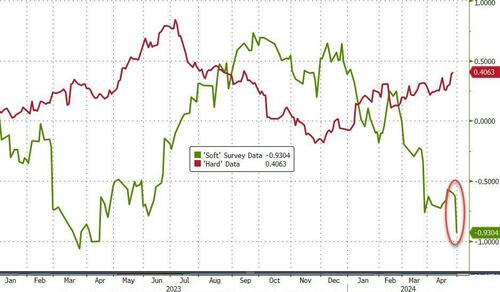

It has been a terrible day for 'soft' survey data...

Source: Bloomberg

And it was just capped off by a big drop in Dallas Fed's Services survey (which compliments yesterday's Dallas Fed Manufacturing meltdown). The headline print dropped from -5.5 to -10.6. That is the 23rd straight month of contraction in the survey (one more month equals the span of contraction around Lehman's collapse)...

Looking ahead, the picture was an ugly stagflationary one with revenue expected to grow slower and prices expected to rise faster...

With General Business Activity expected to decline (the first time since Nov 2023)...

But, just like the Manufacturing survey, it is the respondents answers that tell us the most about what is really occurring in America...

Inflationary pain...

Political and geopolitical Uncertainty is weighing on many firms:

Too much regulation...

Rates are too damn high...

And finally, there's panic in the air...

But, but, but... "Bidenomics!"