Komeito, the long-standing political partner of Japan's powerful Liberal Democratic Party, shocked Japan watchers on Friday when it said it was withdrawing from the ruling coalition following last weekend's election of Sanae Takaichi as the LDP's leader, citing policy differences on tightening political fundraising rules.

Komeito leader Tetsuo Saito told Takaichi of the party's decision at a meeting in parliament. "We are scrapping the coalition agreement with the LDP and bringing an end to our relationship," Saito said at a news conference after the meeting, saying the LDP had failed to work with his party to deal with political funding issues.

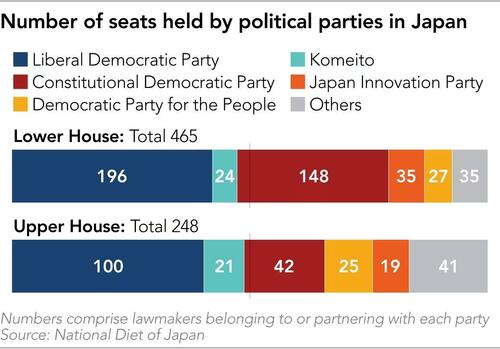

According to the Nikkei, the exit of its ally is a major blow to Takaichi and the LDP, which already lacks a majority in both houses of the parliament, although it remains the largest party.

For Takaichi to become Japan's first female prime minister, she must be appointed by the Diet, Japan's parliament. But Saito said Komeito will not vote for Takaichi in the Diet session to choose the country's new leader. "We cannot write the name of Sanae Takaichi in a vote for a new prime minister," he said. Instead, the party's lawmakers will vote for Saito.

He denied a confidence and supply agreement with the LDP, in which a party supports others for crucial decision-making in parliament.

Takaichi said after the meeting: "We were unilaterally informed by Komeito of its withdrawal from the coalition government." She said Komeito brought its proposal for strengthening regulations on corporate and group donations, and asked Takaichi to decide whether or not to accept it on the spot. She said she told Saito that she needed to consult with other LDP officials. Takaichi quoted Komeito leaders as saying, "That's not a concrete enough answer."

"The LDP has always said that they would consider [Komeito's proposal]," said Saito. "They have been saying for a year that they must listen to the opinions of local assembly members, yet the reality is that nothing has been done."

Komeito's withdrawal increases the chances that opposition parties will unite around an alternative candidate.

"Understanding among parties is deepening," Yoshihiko Noda, president of the main opposition Constitutional Democratic Party of Japan (CDP), told reporters on Friday. "We want to call carefully for a united front."

Jun Azumi, secretary-general of the CDP, on Wednesday said in a meeting with his counterpart from the Democratic Party for the People (DPFP) that DPFP leader Yuichiro Tamaki is a "strong candidate" to represent a unified opposition.

"The possibility of a change in government has certainly emerged," Azumi said after the ruling coalition's split. "I would very much like to hear the opinions of Komeito and engage in an exchange of views."

Still, as Nikkei notes, it is unclear whether the opposition parties can coordinate their policies. "I'm prepared to serve as prime minister," DPFP's Tamaki posted on X on Friday. He added, "We urge the CDP to conduct internal coordination and make institutional decisions to ensure its members can act in unity and solidarity with the DPFP's policies."

For those wondering how to trade this, Goldman's Takayuki Ishibashi has written up his thoughts on the shock development as well as the market implications (full note here). We excerpt below:

This week's Japanese political headlines were complex, even for citizens, making their intricacies challenging to grasp. Let me offer my/our interpretation as a reference.

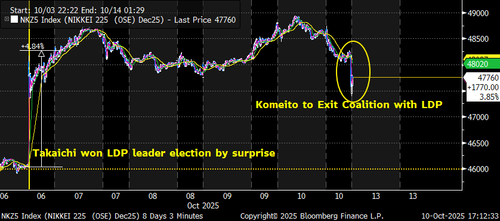

The week began with the October 4 LDP leadership race, where Sanae Takaichi delivered a surprise victory, contrary to market predictions favoring Koizumi. This, alongside Ishiba’s September 2024 win, underscores the LDP’s opaque internal power dynamics, often misread by seasoned observers. The market reacted swiftly and forcefully; with the Nikkei already at all-time highs, Monday saw a 4.8% surge, the fourth-largest point gain on record, mirroring the 4.8% drawdown after Ishiba’s victory a year prior.

However, the political landscape remains tricky. While the LDP presidency usually translates into the premiership, the LDP–Komeito bloc no longer commands an outright majority, having lost it in both the 2024 general election and the 2025 House of Councillors election. This leaves two challenging paths: securing issue-by-issue opposition support or forming a broader coalition. The fiscally expansionary Democratic Party for the People (DPP) under Tamaki was seen as a workable partner for a Takaichi cabinet. However, Komeito bristled at Takaichi’s hard-right posture, hinting at withdrawal from their two-decade alliance and tightening her political room. A tail risk exists if opposition parties coalesce behind Tamaki for the premiership in the Diet’s designation vote.

The overall setup remains tricky. Our Government Affairs lead, Ueki, suggests LDP Vice President Taro Aso, 85, played a kingmaker role in the leadership race. His substantial behind the scenes influence argues against sweeping changes and large scale fiscal expansion the market may anticipate.

As of this writing, Komeito officially announced its withdrawal from the coalition government, as reported by NHK. This headline, released after the close of Japanese cash equities, triggered a panic-driven Nikkei futures sell-off of 130 basis points, a reaction deemed excessive. Other assets, including JGB futures and the Yen, reacted more moderately with slight rebounds.

What happens next?

The immediate next step in Japanese politics is the appointment of a new prime minister, now anticipated to be delayed until October 20 or later. This follows the withdrawal of Komeito from its coalition with the Liberal Democratic Party (LDP). The prime minister is chosen through a multi-round vote in both the House of Representatives and the House of Councillors. In the initial round, each party is expected to vote for its own leader, including Komeito, making it unlikely any candidate will secure a majority. This will lead to a run-off vote, most likely between LDP President Sanae Takaichi and Constitutional Democratic Party (CDP) leader Yoshihiko Noda, based on their parties' seat counts. Despite the need for opposition cooperation in a minority government, the current lack of unity among opposition parties suggests that Sanae Takaichi is poised to be nominated as prime minister in both houses due to the LDP's numerical strength. Takaichi's victory in the LDP leadership election has already influenced markets, with analysts predicting short-term yen selling. She is expected to become Japan's first female prime minister.

Markets often initially underestimate significant regime shifts.

For instance, during the first six months of Abenomics (November 2012-May 2013), foreign investors were the dominant net buyers of Japanese equities, contributing +¥10 trillion.In contrast, corporates were flat, financial institutions sold -¥5.5 trillion, and retail investors were net sellers of cash equities by -¥5 trillion, though they bought via margin accounts. This suggested short-term players capitalized on the rally, while long-term individual holders sold legacy positions at breakeven.

Looking at the post-Takaichi flow picture for 2025, the dynamics differ. Governance-reformed Japan expects corporates to be steady net buyers, around +¥1 trillion monthly or +¥6 trillion over six months. Retail supply appears contained, even after recent market surges. The retail psyche has shifted, with fewer underwater positions and more day-trader behavior, making a repeat of the -¥5 trillion household net sell unlikely, especially with the introduction of the new NISA program in 2024 boosting investments in risk assets. While financial institutions might again be net sellers into strength, the improved corporate and household buying means foreigners don't need to deploy another ¥10 trillion to sustain upside momentum. Unlike 2013's weaker balance sheets and frequent primary issuance, today's buybacks have made Japan a net "share-shrinking" market, retiring over 1% of market cap annually, providing a mechanical tailwind similar to the U.S.

Finally, here are some chart highlights:

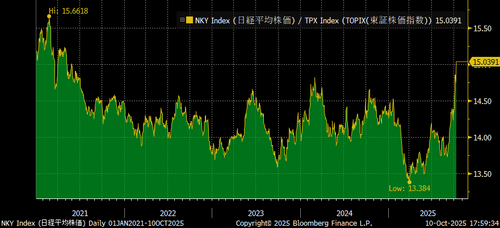

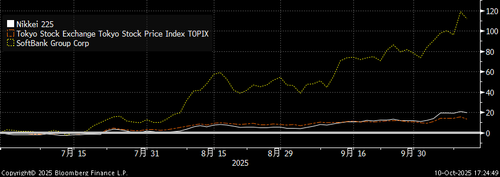

Nikkei vs. TOPIX: The movement of the Nikkei 225 and TOPIX over the past month has been quite significant within their 5-year ranges.

SoftBank Group (SBG): Physical AI became this week's theme, driven by SBG's Stargate initiative with OpenAI and its acquisition of ABB's robotics division. SoftBank's stock price has more than doubled over the past year. This surge in SBG's stock is one of the driving forces behind the movements observed in the Nikkei vs TOPIX.

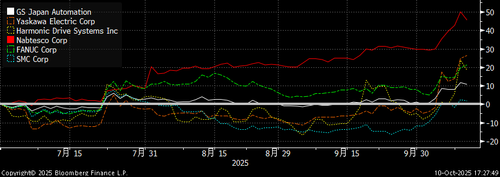

GSXAJATO: This refers to a basket of Japanese Physical AI-related stocks, including Yaskawa, HDS, Nabtesco, Fanuc, and SMC.

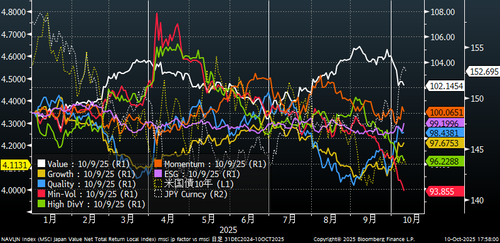

Japanese Stock Factor Returns: There appears to be a trend reversal in factor returns for Japanese stocks on a quarterly basis. This raises the question of what the next quarter will bring.

More in the full note available to pro subs.