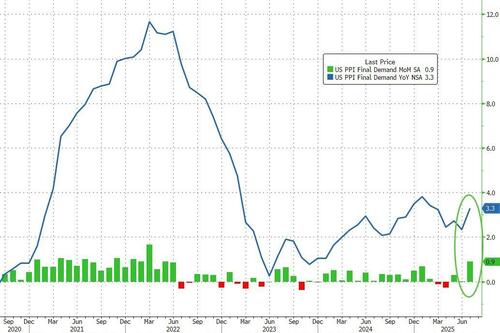

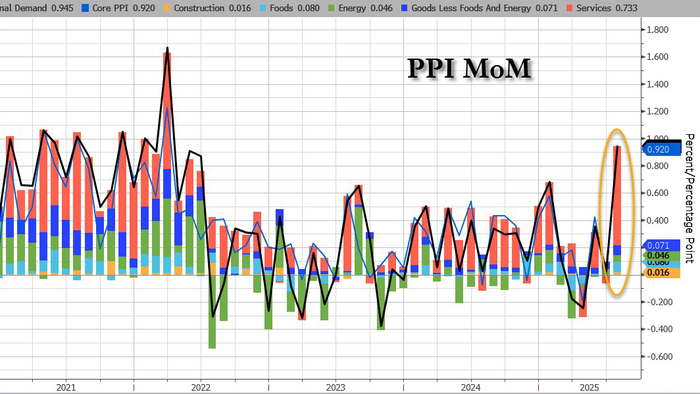

Following the 'mixed' message from CPI earlier in the week (which the market perceived as dovishly cooler than expected), Producer Price Inflation was expected to accelerate in July's data released today.

...and accelerate it did - dramatically with headline PPI rising 0.9% MoM (massively more than the +0.2% expected and the biggest jump since June 2022) sending PPI up 3.3% YoY (highest since Feb 2025)...

Source: Bloomberg

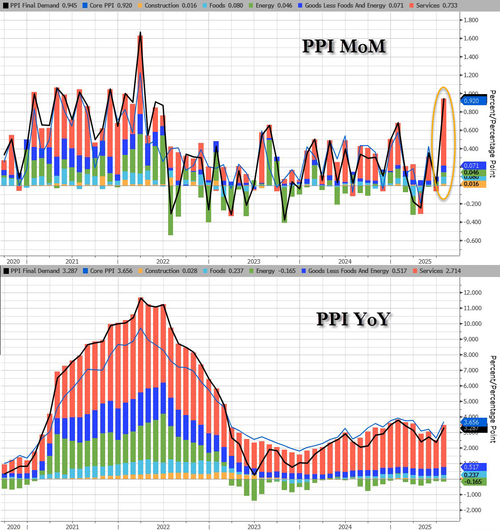

The surge in producer prices was driven almost entirely by Services...

Source: Bloomberg

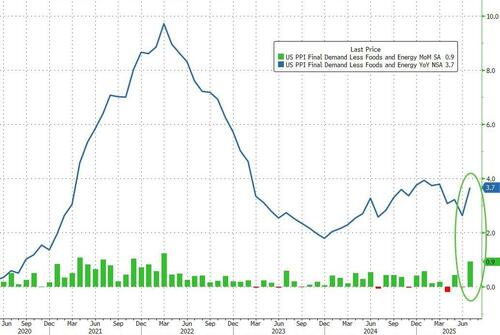

Core PPI also jumped 0.9% MoM (dramatically hotter than expected) with the YoY shift spiking to +3.7%...

Source: Bloomberg

PPI rose 0.9% MoM in July, the biggest increase since March 2022 (after a 0.0% print in June and 0.4% in May). Within final demand, more than three-quarters of the broad-based advance in July can be traced to the index for final demand services, which rose 1.1%. Prices for final demand goods increased 0.7%.

Details:

Final demand services: The index for final demand services moved up 1.1% in July, the largest advance since rising 1.3% in March 2022. Over half of the broad-based July increase is attributable to margins for final demand trade services, which jumped 2.0% (Trade indexes measure changes in margins received by wholesalers and retailers.) Prices for final demand services less trade, transportation, and warehousing and for final demand transportation and warehousing services advanced 0.7 percent and 1.0 percent, respectively.

Final demand goods: Prices for final demand goods moved up 0.7% in July, the largest advance since rising 0.7% in January. Forty percent of the broad-based increase in July can be attributed to the index for final demand foods, which jumped 1.4%. Prices for final demand goods less foods and energy and for final demand energy moved up 0.4% and 0.9% respectively.

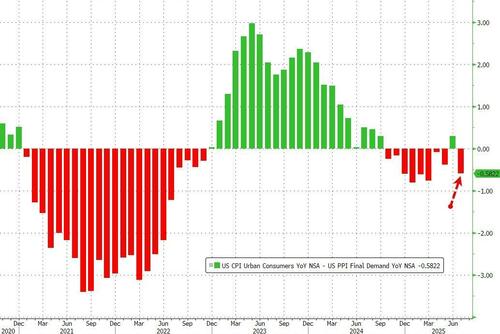

Looking at the PPI detail matters for PCE calculation:

PPI Energy prices are accelerating, tracking the oil price jump (but that will decline next month)...

Source: Bloomberg

Over half of the increase is attributable to margins for final demand trade services, which jumped 2.0% with margin pressure roaring back...

Source: Bloomberg

This implies that companies are eating the higher tariff costs (impacting margins) while end-users are not experiencing much pain.

Will Trump fire the new BLS chief?