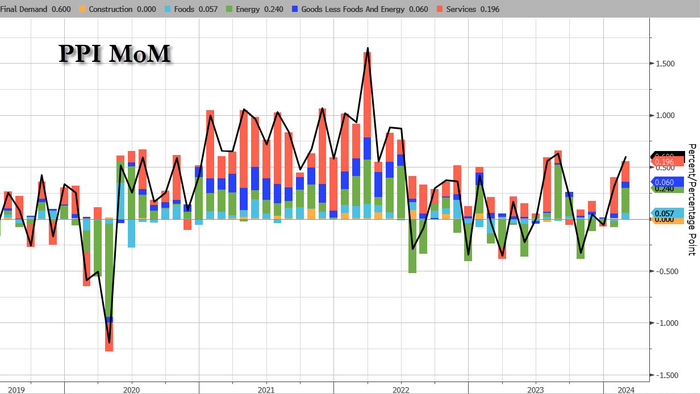

After the hotter-than-expected consumer price data, February Producer Prices were expected to slow their surge from January but they did not... with headline Final Demand PPI rising 0.6% MoM (double the 0.3% rise expected) - the hottest print since June 2022. That lifted the YoY PPI to +1.6%, its highest since September...

Source: Bloomberg

That was the second big beat for PPI in a row with Energy costs leading the MoM charge. 70% of the rise in February Goods PPI can be attributed to the index for energy, which jumped 4.4% (one-third of the February advance in the index for final demand goods can be traced to a 6.8% increase in prices for gasoline.)

Source: Bloomberg

Product detail:

Product detail:

This is not good news for the disinflationistas. And it will stop President Biden's narrative that 'prices are coming down' or refocus his blame-game that 'Big Corporate' greed is driving 'shrinkflation'...?