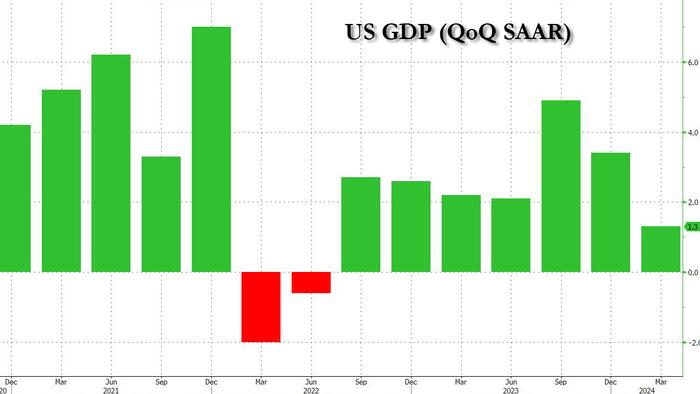

What was until recently a "red-hot" economy, with the US reportedly growing at an annual rate of 4.9% in Q3 and 3.4% in Q4 2024, has suddenly and dramatically downshifted, and according to the latest GDP data released from Biden's BEA, Q1 GDP was revised downward from 1.6% to just 1.3% (1.250% to be specific), which was the lowest GDP since the mini-recession of Q2 when GDP declined for 2 quarters in a row.

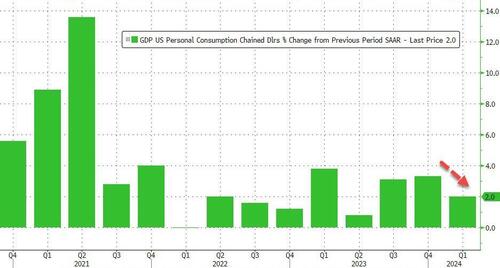

The sharp downward revision primarily reflected a downward revision to consumer spending, which rose 2.0% annualized, down from 2.5% in the first GDP report and below the 2.2% estimate.

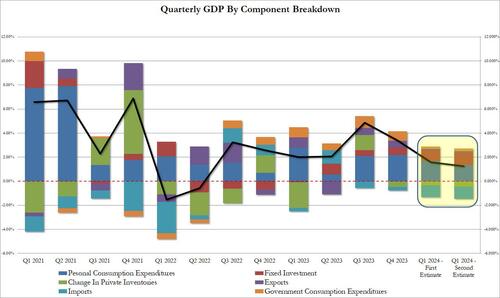

Drilling down into the number, the 1.3% increase reflected increases in consumer spending (below previous forecasts) and housing investment that were partly offset by a decrease in inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.

In terms of bottom-line contributions, we find the following:

Turning to the PCE and price component, while all eyes will be on tomorrow's PCE report, the GDP report - which is clearly quite as it covers Q1 - found that purchases prices, the prices of goods and services purchased by U.S. residents, increased

3.0 percent in the first quarter after increasing 1.9 percent in the fourth quarter. This was down from 3.1% reported in the first GDP report and is also below the 3.1% estimate. Excluding food and energy, prices increased 3.2 percent after increasing 2.1 percent.

Personal consumption expenditures (PCE) prices increased 3.3% in the first quarter after increasing 1.8% in the fourth quarter. Excluding food and energy, the PCE “core” price index increased 3.6% after increasing 2.0%. This number was also below the 3.7% estimate.

Overall, the GDP number confirms that the US economy is slowing rapidly as US consumers - especially those in the lower half - have hit a brick wall with maxed out credit cards and wages which fail to keep up with inflation.

But this bad news is of course good news for the market, and predictable futures jumped to session highs, although exuberance will be contained until tomorrow's PCE report, which we expect will also miss expectations, allowing futures to resume their Nvidia-driven meltup.