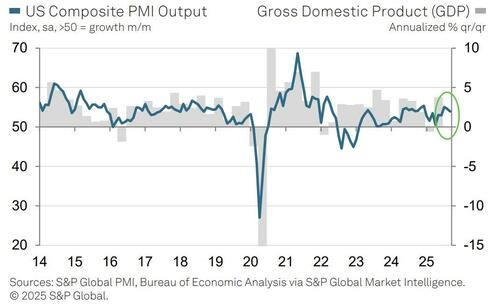

"Combined with sustained growth in the manufacturing sector, the expansion of service sector activity is indicative of robust third quarter annualized GDP growth of around 2.5%."

The recessions shows no signs of appearing:

“Growth is being fueled principally by rising financial services and tech sector activity, though we are also seeing more signs of improving demand for consumer-facing services such as leisure and recreation, likely linked in part to lower interest rates.

Lower borrowing costs have also fed through to a broadbased improvement in business optimism about the outlook for the next 12 months.

But jobs remain a worry:

“Disappointingly, the improvement in business optimism failed to spur more jobs growth, with hiring almost stalling in a sign of further labor market malaise as companies often focused on running more efficiently amid uncertain trading conditions.

As do (tariff-driven) price hikes...

“A further ongoing source of concern from the surveys are heightened cost pressures which survey respondents have attributed to tariffs. Input costs rose sharply again in September as import levies were seen to have again fed through from goods to services.

However, rates charged for services rose at the slowest rate for five months in a welcome sign that some of these tariff price pressures in supply chains are starting to moderate.”

So choose your own adventure - employment data remains in contraction but did improve modestly. The message overall appears to be that there remains 'less' firing, but even less hiring.