By Ven Ram, Bloomberg Markets Live strategist and reporter

What happens to global interest rates after the major central banks reach the end the tightening cycle?

There are two broad schools of thought. The first is what I call the snakes & ladders theory, which is that real neutral rates will go back to square one. The other posits that rates are unlikely to go back to the incredibly low levels we saw before the pandemic.

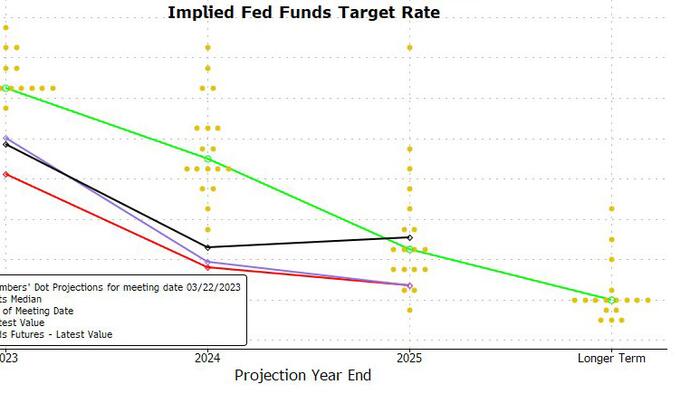

The Fed’s March dot plot implicitly invoices a neutral real rate of 50 basis points, though it would be fair to conclude that the rate has been probably higher than that — at least in the post-pandemic inflation cycle. Given that r* is an unobservable variable and we are yet to reach peak rates in the US — let alone embark on a loosening cycle thereafter — we won’t know the definitive verdict for the relevant rate for this cycle for a long time to come.

For what it is worth, my two cents is that the real neutral rate isn’t either in the 0%-0.5% camp or in the 1.5%-2% territory, but somewhere in between. Even a rate that is in between — of, say, 1% — has profound implications for what we should expect in terms of where central bank nominal rates will be headed when the loosening cycle begins eventually.