Amid all the recent worries about demand for US paper, between the Fitch downgrade, the $1 trillion planned issuance in Q3, the doomsday language in last week's TBAC refunding statement which warned of big increases in auction sizes in coming months and - of course - Ackman's latest melodrama, some were worried that today's 3Y auction would be a dud. It wasn't, and in fact today's 3Y auction was nothing short of spectacular.

The high yield of 4.398% was below last month's 4.534% and also stopped through the When Issued 4.416% by 1.8bps, the second consecutive stop through auction and 5th of the last 6.

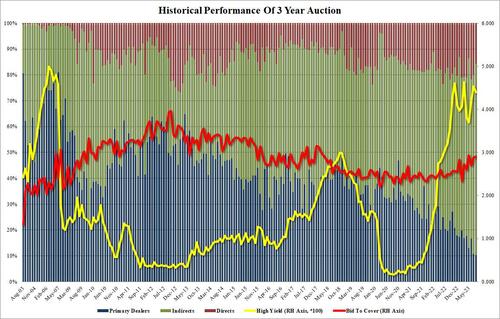

The Bid to Cover rose to 2.901% from 2.882%, the highest since May and excluding that auction, the BtC would have been the highest since April 2018.

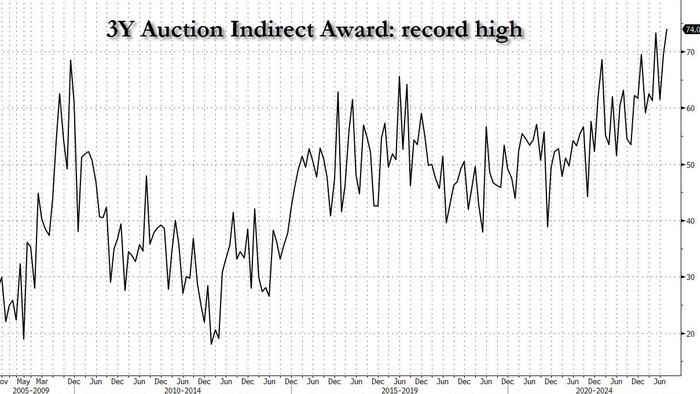

But it was the internals that were spectacular, with foreign buyers (i.e. Indirects) seemingly untouched by Ackman's latest pleas and the Indirect award - or the percentage of the auction awarded to foreign buyers - was a whopping 74.0%, up from 69.4% and the highest on record!

And with Directs awarded 15.7%, below the recent auction average of 19.7%, Dealers were left holding just 10.3%, an all-time lows.

Overall, this was a spectacular, blowout auction and certainly one that laid to rest fears that this week's refunding coupon sequence would spook the bond market. In the end, relentless foreign demand made it just the opposite.