'Brace yourself for a big beat' is the message from BofA's almost omniscient analysts ahead of this morning's retail sales print for July...

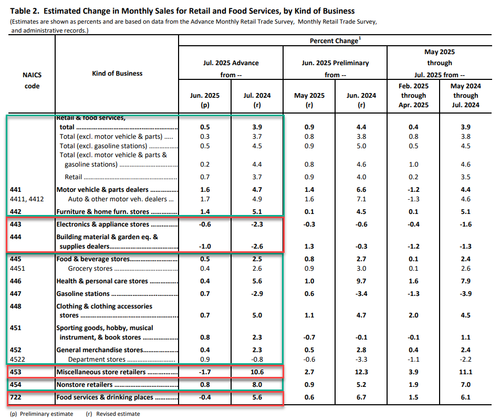

But, for once, the BofA team were not spot n as headline retail sales rose 0.5% MoM (slightly less than the 0.6% exp), but, perhaps some credence remains for BofA's team as June's 0.6% rise was revised up to a 0.9% MoM jump. This is the second bigly month of retail sales gains with sale sup 3.9% YoY...

Source: Bloomberg

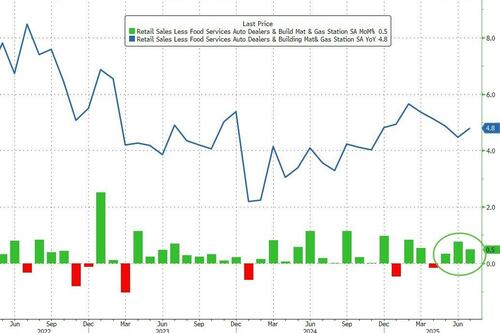

Core retail sales, ex Autos and Gas, rose jst 0.2% MoM (buit also followed a large upward revision) with the Control Group Sales (which slides into the GDP calculation) rising 0.5% (better than the expected 0.4%) and also seeing June revised up significantly. This leaves YoY sales up 4.8%...

Source: Bloomberg

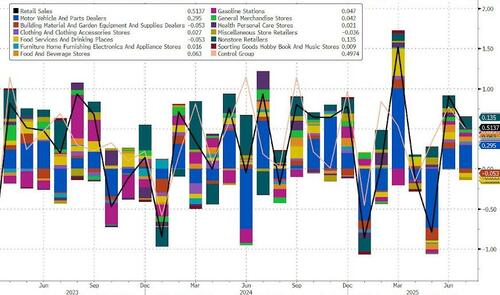

Motor Vehicles and Parts Dealers saw sales rise most MoM...

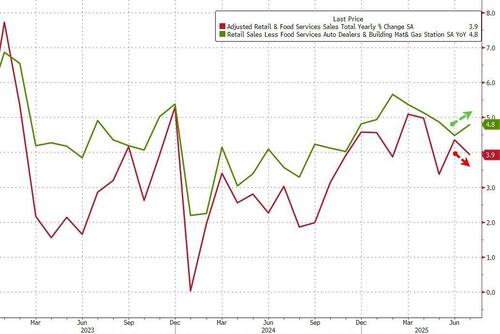

On a YoY basis, the control group ticked up while headline slowed...

Source: Bloomberg

Under the hood, miscellaneous store retailers and food service and drinking places all saw sales decline...

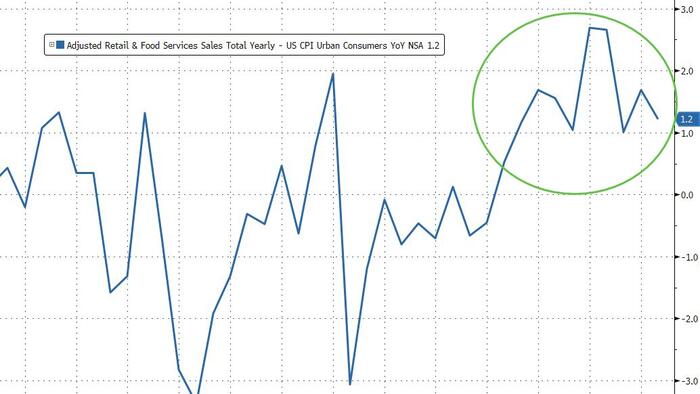

Finally, as a reminder, retail sales data is nominal, so roughly adjusting for CPI, we see 'real retail sales' rose 1.2% YoY - the 10th month in a row of rising real sales...

So, despite all the wailing and gnashing of teeth on soft survey data about the consumer, they still appear to be buy-buy-buying.