With a new boss looming at The BLS, one wonders what the 'old boss' has in hand for today's CPI data (with consensus seeing both headline and core YoY price changes ticking higher) after June's consumer prices came in cooler than expected, disappointing the Trump Tariff Tantrum crowd. Will this time be different... Will the dreaded tariff-flation show up this time?

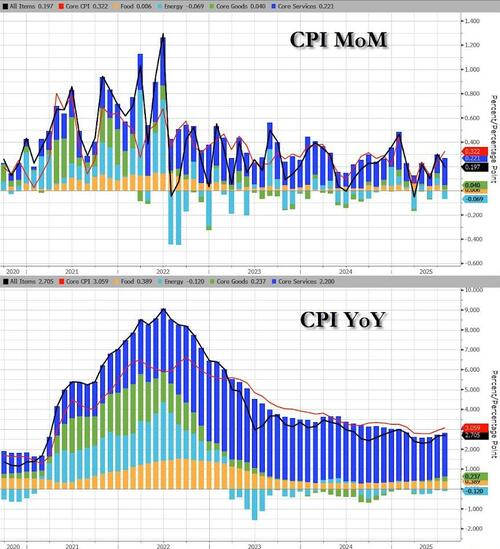

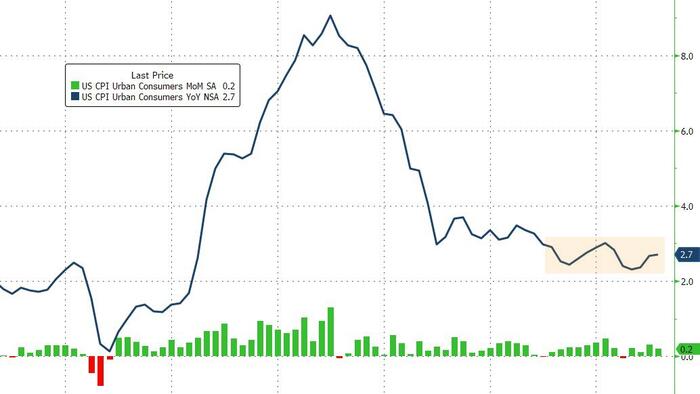

Headline CPI rose 0.2% MoM in July (as expected) and +2.7% YoY (cooler than the 2.8% expected) and in line with the June print...

Source: Bloomberg

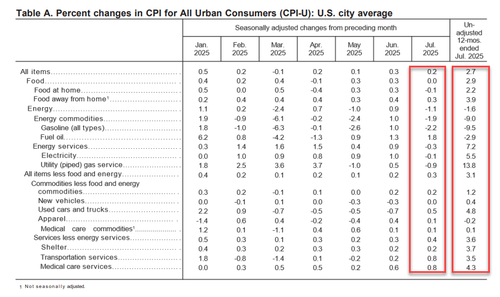

Headline CPI rose 0.2%, after rising 0.3% in June. CPI Core rose 0.3% in July, following a 0.2% increase in June.

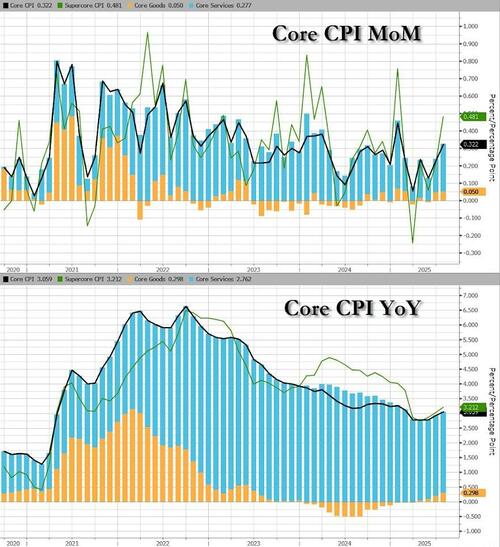

Core CPI rose 0.3% MoM (as expected) but YoY rose 3.1% (hotter than the 3.0% expected) - the highest since February...

Source: Bloomberg

Under the hood, Fuel Oil and Transportation costs rose the most but Gasoline and Food at Home costs fell MoM...

Core CPI MoM Details:

Annual changes:

Goods inflation is accelerating (some will argue 'tariffs', some will argue fuel) while Services inflation has stabilized...

Source: Bloomberg

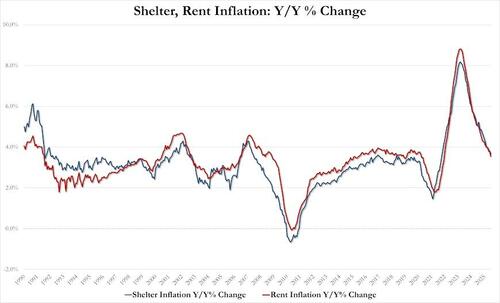

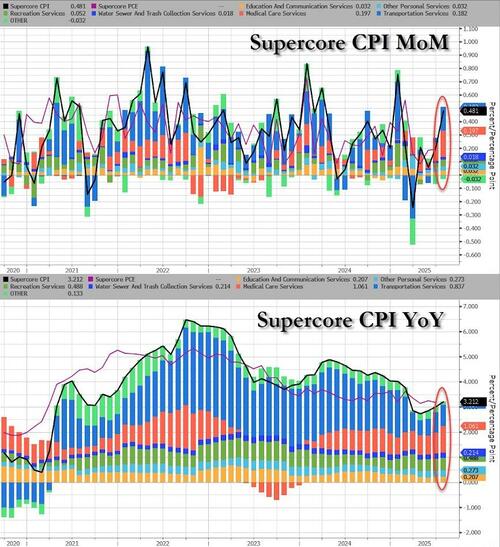

There is one problem in the data... SuperCore CPI (Services ex-Shelter) rose 0.55% MoM (hottest since January) and up 3.59% YoY (hottest since February)...

Source: Bloomberg

The jump in Transportation costs and Medical Care Services stood out for SuperCore (neither seem like they are affected in any way by tariffs)...

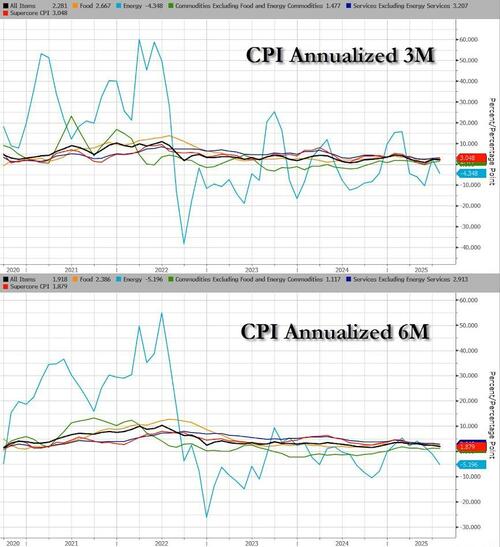

3m and 6m annualized CPI is also refusing to bow to the terror predicted by Trump tariff haters...

So, not exactly the screaming spike in prices that Democrats interviewed by UMich have hallucinated about?

Tiffany Wilding, Pimco economist, tells Bloomberg TV that tariff-related pressures are contained within certain areas of the report:

“It’s very concentrated within goods, it’s happening slowly, and outside of that, inflationary pressures look very manageable. So I think for a Federal Reserve, that is a very good sign.”

Art Hogan, B. Riley Wealth chief market strategist, weighs in:

“Core goods are the real driver of the move up in the index, while being somewhat offset by energy and shelter cost. The report will likely not change the path forward for the Fed, as we expect to see rate cuts at the next three meetings.”

Rate-cut expectations rose after the CPI print with September now trading at 95%...

But there is a silver lining...

And cue the "just wait until next month" arguments!!...