Authored by Simon White, Bloomberg macro strategist,

Risk spreads in France have continued to ease back on a trend basis, even after Fitch’s downgrade on Friday.

However, some spreads remain elevated in absolute terms, indicating the market continues to price in structural problems.

As a reminder that agencies’ ratings changes are lagging, French bond spreads and asset swap spreads are slightly tighter today after Fitch’s downgrade of French government debt to A+ from AA- on Friday.

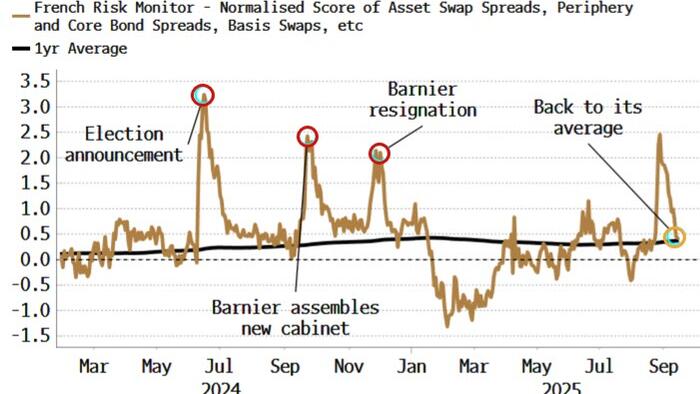

A holistic measure of market-based French risk spreads, in the chart below, shows it is back to its one-year average.

However, the measure is on a trend basis.

In absolute terms, some risk spreads, such as the French-German bond spread and the asset swap spread, remain wide.

What that tells us is that risk is no longer acute, but it remains chronic.

Spreads will not significantly decline until there is clear progress in reducing the deficit.

France may have got a pass from the bond market for now, but it’s still in a fix.

That clemency will be reassuring to other countries such as the UK, yet what happens in the EU’s second largest economy will still be consequential for developed bond markets around the world.