Authored by Peter Tchir via Academy Securities,

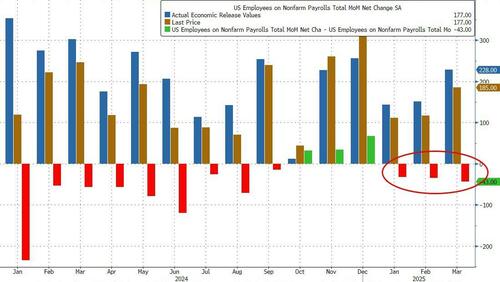

The headline data for NFP was much stronger than expected at 177k.

That doesn’t match well with JOLTS which has been indicating weaker conditions (and it is an extra month behind), and it doesn’t tie in with ADP which was a very weak 62k.

Downward revisions of 58k take some of the umph out of the report.

The Household part of the survey (which drives the Unemployment rate) added 305k Full-time jobs and 56k in Part-time jobs (which helped the underemployment rate drop to 7.8% from 7.9%). The unemployment rate of 4.2%, while unchanged, is impressive as the labor force increased by 0.1% to 62.6%.

It was also encouraging that hourly earnings came in a 0.2% for the month (healthy but not inflationary) and hours worked, often a precursor for more hiring, was 34.3 hours this month and was revised up to that figure for last month as well.

The Birth/Death model accounted for 393,000 jobs!

Apparently, in the face of economic uncertainty, a lot of new businesses were started?

That was the biggest number since 2023! The prior 5 months had averaged -10k.

It is a bit “disturbing” (to me) that a number that is derived from estimations plays such an outsized role in the report.

126,000 professional/business services jobs were created? I guess a lot of people set up businesses to help with taxes?

What are the odds that a lot of people signed up EIN’s (Employer Identification Number) so they could do something in the gig economy?

I am highly suspicious of the accuracy of this number, but, unfortunately, policy makers seem to take it at face value, only to ignore it, when it is eventually reduced significantly, during annual or quarterly reviews.

Weirdly, I see some risks from this report.

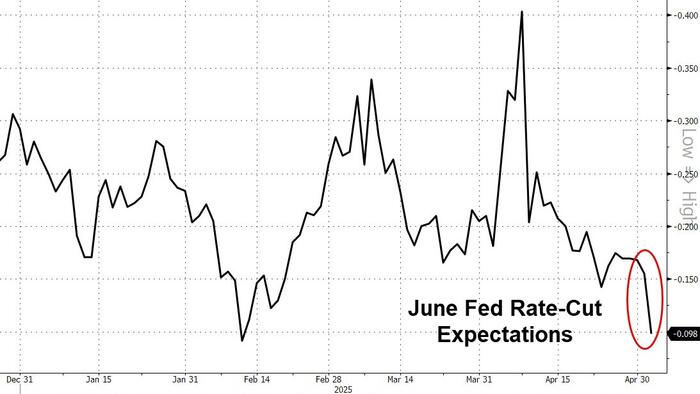

Not good for bonds, pushes the Fed put further away... [ZH: June rate-cut expectations plunged]

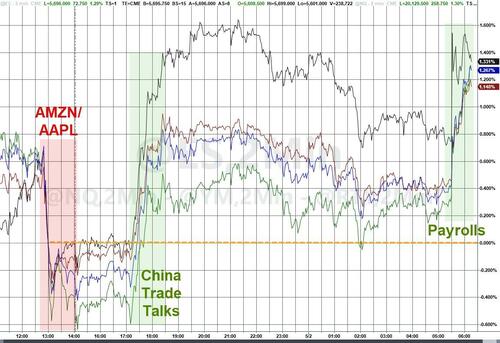

Should be decent for risk, but risk will remain primarily driven by tariffs, trade deals and the big spending bill...

...all of which will determine the direction of the economy for months or even years.