Goldman Sachs' view in recent months has been that the market could probably continue to climb the “wall of worry”.

However, their baseline forecast is still quite benign - with growth recovering in 2026 and the Fed pushing the policy rate steadily lower in the coming months.

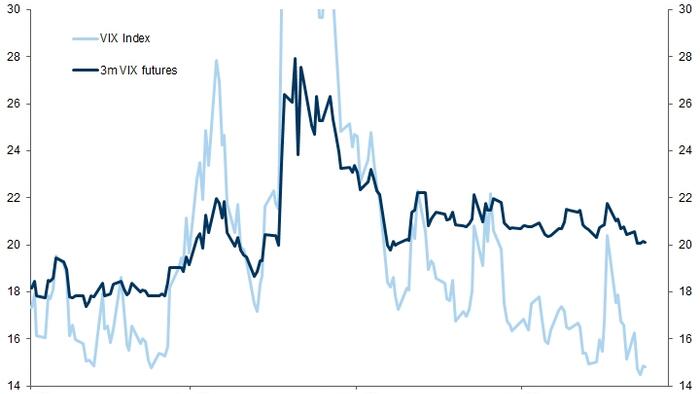

There are pockets of frothiness across assets and the spot VIX is close to the lowest levels of the year.

But, as Goldman's Dominic Wilson highlights below, 3-month VIX futures remain above 20 and the high spread to spot VIX suggests that there may still be risk premium to squeeze out in places if we simply avoid new problems.

The VIX is approaching the year's lows, but VIX futures have been stickier, implying lingering risk premium

Source: Goldman Sachs

As the market has taken more credit for good news, however, it is getting harder to identify clear new macro tailwinds.

We think growth pricing has largely taken credit for the nearly 2% GDP growth we see through 2026 and beyond.

And while we thought the more likely macro tailwind for US equities would come from a dovish policy shift, the market has now moved in that direction too.

The big macro risk is if there is a challenge to the process of looking through spot weakness that makes the market worry more about recession risk.

Markets were quick to move from worrying about growth to welcoming Fed easing on the back of payrolls weakness.

If that move coincides with higher-than-expected inflation outcomes, concerns about a constrained Fed would be an even bigger challenge.

The good news is that short-dated equity hedges and downside in front-end rates are cheaper than they have been for some time, so we continue to think hedging that recession risk into key events makes sens

Professional subscribers can read Dominic Wilson's full detailed note here...