We have repeatedly said that the UMichigan survey - skewed ridiculously higher by the laughably outlier opinions of Democrats...

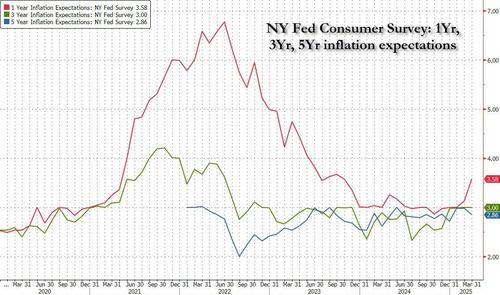

... has become a politicized farce (one overseen by rabid marxist professors with TDS such as Justin Wolfers, who at $600K per year, is rather generously overpaid for a communist). Moments ago the latest NY Fed Consumer Expectations Survey confirmed as much, when it not only reported that 5Y inflation expectations declined to 2.9% from 3.0%, the lowest since January...

... but that 3Y inflation expectations were unchanged and 1Y inflation expectations rose to 3.6% from 3.1%.

Not surprisingly, two-year yields promptly fell to session lows after the inflation data hit the tape, because the NY Fed survey now openly contradicts UMich as one-year inflation expectations - which rose to 3.6% in March, the highest since September 2023 - remained far, far lower than the Democrat-skewed 6.7% preliminary print for the April UMich report.

But even more importantly, expectations on a longer, five-year horizon have slid to 2.9% in the New York Fed survey. That makes the UMich survey, or rather the folks it polls, look literally retarded and will promptly reverse any ludicrous jitters that inflation expectations are getting unanchored on Main Street.

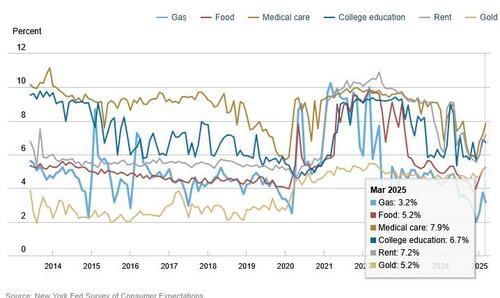

Some more highlights from the inflation panel:

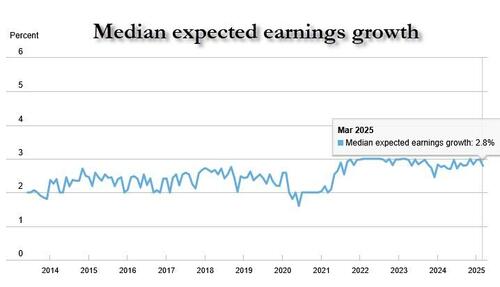

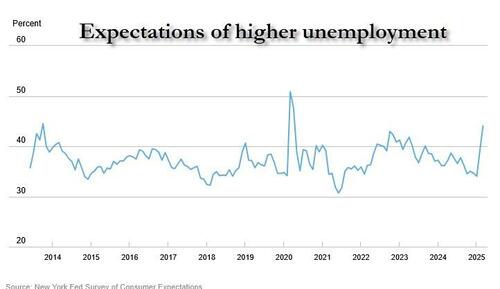

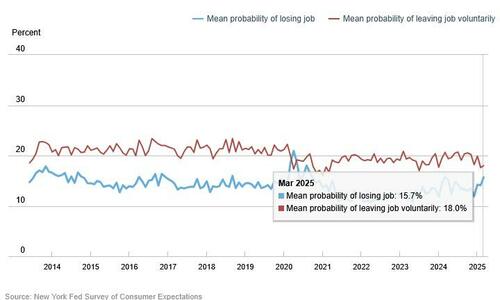

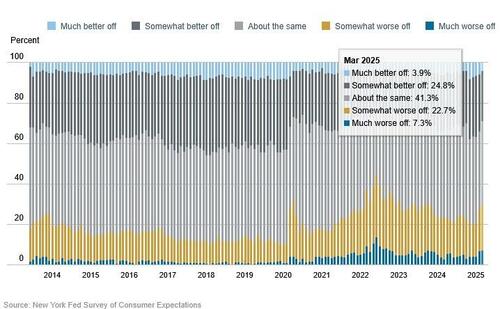

While the NY Fed data greatly reduced stagflationary concerns, it did underscore the threat of looming economic slowdown and an outright recession, to wit: unemployment, job loss, and earnings growth expectations deteriorated, while household income growth expectations declined. Households were also more pessimistic about their year-ahead financial situations and credit access. Finally, stock price expectations declined and reached the lowest level since June 2022.

First, looking at the labor market:

Turning from the labor market to household finances, things go from bad to worse:

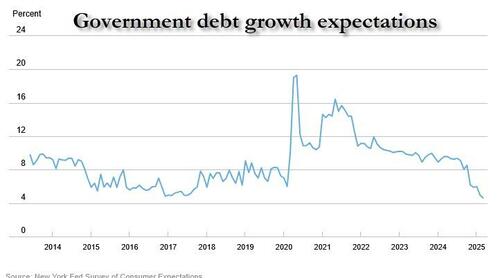

Last but not least, the latest confirmation that DOGE is working:

More in the full NY Fed survey available here.