It's probably safe to say that more were paying attention to today's earnings report from Nvidia than some/all of the other giga caps (which were uniformly solid and beat expectations), if for no other reason than NVDA is viewed as the primary enabler of the current AI-craze which as noted before is solely responsible for all stock market gains in 2023.

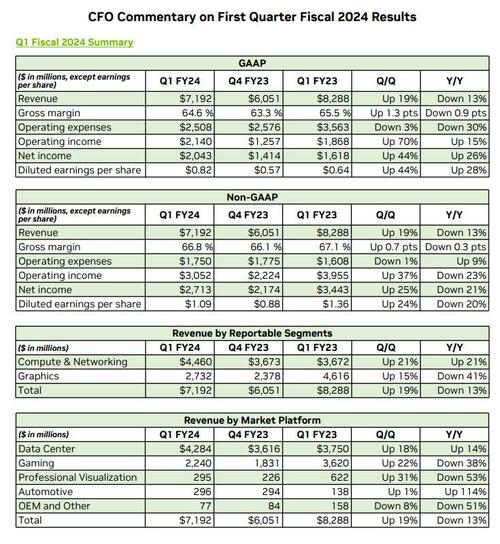

And boy were they not disappointed, because moments ago NVDA reported earnings that blew away expectations and also guided some 50% above Wall Street's forecast! Here is how the company did in Q1:

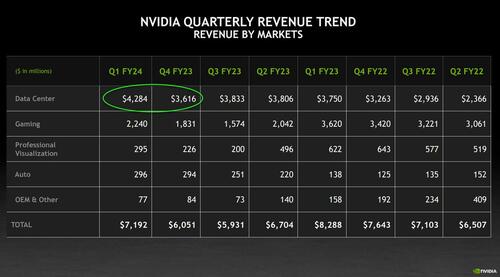

Some more details on the revenue breakdown:

Commenting on the results, CEO Jensen Huang said that “The computer industry is going through two simultaneous transitions — accelerated computing and generative AI,” adding that “A trillion dollars of installed global data center infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process."

“Our entire data center family of products — H100, Grace CPU, Grace Hopper Superchip, NVLink, Quantum 400 InfiniBand and BlueField-3 DPU — is in production. We are significantly increasing our supply to meet surging demand for them,” he said.

But while the results were impressive, it was the company's guidance that blew away investors, as the company now expects Q2 revenues of $11 billion (plus or minus 2%) more than 50% above Wall Street's estimate of $7.1 billion.

Other Q2 guidance:

In response to the stunning earnings, NVDA stock is up 17% after hours, adding $150 billion in market cap after hours, and has just hit a fresh all time high of $364...

... sending it to a new all time high, with its market cap on the verge of surpassing $1 trillion.