After rallying to multi-year highs in June, the preliminary July print for S&P Global's US Manufacturing PMI tumbled to 49.5 - its lowest level of the year.

At the same time, US Services soared to 55.2 - its highest since Dec 2024

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

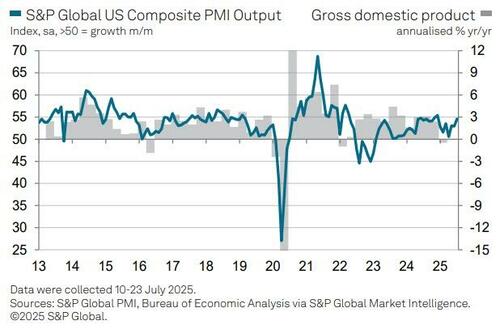

“The flash PMI data indicated that the US economy grew at a sharply increased rate at the start of the third quarter, consistent with the economy expanding at a 2.3% annualized rate. That represents a marked improvement on the 1.3% rate signalled by the survey for the second quarter.

“Whether this growth can be sustained is by no means assured," says Williamson:

"Growth was worryingly uneven and overly reliant on the services economy as manufacturing business conditions deteriorated for the first time this year, the latter linked to a fading boost from tariff front-running.

“Business confidence about the year ahead has also deteriorated in both manufacturing and services to one of the lowest levels seen over the past two-and-a-half years.

Companies cite ongoing concerns over the impact of government policies, notably in terms of both tariffs and cuts to federal spending.

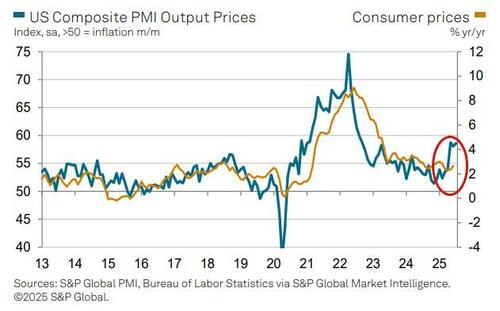

Inflation pressures have meanwhile intensified.

"Companies most commonly attributed higher costs and selling prices to tariffs, though increased labour costs are also prevalent, in part reflecting labor shortages.

“The rise in selling prices for goods and services in July, which was one of the largest seen over the past three years, suggests that consumer price inflation will rise further above the Federal Reserve’s 2% target in the coming months as these price hikes feed through to households.”

So, strong growth but strong inflation... but in the manufacturing sector it looks like stagflation is growing stronger.