The Fed's latest beige book released this afternoon was a rather boring affair, one signaling US economic growth was "modest" during July and August.

What was most interesting within this drab big picture, was the divergence within consumer spending, where according to the Beige Book, "consumer spending on tourism was stronger than expected, surging during what most contacts considered the last stage of pent-up demand for leisure travel from the pandemic era." But, it's the other side of the equation that was more concerning, as the Fed found that "other retail spending continued to slow, especially on non-essential items."

And the punchline: "some Districts highlighted reports suggesting consumers may have exhausted their savings and are relying more on borrowing to support spending." Bingo: this is precisely what we said last week in "US Consumers Paid For July Spending Spree By Burning Through $150BN In Savings", and while the Fed is right that households have burned though savings, it is wrong that they have borrowing capacity to support spending: as we showed last month, households paid down credit card debt for the first time since the covid crash, a clear sign that US consumers are now hunkering down.

Here are some other details from the latest Beige Book:

Turning to labor markets, the Beige Book noted that "job growth was subdued across the nation. Though hiring slowed, most Districts indicated imbalances persisted in the labor market as the availability of skilled workers and the number of applicants remained constrained. Worker retention improved in several Districts, but only in certain sectors such as manufacturing and transportation." And the clearest sign yet that the wage party is over, "many contacts suggested “the second half of the year will be different” when describing wage growth." For now, however, growth in labor cost pressures was elevated in most Districts (thanks to Biden's explicit greenlighting of Labor union demands for double digit wage increases) often exceeding expectations during the first half of the year. "But nearly all Districts indicated businesses renewed their previously unfulfilled expectations that wage growth will slow broadly in the near term."

Turning to prices, most Districts reported price growth slowed overall, decelerating faster in manufacturing and consumer-goods sectors. However, and as discussed here previously, "several Districts highlighted sharp increases in property insurance costs during the past few months."

The worst news however is that the profit margin expansion is over as "contacts in several Districts indicated input price growth slowed less than selling prices, as businesses struggled to pass along cost pressures. As a result, profit margins reportedly fell in several Districts."

Turning to the specific regional Feds, we found these summaries notable:

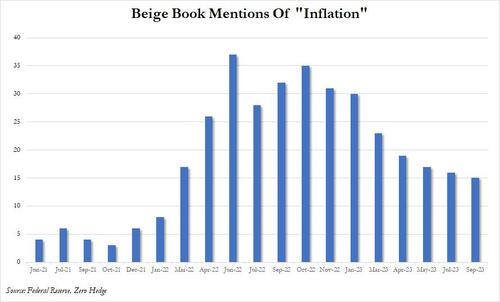

Finally, taking a visual approach to the data, we find that the mentions of inflation were the fewest since Jan 2022...

... although the chart above correlates perfectly, if with a 3 month lag, to the price of oil. So expect a jump in inflation mentions next month when the Beige Book participants realize that crude oil is at 2023 highs.

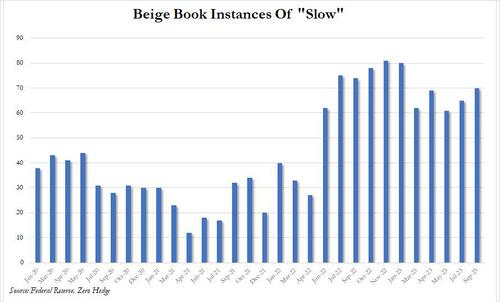

And while mentions of "slow" persisted at a far higher rate...

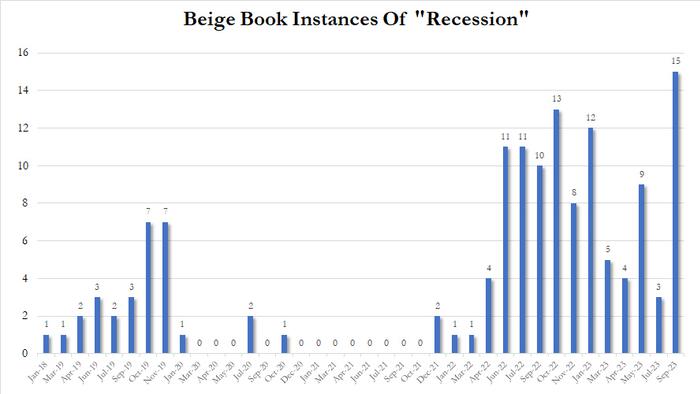

... what we found most interesting is that mentions of recession jumped to the highest level since at least 2018. Granted, some were in a favorable context, but the fact that there have been so many mentions of a word which as recently as 2020 and 2021 barely existed in the Beige Book vocabulary, tells you all you need to know about what the Fed is most worried about today.

More in the full Beige Book (link).