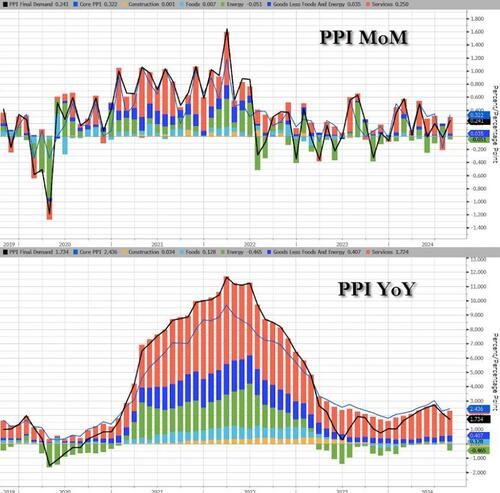

After a mixed (to hotter than expected) CPI, this morning's Producer Prices also surprised to the upside with headline PPI rose 0.2% MoM (vs +0.1% MoM exp). This did push the YoY PPI down to +1.7% (the lowest since Feb)...

Source: Bloomberg

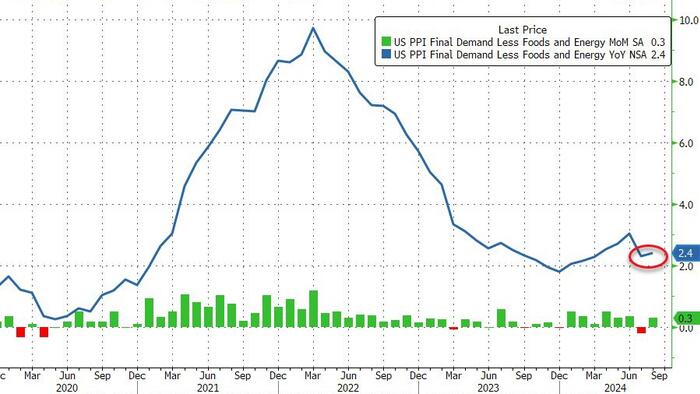

Core PPI rose 0.3% MoM (also hotter than expected) with YoY core PPI re-accelerating...

Source: Bloomberg

Services costs rebounded significantly in August (offset by energy costs deflating)...

Source: Bloomberg

Prices for final demand services rose 0.4 percent in August after declining 0.3 percent in July. Nearly 60 percent of the increase is attributable to a 0.3-percent advance in the index for final demand services less trade, transportation, and warehousing.

Product detail:

Prices for final demand goods were unchanged in August after rising 0.6 percent in July. In August, the indexes for final demand goods less foods and energy and for final demand foods advanced 0.2 percent and 0.1 percent, respectively. In contrast, prices for final demand energy fell 0.9 percent.

Product detail:

One bright spot was that the 'pipeline' for PPI (intermediate demand) slowed notably in August...

Source: Bloomberg

Not a pretty picture for a dovish Fed to defend.