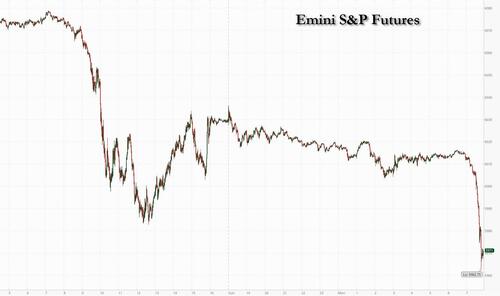

US equity futures dropped sharply on the second to last day of 2024, crushing a deathly blow to any hopes of a belated Santa rally, as the powerful meltup in technology shares and among momentum chasers crumbled in the final trading sessions of 2024. As of 8:00am, S&P 500 futures slumped 1%, dropping for a 3rd straight session and signaling extended weakness on Wall Street after Friday’s retreat led by tech megacaps weakness; Nasdaq futures also slid 1%. Monday's weakness was broad based: Europe’s Stoxx 600 index retreated, while Asian stocks snapped five days of gains. Treasuries reversed an earlier slide, and the 10-year yield dropped from near the highest levels since May. The dollar also reversed earlier gains while gold and bitcoin were relatively flat. The US economic data calendar includes December MNI Chicago PMI (9:45am, several minutes earlier for subscribers) and November pending homes sales and December Dallas Fed manufacturing activity (10am)

Mag 7 stocks were set to end the year on a damp note, with all in the red in pre market trading: Apple -0.6%, Nvidia -0.8%, Microsoft -0.4%, Alphabet -0.4%, Amazon -0.7% Meta Platforms -0.6%, Tesla -1.7% in premarket trading. Boeing shares slid 4.8% in premarket trading on Monday after a 737-800 aircraft operated by Jeju Air crashed at Muan International Airport. Investigators are focusing on a possible bird strike or landing-gear failure, and an analyst said it’s unlikely the events were related to Boeing’s production. Axsome Therapeutics shares fall 13% in premarket trading on Monday after the company announced its Phase 3 trial for AXS-05 in Alzheimer’s disease agitation.

The Mag 7 tech supergiants have been behind the 25% gain in the S&P 500 this year, which has prompted some to worry that the gains are too concentrated in a small group of names (see "Supercharged AI Bubble Or Epic Market Bust: BofA Derivative Desk's Dire 2025 Outlook"). Still, few are calling for the rally to end and none of the 19 strategists tracked by Bloomberg - all of whom were wrong in their 2024 year-end price forecasts - expects the S&P 500 to decline next year.

“In these moments, it’s best to stay put,” said Nicolas Domont, a fund manager at Optigestion in Paris. “The US remains the place to be. Growth stocks continue to outperform and earnings forecasts are good, so there are good reasons to remain optimistic.”

European stocks also fell in the penultimate trading session of 2024, tracking declines in their Asian counterparts amid thin trading volumes. The Stoxx 600 is down 0.2%, led lower by declines in media and health care shares.

Earlier in the session, Asian equities snapped a five-day advance, with Japanese benchmark indexes leading losses. The MSCI Asia Pacific index declined as much as 0.6%, its biggest drop in a week, with Toyota, Sony and Hitachi dragging down the benchmark. Japan’s Topix Index fell from a five-month high on the last trading day of the year for the nation. Stocks also declined in Australia and India. Shares were mixed in China. The onshore CSI 300 gauge closed with small gains, while the Hong Kong measure fell, weighed down by technology names.

“Overnight weak markets in the US have weighed on sentiment, notably in Japan & Hong Kong,” said Kok Hoong Wong, head of institutional equities sales trading at Maybank Securities. “We would expect volumes to continue to be low for rest of the week, and sentiment to be cautious,” he said.

In FX, the Bloomberg Dollar Spot Index dropped 0.1% after rising more than 7% in 2024, driven by the anticipation of “America First” policies from President-elect Donald Trump. The kiwi tops the G-10 FX leader board, rising 0.4% against the greenback; NZDUSD and AUDUSD lead G-10 gains versus the dollar climbing as much as 0.5% respectively. The euro strengthened after Spanish consumer prices rose to 2.8% in December, exceeding expectations and staying above 2% for the second month; EURUSD rose as much as 0.2% to 1.0444.

Treasuries rose, with 10-year yields dropping from near the highest levels since May as the treasury market was close to erasing the small gains it has made so far in 2024. 10-year yields fell 5 bps to 4.57%, while German 10-year yields fall 1 bp to 2.39% having briefly risen after Spanish inflation data surprised to the upside.

In commodities, oil prices declined again, with WTI falling 0.3% to $70.40 a barrel. Spot gold falls $9. Bitcoin rises toward $94,000.

The US economic data calendar includes December MNI Chicago PMI (9:45am, several minutes earlier for subscribers) and November pending homes sales and December Dallas Fed manufacturing activity (10am)

Market Snapshot

Top Overnight News