Oil dipped modestly, extending its two-day slide, after the latest DOE data showed another weekly increase across most oil products, even as expectations were for continued declines.

The 1.79-million-barrel build in commercial crude stockpiles contrasts with the 3.7-million-barrel draw seen by the API on Tuesday.

Following draws in the past two weeks, crude, gasoline and distillate inventories were expected to post another modest drop, but the official data showed an increase across all three products.

Increases in crude, gasoline and propane are enough to push total crude and product inventories higher versus last week. It’s the fourth overall build in the last five weeks and the largest weekly increase since early September.

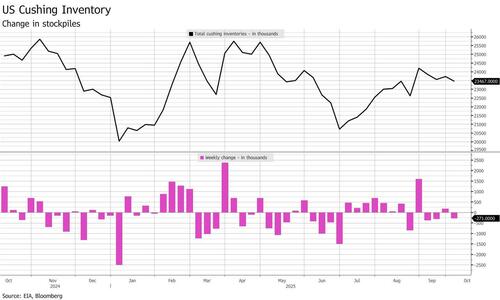

Meanwhile, crude inventories at Cushing, Oklahoma fell to around 23.5 million barrels. It’s the third draw at the hub in four weeks, bringing levels to the lowest since late August.

Some other notable weekly changes:

The build in commercial stockpiles was boosted by another 742,000 barrels injected into the SPR. That increased the overall nationwide crude build to 2.53 million barrels in the week to Sep. 26.

Crude exports fell below 4 million barrels a day, which brings them to the lowest in about one month. More barrels staying put might have helped relieve a bit of downward pressure on US inventories, which rose to the highest since early September.

According to BBG, a decline in Gulf Coast crude refinery runs pulled down the overall US number to 16.2 million barrels a day, the lowest level since May. That was most likely due to the turnaround at Marathon’s Garyville plant in Louisiana, one of the largest refineries in the nation. Overall US crude runs are still at the highest seasonal level since 2018.

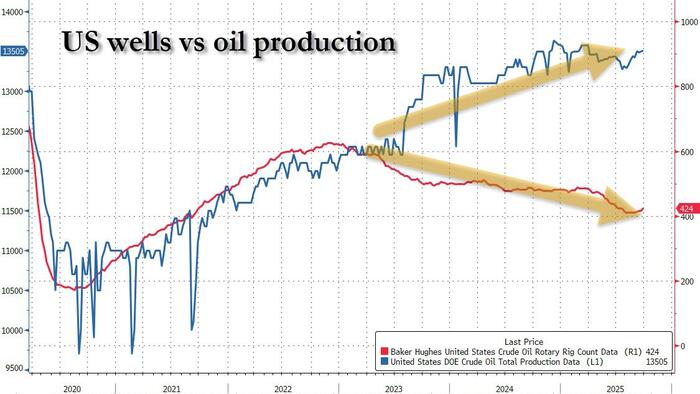

Meanwhile, US production continued its relentless weekly increase, rising by another 4k barrels/day on the week, back near record highs, even as rig counts remain near 4 year lows. Indeed, total crude production edged higher to 13.5 million barrels a day last week, the highest since March. The small increase came as the number of rigs drilling for oil rose for a fifth straight week, with six units put into operation last week, according to Baker Hughes. At some point there will be questions about all the toxic water flowing out of Permian wells which is allowing productivity to approach 100%, but not yet...

Oil prices recovered some of their losses, having plunged from their Friday highs (oil had just closed its best week since the Iran-Israel conflict) and sinking to the lowest level since June as CTAs are now back aggressively shorting the price as long as momentum remains lower.

Finally, Bloomberg reports that US gasoline demand continues to pull back, recording a fourth consecutive decline last week based on the four-week average of product supplied. The figure is down 351,000 barrels a day over the stretch and brings the figure to a six-month low. That said, demand is still closely tracking year-ago levels and is still firmly above where it sat this week in 2023. If that trend continues, we could see a solid bounce back in the next few weeks.