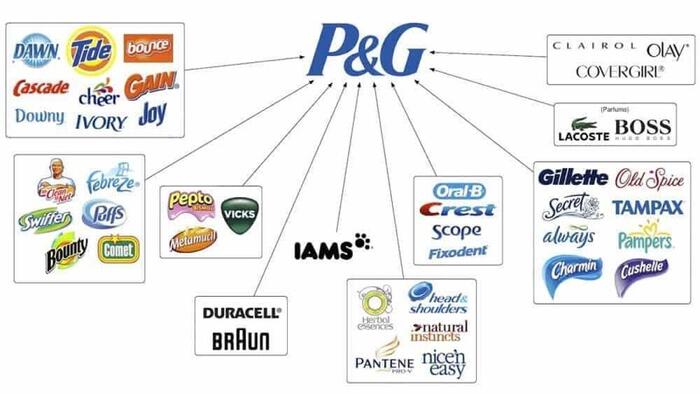

The maker of Bounty paper towels, Dawn dish soap, Pampers diapers, Tide detergent, and Gillette razors—Procter & Gamble—announced a restructuring plan at a Paris-based conference earlier today, revealing plans to slash upwards of 7,000 jobs, or about 15% of its global non-manufacturing workforce over the next two years. The move comes amid uneven consumer demand and a challenging macro environment, exacerbated by ongoing tariff uncertainty.

P&G executives, speaking at the Deutsche Bank Consumer Conference in Paris, announced plans to reduce the company's non-manufacturing workforce by 15% while also unveiling efforts to streamline its product portfolio by exiting certain categories and divesting in smaller brands, according to a Financial Times report.

After the two-year restructuring plan is completed, Bloomberg data show that P&G's total workforce levels will return to 2018 levels, around 100,000.

"This is not a new approach, rather an intentional acceleration of the current strategy...to win in the increasingly challenging environment in which we compete," executives told the audience at the conference.

CFO Andre Schulten stated that the restructuring will begin in the second half of the year, involving the streamlining of management teams and the adoption of more AI and automation.

The restructuring plan follows P&G's April earnings report, which showed a decline in quarterly sales and a lowered full-year forecast, as the company cited growing consumer uncertainty and ongoing tariff pressures.

RBC Capital Markets analyst Nik Modi told clients after P&G's April earnings that "the majority of consumer staples companies to cut their earnings forecasts significantly ... investors are looking for visibility and can't find it in the most visible of sectors like consumer staples."

In markets, P&G shares are -1% year-to-date in New York. Zooming out to a five-year timeframe reveals choppy trading, with the stock oscillating between a $160 floor and a $180 ceiling since mid-2024.

If some of P&G's brands hadn't alienated their core male customer base with years of toxic woke advertising, the company likely wouldn't be shedding thousands of jobs.