By Michael Every of Rabobank

As expected, the French government collapsed yesterday, leaving the country in political chaos just as it needs to deal with massive economic and national security challenges. President Macron has ruled out a snap election. (See here for our pre-confidence vote take.)

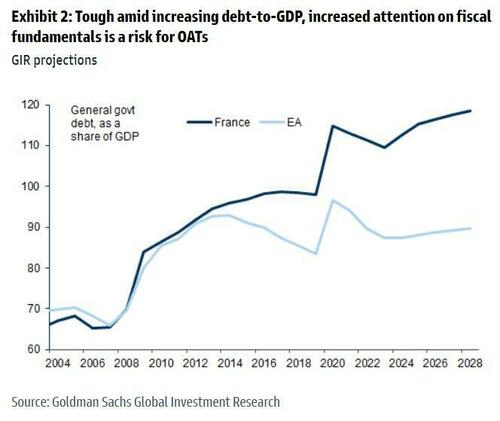

As is the way of markets --albeit helped by directionality from the US-- French bond yields were lower on the day. However, markets and realpolitik have not communicated in recent years: is the second largest economy in Europe, and the only one with a nuclear trifecta, looking unable to deal with its fiscal deficit, and perhaps ungovernable, something that can be easily shrugged off?

Le Figaro English recently noted: ‘“Prices Have Literally Exploded”: Have French Restaurateurs Been Too Gluttonous for Their Own Good?”, noting “Empty terraces, silent dining rooms… Despite the heatwave, this summer has been a cold shower for restaurateurs. While the tourist season is in full swing, cafés, bistros and traditional inns are being shunned by the French.” Is this not perhaps tiptoeing towards ‘Let them eat cake’ territory?

Now ex-French PM Bayrou warned just before losing the vote, “Don’t become the UK”, and there the mood remains febrile regardless of Labour’s huge parliamentary majority. The anti-Labour Daily Mail notes ‘Desperate Starmer accused of the 'mother of all stitch-ups' and trying to 'fix' Labour's deputy leadership contest by giving hopefuls just THREE DAYS to get the backing of 80 MPs’. The pro-Labour Guardian says: ‘Revealed: how Boris Johnson traded PM contacts for global business deals’ (Guardian), including being paid £240,000 just after meeting Venezuelan President Maduro last year. Perhaps unsurprisingly, the anti-establishment Reform Party continues to sit at the top of all opinion polls.

In the US, the Wall Street Journal reports that the ‘White House Prepares Report Critical of Statistics Agency’ and ‘The Renewed Bid to End Quarterly Earnings Reports’. What, no data and no quarterly higher/lower-than games? What is a capitalist to do?! Innovate and invest in physical capital? But who wants to do that when there are assets to speculate on?

Moreover, US Treasury Secretary Bessent threatened to punch FHFA Director Pulte in the face, with additional expletives. That likely burgeoned his reputation in some circles: the man who as a young trader broke the Bank of England for Soros in 1992 arguably now wants to break the international financial architecture, and in the US’ favour. While many in DM who don’t see it, those in EM do – albeit in exaggerated form.

Putin advisor Kobyakov just stated: “The US is now trying to rewrite the rules of the gold and cryptocurrency markets. Remember the size of their debt - $35 trillion. These two sectors --crypto and gold-- are essentially alternatives to the traditional global currency system. Washington’s actions in this area clearly highlight one of its main goals: to urgently address the declining trust in the dollar. As in the 1930s and the 1970s, the US plans to solve its financial problems at the world’s expense, this time by pushing everyone into the “crypto cloud.” Over time, once part of the US national debt is placed into stablecoins, Washington will devalue that debt. Put simply: they have a $35 trillion currency debt, they’ll move it into the crypto cloud, devalue it, and start from scratch. That’s the reality for those who are so enthusiastic about crypto.”

We recently wrote about the geopolitical implications of dollar stablecoins, while most of the market seems to only focus on the ‘buy all the things’ aspect of them.

That said, yesterday’s BRICS virtual summit saw its members appear wary of exacerbating any trade wars with the US: although that geopolitical grouping criticised US policies, it steered clear of any direct attacks on President Trump. That’s following Chinese trade data yesterday that saw exports to the US slump 33% y-o-y but total exports still rise 4.4% - somebody is buying a whole lot more: shipments to the EU were up 10.4%, to ASEAN 22.5% and to Africa 26%. That’s either a lot of transshipment for the US to deal with or a lot of deindustrialisation everywhere else, with unhappy politicians to follow in short order.

Japan is also looking to find another new PM who can deal with a similarly fractious parliament and worrying geopolitical backdrop with public debt more than twice as high as France. That’s as China called Australia (and, by proxy, Japan?) a “geopolitical puppet” for holding a security meeting with the Japanese alongside the recent military parade in Beijing.

More importantly, it’s as reports have it that the looming update to the US National Defence Strategy will see a focus on the homeland and the Western Hemisphere (read: the Monroe Doctrine) rather than a pivot from Europe to Asia.

If you are in Asia, get ready to be told to spend 5% of GDP on defence like Europe has: how you then finance that is your business, but you will be financing the new US factories that build the weapons you will be buying to defend yourself with. That’s as Indonesian President Prabowo removed his finance minister after street protests, risking more turmoil for that G20 economy, while Thailand’s new PM and finance minister --with a fiscal deficit of nearly 6% of GDP-- are seeing tourism groups call for cash coupons to be given to foreign visitors to spend in the hopes of boosting the economy. That’s how well things are going.

If you are working against US interests in Latin America, the tail risks are larger. Not only did the US recently blow up a Venezuelan drug-trafficking vessel in international waters, send a Naval flotilla there, and base 10 F-35 jets in Puerto Rico, but there are reports the White House is considering military strikes on narcotics facilities inside Venezuela. Which just happens to be a Russian, Chinese, and Iranian ally and very oil rich.

Not too far away, Argentina’s pro-US President Milei saw his party suffer a notable local election defeat in Buenos Aires, which unlike in Europe led to a real slump in both the peso and Argentinean bonds. In short, while DM might now look and act a lot more like EM, they can still get away with legacy DM FX and bond pricing… for now at least.

Indeed, while DM don’t really think about it, “because DM”, gold is at a fresh all-time high even as US yields decline. That’s as close to a “Down with this sort of thing” protest as you are going to get.

But back in the world of financial market commentary, Bloomberg, which neatly summarizes all its stories with AI, sees Shuli Ren recommend that due to AI rapidly replacing white collar jobs ahead, the only way readers can now avoid becoming future “peasants” is by investing thematically in tech to try to stay ahead.

Why does “Dennis! There’s some lovely filth down here!” suddenly spring to my mind? And why does ‘Do You Hear the People Sing?’ from Les Misérables? Both fit a Sacré bleu Monday and thoughts of a New Order.