Shares of Sarepta dropped as much as 11% in premarket trading and remain down about 6% after the cash open this morning.

The decline follows H.C. Wainwright’s reiteration of its Sell rating and a drastic cut in its price target—from $10 to $0—after the FDA requested Sarepta voluntarily withdraw its ELEVIDYS gene therapy from the market. Sarepta has reportedly declined to comply.

The FDA’s request follows a third liver-related death linked to the company’s gene therapy programs—two associated with ELEVIDYS and one from a separate LGMD subtype trial.

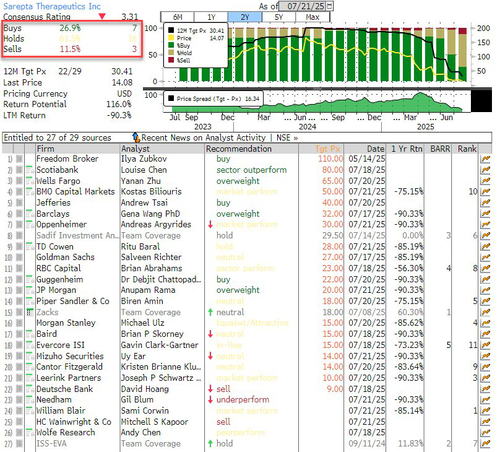

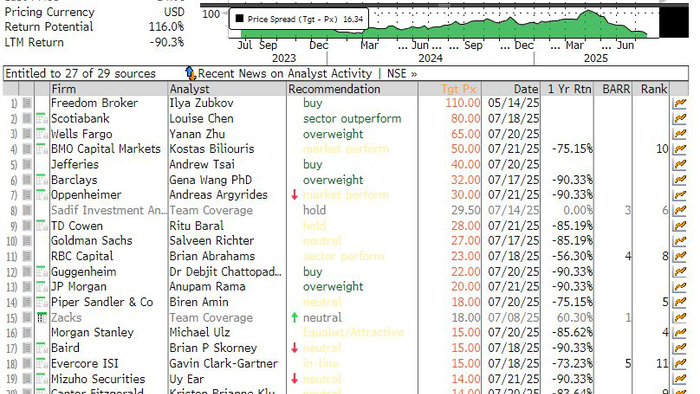

Sarepta shares have already plunged more than 90% over the past year, now trading at $14.08, down from a 52-week high of $150.48. According to Bloomberg, the stock now holds 7 Buy, 16 Hold, and 3 Sell ratings.

H.C. Wainwright raised concerns over Sarepta’s deteriorating commercial outlook, noting that its non-ELEVIDYS franchise is expected to decline, with 2025 revenue guidance of $900 million, down 6% year-over-year. Its LGMD2E asset, while still in development, addresses a very small patient population—estimated at just 250 cases annually.

Financially, Sarepta faces mounting pressure: it holds $1.1 billion in convertible debt due in 2027, against $850 million in cash.