Puma SE shares crashed the most in decades after the German sportswear giant slashed its full-year outlook, citing dismal global demand. Jefferies labeled the preliminary earnings report a "major profit warning," while RBC warned the brand is facing an "existential identity crisis" as it struggles to stay relevant in international markets.

The key takeaways from the preliminary earnings release are that second-quarter sales missed expectations, the full-year outlook was slashed, and Puma warned of further pain from U.S. tariffs. Inventories are also rising as demand for its products continues to shrink.

Puma 2Q25 Earnings Pre-Announcement – Key Summary:

Adjusted EBIT: –€13.2 million (vs. Goldman Sachs consensus +€101.8 million)

Sales (currency-adjusted): –2.0% YoY (vs. consensus +1.7%)

- Direct-to-consumer (DTC): +9.2%

- Wholesale: –6.3%

Gross Margin: 46.1% (–70bps YoY; consensus 46.8%)

EBIT Margin: –0.7% (down 620bps YoY; consensus +4.9%)

Regional Sales vs. Consensus (YoY, cFX):

Inventories:

+9.7% YoY (or +18.3% cFX), due to elevated levels in key markets.

Puma's revised FY25 guidance paints a picture of a company in distress...

Here's commentary from Golmdan analyst Natasha de la Grense on Puma:

Big Q2 miss and warning which implies materially worse trends in H2. Q2 cFX -2% (consensus +2%) and they are guiding FY now down low double digits (previously +L-MSD, consensus +2%). This implies H2 down more then 20% which we think could imply 1) wholesale order cancellations (Q2 DTC was +9%), 2) potentially buying back inventory already sold to the trade (Q2 wholesale -6%) and reversing the sale. Puma's own inventories were +18% in cFX terms in Q2. EBIT guidance is now for a loss (vs consensus €445m) reflecting promotional pressure, tariff headwinds, currency headwinds and restructuring costs. Think some had been hoping the new CEO would cut guidance and that would be a clearing event but this is a very big cut.

Additional commentary from other institutional desks (courtesy of Bloomberg):

Jefferies (hold)

RBC (sector perform)

Citi (neutral)

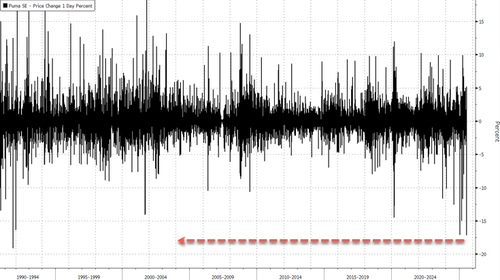

In markets, Puma shares in Germany have crashed the most (as much as -19%) since Aug. 8, 1991 (-17%).

. . .