Over the weekend, when writing about the shift in hedge fund positioning in the past two weeks during which we observed bearish capitulation as stocks broke out to new 2023 highs, we said that this was the first material "sentiment shift" of 2023, driven by "FOMO Frenzy, Hedge Fund Buying." Yet not everyone was on board.

According to Bank of America's Jill Carey Hall, who keeps tabs on the bank's client flow trends, last week was indeed one where most bears capitulated as BofA clients were net buyers of US equities with the biggest inflows since Oct. (+$4.4B): "Both stocks and ETFs saw inflows, led by the former. Despite “risk on” flows, inflows were chiefly in large caps (mid caps also saw inflows – largest since Dec.)."

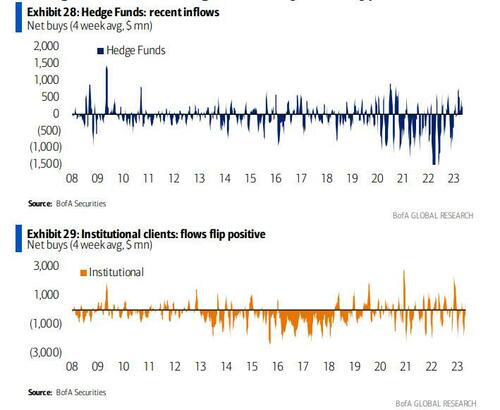

These massive flows over the past two weeks were driven by institutional & hedge fund clients, as we already discussed...

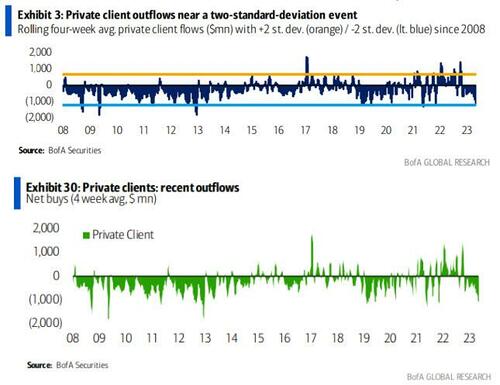

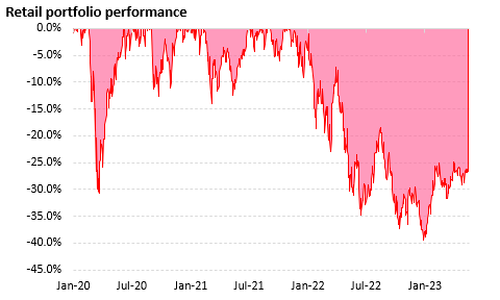

... but on the other end were the bank's private clients (i.e., high net worth retail investors) who were capitulating: according to BofA, "Private clients were sellers for the 8th straight week and are the biggest sellers YTD"

Here are the details:

Rolling 4-wk. avg. sales by retail are the largest since Oct. ‘21 and close to a two-standard-deviation event.

Our GWIM survey suggest heightened levels of sideline cash and shifts into bonds/cash from equities this year.

Needless to say, capitulations are infallably bullish events, and this one should be no different. According to Hall's calculations, the S&P 500 has been up more than average over the next 1, 3 and 6 months four of the last five times when there was a -2 std dev event in retail flows since ‘09 (with avg. 1/3/6 mo. S&P returns of 2%/4%/8%).

And sure enough, BofA writes that it just upgraded its outlook for stocks (as noted on Monday, the bank raised its S&P 500 target to 4300), "in part because of capitulation-like trends out of equities."

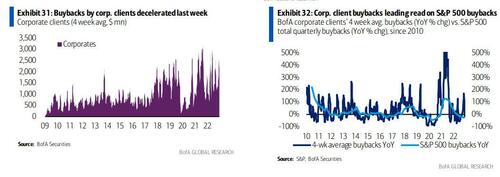

As an aside, with retail quietly exiting stage left, corporate buybacks also slowed for a second week after tracking above typical seasonal trends throughout April during earnings season. BofA calculates that YTD corp. client buybacks as a % of S&P 500 mkt. cap (0.10%) remain slightly above 2022 highs at this time (0.09%).

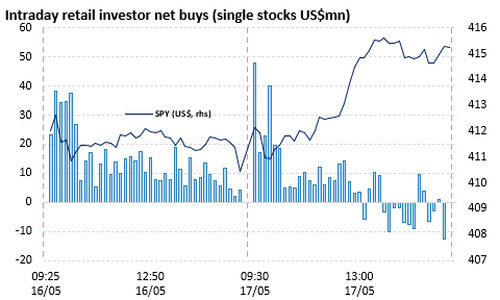

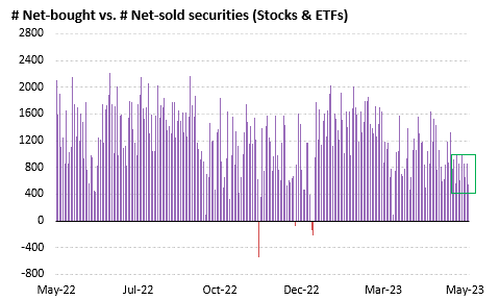

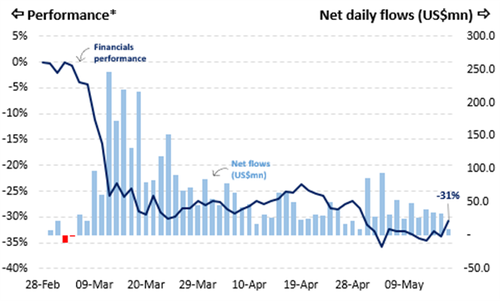

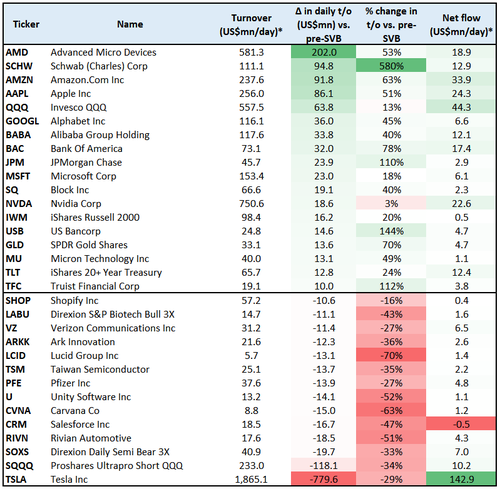

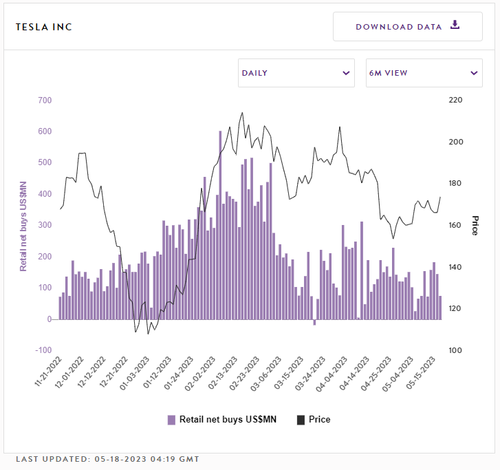

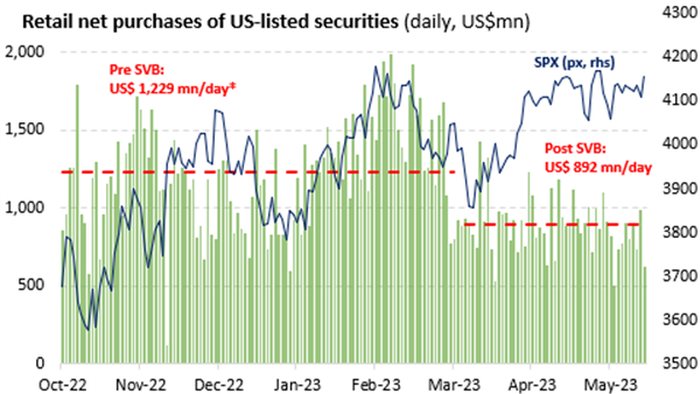

A separate report by Vanda Research confirms as much: according to Vanda's Marco Iachini, even though the S&P 500 is within striking distance of its 2023 peak, retail investors are not chasing the rally as they usually do when the market keeps grinding higher. Indeed, the average daily flow into US markets has stayed near or below $900MM/day for all but one day over the past two weeks. That’s been the trend since the SVB fallout kicked off the broader banking crisis: as if retail investors lost their mojo when the regional bank crisis started... either that or retail kept averaging down into the collapsing stock price until everything was lost. During this period, average daily retail flows have dropped roughly 27% below the mean of the past two years (chart below).

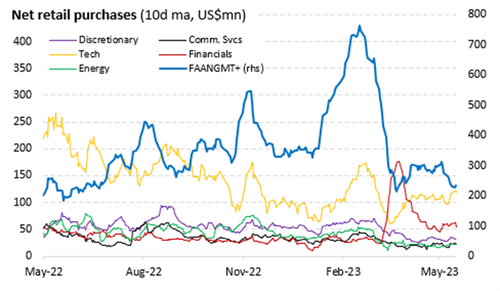

According to Vanda, there "clearly has been a sentiment shift" as growth/recession worries have dominated market narratives. Such behavior is characteristic of end-of-cycle phases, during which retail traders are more reluctant to chase rallies as aggressively as in the earlier parts of the market cycle. Nonetheless, under the surface, retail traders have remained more active than the net level of inflows would suggest.

Below Vanda shares some more observations on the latest

More in the full BofA note available to pro subs in the usual place.