By Peter Tchir of Academy Securities

Rates, “Credit”, and Geopolitical Inflation

Rates dominated the market this week. Equities seemed to follow rates around, but that correlation broke down on Friday afternoon as yields moved lower (and stocks slumped). We will address rates and the “credit” story (which is really about the credit of the U.S. government). We will also re-emphasize several sources of inflation that seemed to garner attention this week.

Rates

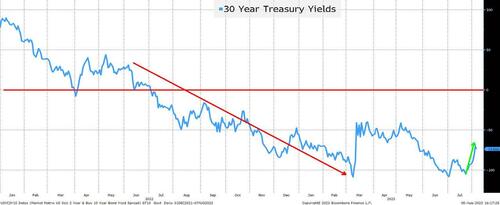

The 30-Year Yield Breaks Above 4%

For the second time since the Fed started hiking, the 30-year materially breached the 4% level. It had done that back in October 2022. At that time, the S&P 500 was at 3,600, a long way from today’s lofty level of 4,500. That move in Treasuries back in the autumn of 2022 was quickly followed by a move taking the 30-year Treasury back to 3.5%. It is unclear if that can or will happen again. It is also unclear if equities can be valued so highly now compared to then.

There are a few things that are “different” this time (yes, famous last words), but let’s first look at the other move in rates that caught my eye (and one that I’m completely on board with).

2-Year Yield vs 10-Year Yield Much Less Inverted

There are a few key differences in today’s environment compared to late 2022.

"Credit"

Fitch downgraded the U.S. debt rating to AA+. At the time, I took the stance that “investors don’t buy Treasuries based on ratings”. That quotation was picked up by a myriad of financial publications (including Bloomberg, The New York Times, and the Financial Times). I completely stand behind that quotation and think that the downgrade was relatively trivial in the grand scheme of things.

I got some pushback, and maybe that is why stocks did poorly. The argument goes that if you make the “least risky asset” slightly riskier, than more risk premium must get priced into everything (from the long-end of the yield curve, to credit spreads, and also into equity valuations). I could have always “bought into” (or in this case “sold into”) the argument if something had really changed. But the difference between AA+ and AAA seems trivial to me. Sure, BB and AA are different, but what the heck is the difference between AAA and AA+? I’ve got more important things to worry about.

In an era where the NRSROs (Nationally Recognized Statistical Rating Organizations) have been looking to reduce the amount of debt that gets rated AAA, it isn’t at all surprising that the entities would take an opportunity to nudge ratings down slightly. If anything, the surprise to me is how long it took for another company to follow S&P’s lead.

I have no issue with the downgrade.

I guess that is a long way of saying that I think the message being sent to D.C. by Fitch is that “we are heading in the wrong direction and while it isn’t remotely concerning from a risk standpoint today, we can’t just let you go down this path without at least raising our hand and trying to get your attention.”

Geopolitical Inflation

Our position on longer-term inflation is:

That has been our position for some time now and is largely (but not totally) driven by the efforts that the country and companies are taking to make their supply chains “more secure”.

We first tried to hammer home the point that ESG is Inflationary in March of 2021. I view “ESG Inflation” as a subset of “Geopolitical Inflation”. The two main themes of “ESG Inflation” were:

We had some conditions that would be required for “ESG Inflation” to gain momentum:

I think that we could substitute “ESG” with “Security” or “Geopolitical” and come to the same conclusions, which are:

This fits in perfectly well with our Battle for Rare Earths and Critical Minerals theme. Global Relations Cooling is another key element of all of this “Geopolitical Inflation”. We hit on many of these inflationary and problematic issues at our Geopolitical Summit West earlier this year.

I cannot believe The Recentralization of China is 2 years old or that World War v3.1 may be far more broadly applicable than originally thought.

The flipside of the coin is the potential risk to sales for U.S. corporations if we are correct in the Shift From Made in China to Made By China and their increasingly deft use of their currency to shift power away from the West. Potential lost sales by non-Chinese companies (especially into emerging markets) would hurt earnings power. It isn’t part of the “inflation” argument, but it is a real risk that should be aggressively addressed now before it is too late and we find ourselves well down a slippery slope.

I could, quite easily, link to even more reports, but I’m running out of time, and you get the gist – this is a subject that is near and dear to my heart and one I think that we all need to be thinking about.

In any case, I expect inflation to be persistently higher for longer than it has been in the past few decades as every step of creating “secure” supply chains will increase costs (at least until they have been rebuilt). The term “secure” can also apply quite broadly.

My 3% to 5% estimate for 3 to 5 years is admittedly a finger in the air estimate and maybe I’m too low (or too short), but that is my working premise on inflation.

Is the 80 Cent Widget More Expensive than the 1 Dollar Widget?

This is the analogy that we use in meetings. It is meant to provoke thought and discussion and I think that this is relevant to most companies.

A few years ago, if it cost 80 cents to make a widget (say in China), but $1 to make the widget in the U.S., the choice was obvious – China.

But now companies are examining the accuracy of that 80 cent cost. What isn’t being priced into the 80 cents? Shipping costs? Shipping availability? Pollution? Hazardous or unsavory work conditions? Ability to refuse to produce or ship? How much is the intellectual property theft costing (extra important if I’m correct in the shift to China selling “their” goods and brands globally)? Sure, some things can be insured (driving up the cost), but some of the costs are intangible. Things that we either ignored or dismissed as “unlikely” turned out to have real costs. Are they outliers, or could they be repeated? Maybe another pandemic is unlikely, but our relationship with China seems to be shifting and it is impossible to ignore their growing influence across the globe. So maybe that 80 cent widget really should be viewed as costing 90 cents. Difficult to account for, but maybe an accurate reflection of the true cost.

With a bit of government support maybe we can get that cost down to 95 cents domestically. Bills like the Chips Act are meant to address this.

Finally, if investors value companies which have taken steps to secure/make their supply chains more sustainable and customers are willing to spend a fraction more for such products, then maybe the stock price can go up, even while paying 95 cents instead of 80 cents.

A theoretical and simple analogy, but I think that this is what companies (and countries) are facing in their decision process.

Bottom Line

Geopolitical (supply chain, ESG, rare earths, or any other name) inflation is real and persistent. The downgrade of the U.S. shouldn’t affect risk premiums (as it was negligible) and it wasn’t a “wrong” step to take.

However, this time is “different” enough that even with all that is going on, I think that curves will continue to become less inverted (though driven more by 2-year yields drifting lower than longer yields heading higher). Maybe the new range is 4% to 4.25% on the long bond, but I struggle to get too bearish on Treasuries even with my geopolitical inflation view.