By Benjamin Picton, senior market strategist at Rabobank

YOUNGSTOWN ON THE RUHR

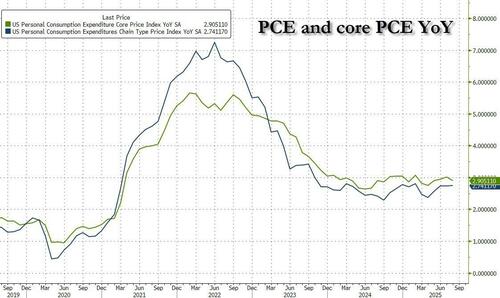

US equity markets rallied and short-end yields fell on Friday following a benign PCE price index report for the month of August. Both headline and core PCE printed in-line with expectations at 2.9% and 2.7% respectively, but month-on-month disinflation for both durable and non-durable goods saw core inflation fall on a monthly basis for a second straight month and perhaps calmed some market nerves over the impact of tariffs on inflation.

OIS futures now imply a further 44bps worth of cuts to the Fed Funds rate in 2025, compared to 39bps prior to the release of the PCE figures. Gold prices are rallying to new all-time-highs again and the VIX index had its biggest one-day fall in five weeks.

Along with the encouraging inflation figures, personal incomes rose faster than expected and growth in personal spending accelerated from the prior month to rise by 0.6%. This dynamic perhaps underlines the upward revisions to the Q2 GDP growth figures released the previous day, where faster growth was mainly propelled by upgrades to personal consumption.

Faster growth coinciding with relatively benign inflation creates an interesting setup as we run into jobs week. Initial jobless claims printed below consensus estimates for a second-straight week last Thursday, but recent payrolls data has seen the pace of hiring drop sharply and – as Fed Chair Powell pointed out last week – the pace of job creation seems to be running below the rate required to hold the unemployment rate steady at 4.3%.

Powell has been saying that the risks to inflation are tilted to the upside while the risks to employment are tilted to the downside. In a word, what he is describing is stagflation, but the White House and newly-minted Fed Governor Stephen Miran disagree and see risks to growth and employment as far more pressing than upside risks to prices. Miran argued last week that the neutral Fed Funds rate has fallen to somewhere around 2.5% because of changes to net immigration patterns and fiscal policy. He says that if the Fed fails to cut interest rates it will fail to achieve its employment mandate.

The University of Michigan consumer sentiment report released late last week provided some interesting perspective on economic pain points from households. Overall sentiment fell from a preliminary reading of 55.4 to 55.1. Current conditions and consumer expectations both softened, as did 1-year ahead and 5-10 year inflation expectations. The mean percentage of respondents expecting family income to exceed inflation rose slightly while sentiment surrounding employment fell. Overall, the message seems to be that consumers are concerned by inflation AND job prospects (so, stagflation), but more concerned about jobs than inflation.

This week will be important for shoring up market judgements about where the balance of risks lays between the price stability mandate and the employment mandate. 2.7% inflation is quite a bit higher than the 2% target, but the Fed has already cut interest rates four times – including a 50bp cut in September last year. Does this suggest that – like the household sector – the FOMC is also more sensitive to labor market deterioration than they are to stubbornly high inflation?

Of course, inflation missing the target by a few tenths of a percentage point might seem like small beer compared to the changes currently underway in geopolitics and geoeconomics. This Daily has been quite open for years that we see what is happening as a complete breakdown of the liberal economic order, because that order had failed to address compounding imbalances between and within economies that were always going reach a breaking point at some stage. It appears that the fraying of the social fabric in many Western countries is sufficiently advanced for that breaking point to have been reached, and we are now experiencing an abrupt shift towards mercantilist economics as advocated by political populists and, increasingly, by reluctant former liberal-centrists who now see this issue as existential for their own political survival.

To illustrate, erstwhile free trade evangelists at the European Commission are reportedly considering new tariffs to discourage Slovakia and Hungary from buying Russian energy and thereby funding the Russian war machine. Donald Trump called Europe out over those ongoing purchases at the UN last week and said that he was willing to impose tariffs of 50-100% on buyers of Russian energy if NATO allies were willing to do the same. This would effectively mean a common tariff against China who, along with (already tariffed) India is the major buyer of Russian energy.

In a similar move, Handelsblatt recently reported that the EU plans to impose tariffs of 25-50% on Chinese steel and steel-related products within the next few weeks while simultaneously imposing local content rules for public contracts. This is not just protectionism, but economic statecraft that seeks to secure European interests vis-à-vis China, who – after having practiced mercantilist economics for decades – now produces more than half of the world’s steel output and has shown plenty of willingness to use supply chain dominance to coerce other economies (via rare earths, notably).

Steel is seen as a strategic good where domestic production is critical for national security, but also critical for working class identity and economic security. Donald Trump articulated this bluntly when he said “if you don’t have steel, you don’t have a country”. Bruce Springsteen (not a Trump fan) articulated it more lyrically in ‘Youngstown’ when he sang:

“Well my daddy come on the Ohio works,

When he come home from world war two,

Now the yards just scrap and rubble,

He said, “Them big boys did what Hitler couldn’t do”,

These mills they built the tanks and bombs,

That won this country’s wars,

We sent our sons to Korea and Vietnam,

Now we’re wondering what they were dyin’ for.”

Having obviously sensed the shifting geopolitical and geoeconomic winds, EU Industry Commissioner Stéphane Séjourné told Handelsblatt “Europe has no choice but to find a new balance... fewer trade barriers at home, with a single market that really works, [but also] protective measure to restore balance with partners who no longer respect any rules at all.”

So, free trade within the bloc, but not outside of it. That sounds an awful lot like the old British Empire system of Imperial Preference, or the USMCA under an updated Monroe Doctrine...

More in the full note