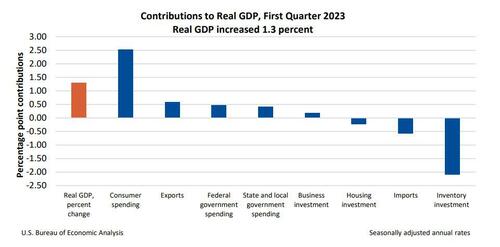

In the second estimate of Q1 GDP, the BLS reported a that the US economy grew at an annual rate of 1.3%, up from 1.1% in the advance estimate published a month ago and down from the 2.6% growth rate in Q4 of 2022.

The increase in the first quarter primarily reflected an increase in consumer spending that was partly

offset by a decrease in inventory investment.

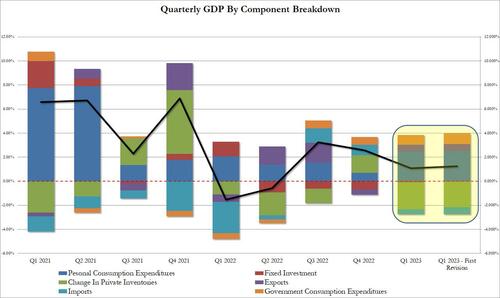

Compared to the fourth quarter, the deceleration in real GDP primarily reflected a downturn in inventory investment and a slowdown in business investment. These movements were partly offset by an acceleration in consumer spending, an upturn in exports, and a smaller decrease in housing investment. Imports turned up.

Specifically, here are the changes to the bottom line GDP print:

Bottom line, Q1 GDP rose 1.250%, rounded up to 1.3%.

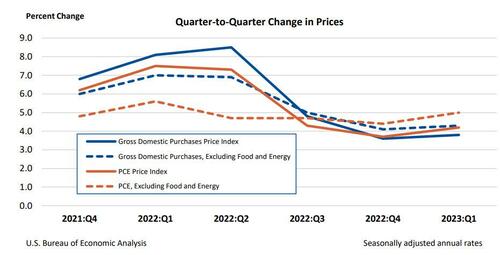

While the change in GDP will be mostly ignored as it is a very stale data point, there may be some attention to the price index and core PCE, both of which came in slightly higher than expected:

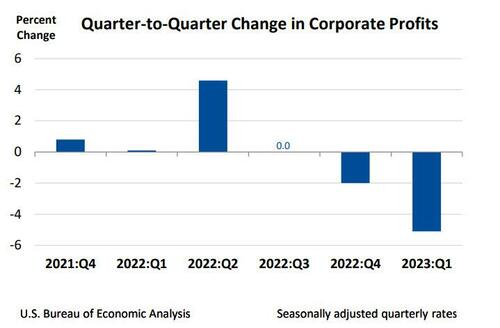

The BLS had less good news when looking at corporate profits which fell 5.1% Q/Q (after decreasing 2.0% in the

fourth quarter) and decreased 2.8% in the first quarter from one year ago.

Overall, a slightly stronger Q1 although it appears to merely pull demand from the future, while the higher than expected core PCE will be closely watched by the Fed, and sure enough, moments ago the market appears to have fully priced in one more full hike in June.

But while normally this would have sent stocks sharpy lower, a burst of unfounded optimism about a debt deal following some cheerful comments from McCarthy, not to mention the explosion in Nvidia, is pushing futures to session highs, more rate hikes be damned.