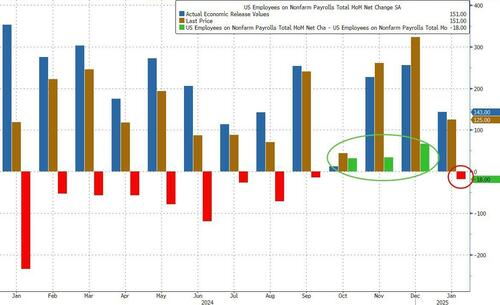

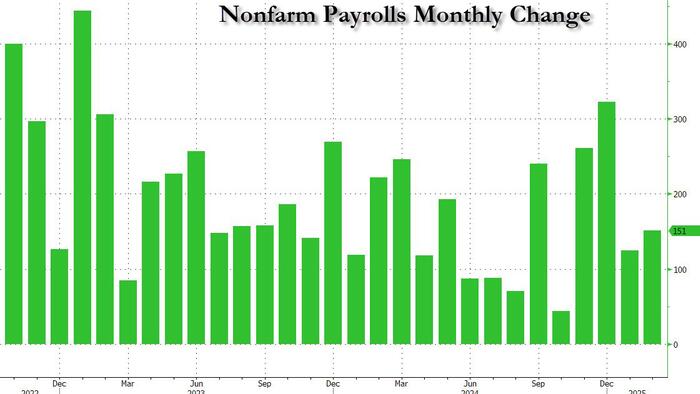

In our payrolls preview we said that contrary to whisper expectations of a 122K number, and even more widespread mumbled expectations of a negative print, the actual February number would "not be as bad as feared" (contrary to last month when we correctly warned the number would be a disaster), and sure enough moments ago the BLS reported that in February the US added 151K jobs, up from the (downward revised) 125K in January, just below the consensus estimate and well above the whisper number.

The change in total nonfarm payroll employment for December was revised up by 16,000, from +307,000 to +323,000, and the change for January was revised down by 18,000, from +143,000 to +125,000. With these revisions, employment in December and January combined is 2,000 lower than previously reported.

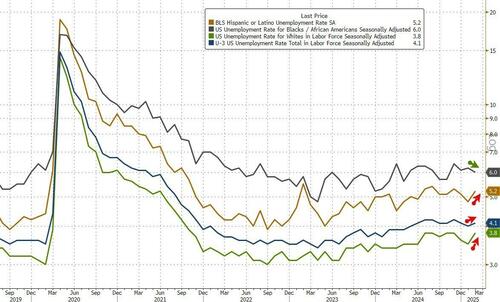

The unemployment rate rose to 4.1%, from 4.0% in January, just above the consensus estimate of 4.0% as the number of unemployed people, at 7.1 million, was little changed little in February. The unemployment rate has remained in a narrow range of 4.0 percent to 4.2 percent since May 2024. Among the major worker groups, the unemployment rate for Whites (3.8%) increased in February. The jobless rates for adult men (3.8%), adult women (3.8%), teenagers (12.9%), Blacks (6.0%), Asians (3.2%), and Hispanics (5.2%) showed little change over the month.

More notably, the Underemployment rate jumped to 8%, its highest level since October 2021, as household employment dropped by 588k as noted above. As RJ Obrien's John Brady notes, "the jump in broad unemployment is pretty noteworthy."

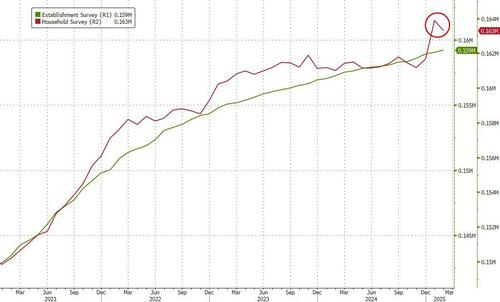

Looking at the household survey, the number of employed workers dropped by 588K after soaring in January; the number of unemployed workers rose by 203K from 6.849MM to 7.052MM.

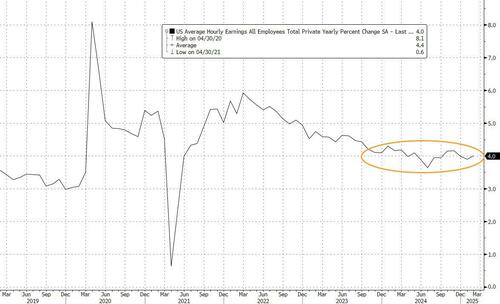

Average hourly earnings for all employees on private nonfarm payrolls rose by 10 cents, or 0.3%, to $35.93, in line with estimates. Over the past 12 months, average hourly earnings have increased by 4.0%, below the 4.1% expected. In February, average hourly earnings of private-sector production and nonsupervisory employees rose by 9 cents, or 0.3 percent, to $30.89. In February, the average workweek for all employees on private nonfarm payrolls was unchanged at 34.1 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls was unchanged at 33.6 hours.

Some more details from the report:

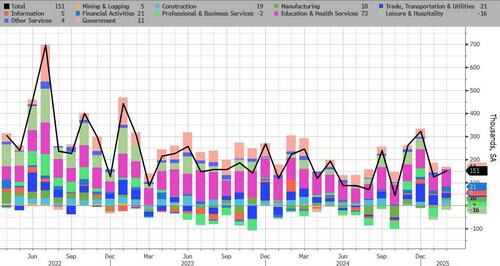

Digging deeper we find that manufacturing jobs, a closely tracked category, increased by 10K, the first increase since November.

Here is the full breakdown of jobs by sector:

And visually:

Commenting on the report, Lindsay Rosner, head of multisector fixed income investing at Goldman Sachs Asset Management, weighs in:

“To sum it up: Today’s print wasn’t as bad as feared. The payrolls growth surprised slightly to the downside and the unemployment rate ticked up, justifying the momentum that’s been building for a resumption in the Fed’s cutting cycle.”

Others such as Adam Crisafulli of Vital Knowledge, agreed, saying nothing in the report really changes their view on the world.

“Growth is still slowing (at the least), Washington remains a huge source of uncertainty (Trump’s pain threshold is high, and 151K def. doesn’t surpass it), and the Fed isn’t coming to the rescue (the market is already pricing in 75bp of cuts vs. the dot plot guidance of 50bp – even if Powell blesses the former number, that won’t come close to offsetting tariffs).”

As Bloomberg's Enda Curran summarizes, "this set of data has an "as you were" feeling to it. The numbers were broadly as expected, perhaps some hints of softening (in, say, labor force participation) but otherwise the numbers are in line. However, we know the fast-moving events of recent weeks won’t have been captured in February’s data. The real test for how public spending cuts, federal government layoffs and the impact of tariffs will become clearer in the months ahead."