It's now officially the "most important stock on planet earth", and thus everyone was watching what Nvidia would report after the close, with option markets expecting a 10% swing (a $200 billion delta) after hours. And while many were hoping that the company to continue its relentless meltup ways, Goldman's trading desk was less euphoric with TMT specialist Peter Callahan warning overnight that there is "plenty of tactical debate whether this print will be a local top or a ‘break-out’ moment for the stock and for the A.I. trade (from my seat, feels like consensus is learning more towards the former).

In retrospect he may have been right because even though NVDA reported stellar Q4 results, they may not have been stellar enough and the stock is now sliding after hours.

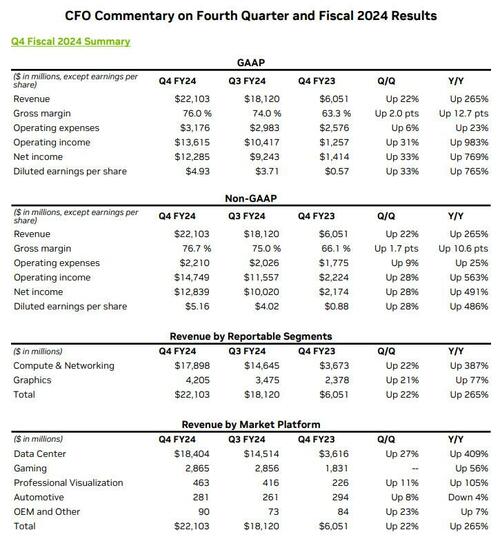

Here is what NVDA reported for Q4 earnings:

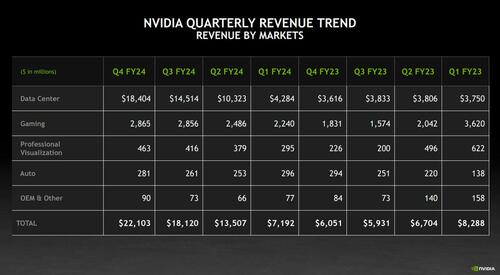

Some more details on the revenue breakdown

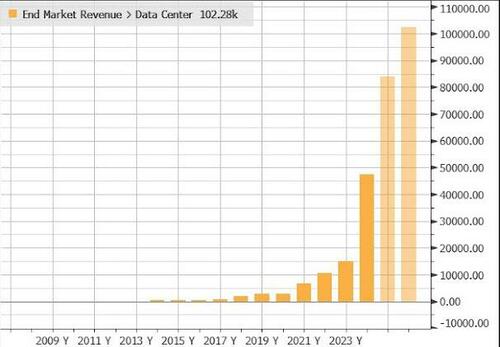

The chart below shows all you need to know about the company's main revenue driver

Going down the line:

Gross Margin:

Expenses:

The financial results in a nutshell:

Commenting on the results, CEO Jensen Huang said that “accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations." He added that “our Data Center platform is powered by increasingly diverse drivers — demand for data processing, training and inference from large cloud-service providers and GPU-specialized ones, as well as from enterprise software and consumer internet companies. Vertical industries — led by auto, financial services and healthcare — are now at a multibillion-dollar level.

“NVIDIA RTX, introduced less than six years ago, is now a massive PC platform for generative AI, enjoyed by 100 million gamers and creators. The year ahead will bring major new product cycles with exceptional innovations to help propel our industry forward. Come join us at next month’s GTC, where we and our rich ecosystem will reveal the exciting future ahead."

And while the Q4 results were stellar, it was once again the company's guidance that blew away investors - even if it did take algos a few minutes to process it - and send the stock sharply higher after hours.

Unlike two quarters ago, when the company announced a $25BN stock buybacks, there was no such kicker this time, although judging by the market's reaction the company probably won't be need to repurchase shares any time soon. NVDA reported that at the end of the year, cash and cash equivalents were $26.0 billion, up from $13.3 billion a year ago and $18.3 billion a quarter ago. The increases primarily reflect higher revenue partially offset by taxes paid and stock repurchases.

In response to the stunning earnings, NVDA stock first dumped - perhaps as the company's guidance missed the whisper number of $25 billion and also disappointed on the gross margin guidance, but then reversed all losses and ended up spiking about 9% after hours. But since option straddles were pricing in a 10% move in either direction, tomorrow a whole lot of put and call buyers will be left very disappointed when they see the value of their options vaporize.