Authored by Mike Shedlock via MishTalk.com,

The more you think you really need a loan, the less likely you are to get one, especially auto loans...

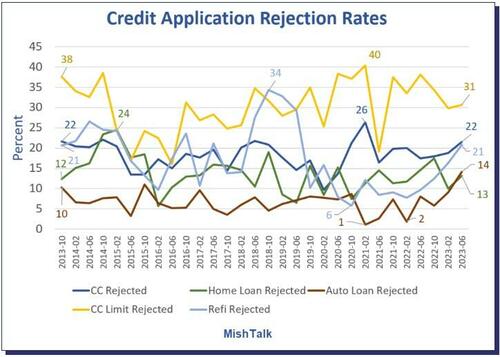

Data from New York Fed Survey of Consumers, chart by Mish

New York Fed Credit Access Survey report comes out every for months. The June report shows significant tightening of credit standards by lenders and less demand for loans by consumers.

Count data from New York Fed Survey of Consumers, rejection percent calculation and chart by Mish

Some of the decline in applications is due to declining observations. But the percentages tell the story.

Among survey respondents, the auto loan rejection rates was 2 percent in February of 2022. It’s jumped to over 14 percent as of June 2023. And that is with an application rate decline of 12 percent.

In short, fewer people want auto loans, but of those who do, rejection rates are soaring.

ZeroHedge noted Credit Scores Abruptly Plunge As Americans Stop Paying Down Debt; Synchrony Financial Warns

“What we are seeing is people who are doing significant score migration — a 680 or a 690 going to a 620,” Synchrony Financial CFO Brian Wenzel said in an interview.

That’s a dive from good to fair.

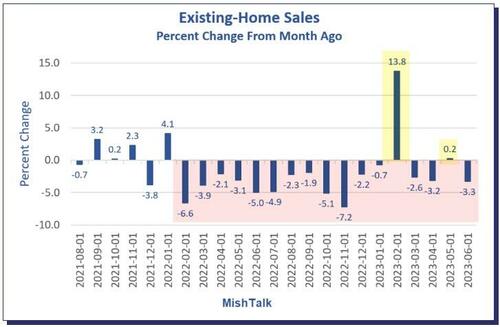

Note that Existing Home Sales Resume Slide, Down 15 of the Last 17 Months

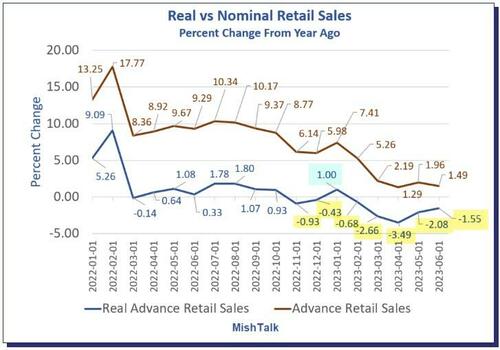

Real vs nominal retail sales percent change from year ago, data from Commerce Department, chart by Mish.

On July 18, I noted Inflation-Adjusted Retail Sales Weak Four of the Last Five Months

It’s not just consumers.

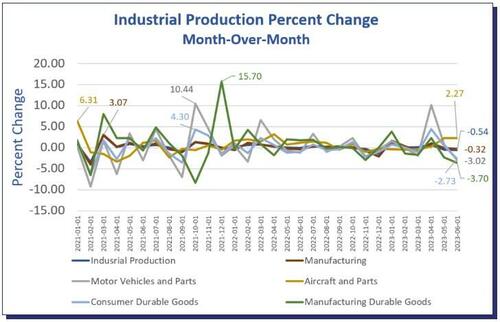

Industrial production data from the Fed, chart by Mish

Also note The Fed Reports Abysmal Industrial Production Numbers and Negative Revisions Too

The Bloomberg Econoday consensus estimate was unchanged in May from June. Instead, Industrial production fell 0.5 percent and the Fed revised May from -0.2 percent to -0.5 percent.

Meanwhile, the consensus opinion has changed from recession to soft landing. Does anyone hear a bell?

* * *