One of The Fed's favorite inflation indicators - Core PCE Deflator - slowed to 3.9% YoY in August (its lowest since Sept 2021). Headline PCE jumped up to +3.5% YoY, its highest since May...

Source: Bloomberg

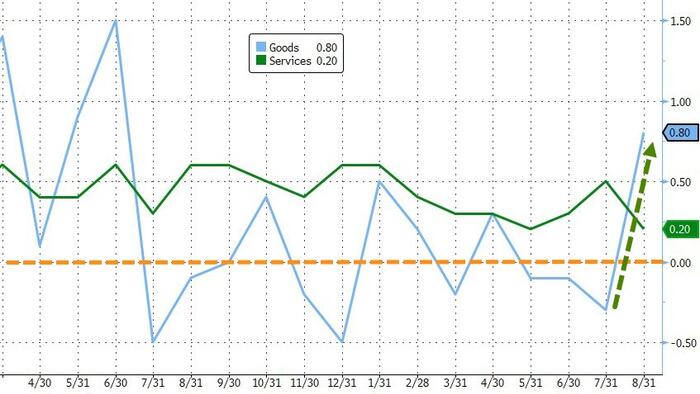

After 3 months of 'deflation', Goods prices rebounded strongly in August (up most since June 2022)..

Source: Bloomberg

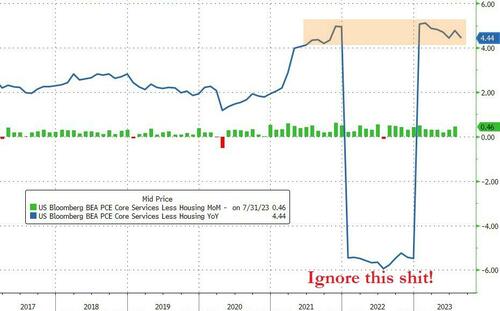

Even more focused, is the Fed's view on Services inflation ex-Shelter, and the PCE-equivalent shows that is very much stuck at high levels (ignore the data series, Bloomberg screwed up on revisions)...

Source: Bloomberg

Personal income grew 0.4% MoM and so did Spending...

Source: Bloomberg

But both remain up significantly on a YoY basis...

Source: Bloomberg

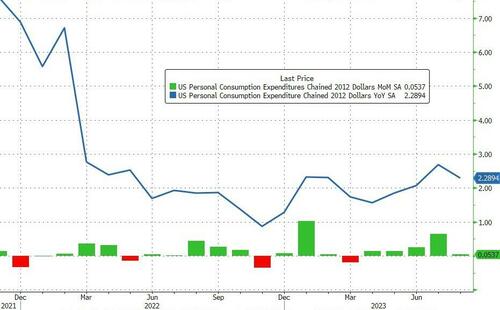

Adjusted for inflation, 'real' personal spending was higher in August (up 2.3% YoY)...

But Real Disposable Income fell 0.2% MoM (the 3rd monthly decline in Americans' earnings in a row)...

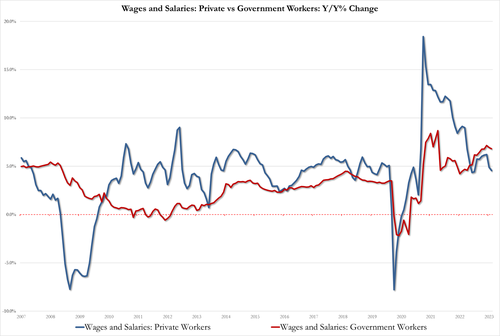

And Wage growth is slowing:

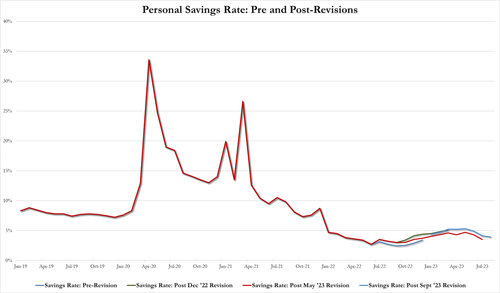

All of which pushed the savings rate lower (amid numerous revisions once again) to 3.9% of DPI - the lowest in a year...

So 'stickier' than expected inflation - driven by a re-emergence of goods inflation - and savings rates shrinking again... Bidenomics, bitches!