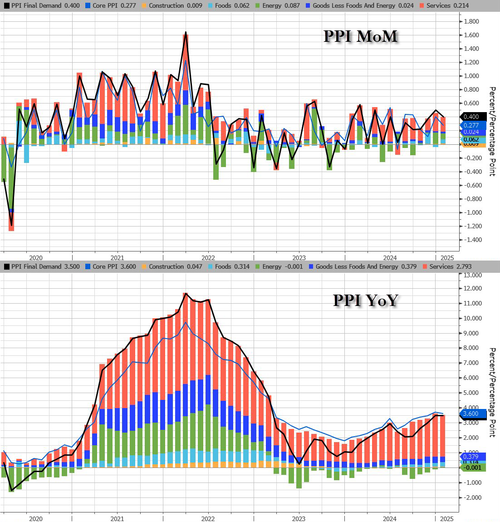

Following yesterday's hotter than expected surge in consumer prices, all eyes are on producer prices this morning as headline PPI rose 0.4% MoM (more than the 0.3% exp) in January, but December's 0.2% MoM rise was revised dramatically higher (to +0.5% MoM). Between the hot headline and upward revisions, headline PPI rose 3.5% YoY (+3.3% exp) - the hottest PPI since Feb 2023...

Source: Bloomberg

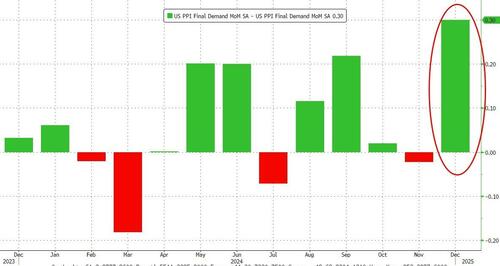

That is the 13th straight month without a MoM decline in producer prices.

2024's PPI data has been serially revised higher with December's the biggest upward revision since Dec 2021...

Source: Bloomberg

Core PPI also rose more than expected (+0.3% vs +0.2% exp) which dragged prices (ex food and energy) up 3.6% YoY...

Source: Bloomberg

Under the hood, Goods costs rose at double the pace of Services....

PPI Highlights:

PPI Services Details:

PPI Goods Details:

Energy deflation is over...

Source: Bloomberg

...but will energy deflation return next month?

Source: Bloomberg

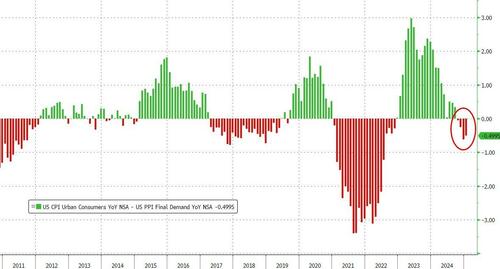

None of this is a good sign for bullish micro investors (margins compressed)...

...or bullish macro investors (doves crucified once again on the cross of transitory).

So much for Fed Chair Powell's comments this week that inflation expectations “appear to remain well-anchored” and central bankers have scope to be patient with rate adjustments...